Politics & CRE Sales (Déjà Vu)

By Kenneth P. Riggs Jr., Chairman & President, Real Estate Research Corp.: The failure of Congress and the administration to reach a budget agreement before Oct. 1, the possibility that the debt ceiling will not be raised before the nation is unable to pay its obligations, and the huge swings in the stock and bond markets are all too familiar.

By Kenneth P. Riggs Jr., President, Real Estate Research Corp.

The failure of Congress and the administration to reach a budget agreement before the Oct. 1 deadline, the possibility that the debt ceiling will not be raised before the nation is unable to pay its obligations, and the huge swings in the stock and bond markets are all too familiar. After the last time we went through this and our nation’s credit rating was downgraded and the sequester became law, we thought our politicians would have learned to put politics aside on behalf of the people, but here we are. Unfortunately, we’ve seen this movie (or one very much like it) before.

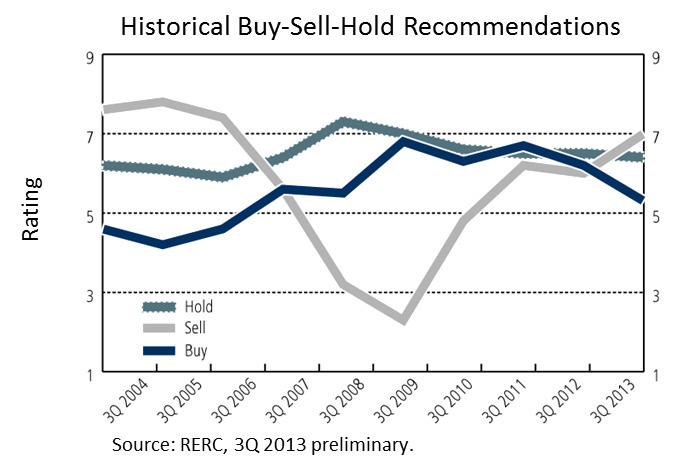

This spectacle in Washington is not the only repeat performance we have seen in recent memory, however. Real Estate Research Corporation (RERC) spotted something else in our preliminary third quarter 2013 institutional investment survey data that warranted attention. As noted in our early buy, sell, hold ratings, investors gave the sell recommendation a rating of 7.0, on a scale of 1 to 10, with 10 being high. The sell rating has not been this high since second quarter 2007, just months before the beginning of the Great Recession. We also noted that the recommendation to buy commercial real estate fell to 5.3, the lowest this rating has been since second quarter 2008, just months before the fall of Lehman Brothers.

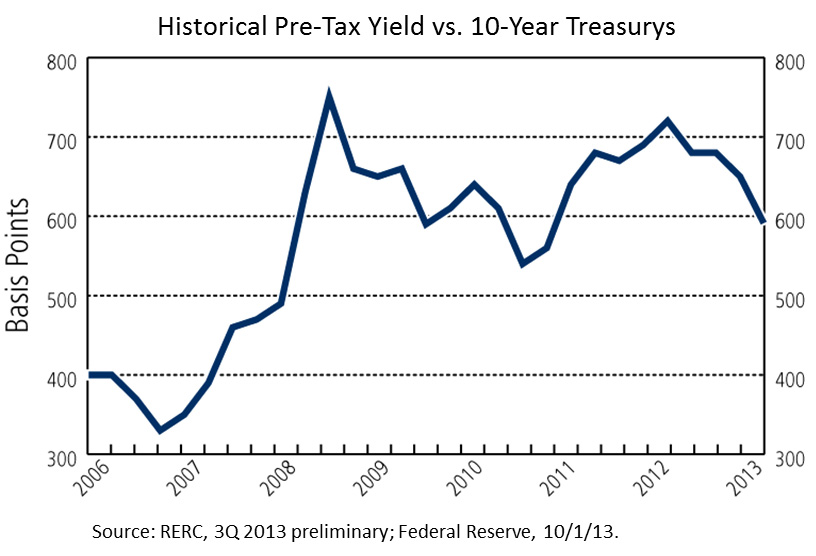

Further, the spread between RERC’s required pre-tax yield rates for commercial real estate and 10-year Treasurys continued to decline, with the current spread falling to 590 basis points. According to RERC’s preliminary research, yield rates continued to increase for all property types in third quarter 2013, which helped to keep the spread somewhat higher than it might have been otherwise. Even though the spread between the pre-tax yield rate and 10-year Treasurys has been declining, it still shows that commercial real estate is an attractive risk-adjusted investment over the alternatives, as illustrated in the graph below.

Although these preliminary ratings (as highlighted in RERC’s current Flash Report) may change slightly once RERC’s final analysis for third quarter research is analyzed in our fall 2013 RERC Real Estate Report in a few weeks, it is worth noting now that we have seen these numbers and trends before. We do not forecast that the economy and financial system will re-experience what we went through during the Great Recession and the near-collapse of our financial markets (the Federal Reserve’s $85 million monthly purchases of securities, Dodd-Frank regulations, etc. should prevent that), but commercial real estate could be in for some additional challenges.

Investors can expect:

- Economic growth to slow in fourth quarter 2013 and possibly also in first quarter 2014, depending on how long the partial government shutdown continues, due to lower government contributions to GDP. Several major economists have already projected 0.2 percent will be removed from future economic growth based on the partial government shutdown thus far.

- Short-term interest rates to remain low for another year or longer, but long-term interest rates are likely to further increase. This will affect capital, which could also cause cap rates to increase.

- Commercial real estate to remain priced for perfection in the major markets for the top tier properties in the near term. Commercial real estate values in the 24-hour primary coastal markets are near peak, while values in the secondary and tertiary markets are significantly lower on a price per unit basis. However, there is also a high amount of risk involved given the slow rebound in the secondary and tertiary markets. Preliminary RERC analysis indicates that the apartment sector has the lowest rating relative to value versus price among the property types, with price already overtaking value on a national level, which indicates that it is a relatively expensive investment.

- Returns have been solid, but they may decline slightly by the end of 2014. Preliminary third-quarter total returns according to the National Council of Real Estate Investment Fiduciaries (NCREIF) Fund Index-Open End Diversified Core Equity (NFI-ODCE) declined from the prior quarter to 3.5 percent, with income holding mostly steady at 1.31 percent and appreciation declining to 2.18 percent. During third quarter, the total return for the NFI-ODCE was higher than the Dow Jones Industrial Average (DJIA) total return, making the argument that commercial real estate is an attractive investment alternative.

The main reasons why commercial real estate has served as a relatively good investment alternative in times of great uncertainty and economic difficulty remain intact. Real estate is a hard asset, transparent, a good hedge in times of inflation, and as a longer-term investment, has leases in place for a steady income stream. While returns may not be as high as some of the stock indices recently (i.e., S&P 500), they aren’t as volatile either. Another benefit of commercial real estate—particularly relevant in today’s investment climate—is that our chaotic politics don’t rattle it as much as they do other investment alternatives.

You must be logged in to post a comment.