Plymouth REIT Buys Ohio Industrial Portfolio for $193M

The buyer paid about 25 percent less than replacement cost.

Plymouth Industrial REIT has paid $193 million for a nearly 2 million-square-foot industrial collection spread throughout Ohio. The portfolio traded for roughly 25 percent below replacement cost.

The 21 buildings are in Cincinnati, Columbus and Cleveland, Ohio. The infill facilities have a mix of functional features, including elevated clear heights, sizable truck courts and revamped lighting systems and updated office finishes.

Plymouth sought to make a value-add play with this acquisition. The properties were 97 percent leased at closing, with 75 tenants in total. Rents were 22 percent under current market rates and the weighted average remaining lease term stood at 2.47 years.

READ ALSO: New Growth on the Horizon

The REIT owns more than 30 million square feet of industrial product across 10 markets. Its portfolio also comprises about 5.9 million square feet of space in metro Chicago, of which it sold a 65 percent stake to Sixth Street in a $500 million joint venture last year.

Plymouth’s Cincinnati-focused industrial investment

With its latest purchase, Plymouth’s footprint rose to more than 12 million square feet in the Buckeye State. The firm is bullish on Ohio, especially Cincinnati, as more than 62 percent of its acquisitions in the first quarter targeted the market.

Earlier this year, it paid $23.3 million for a 263,000-square-foot asset in Cincinnati and $17.9 million as part of a larger portfolio’s second tranche comprising four shallow bay industrial buildings, spanning 240,578 square feet, also in the same market.

Plymouth closed the first tranche last year, paying $20.1 million for nine buildings encompassing 258,082 square feet. TradeLane Properties sold the portfolio, CommercialEdge shows.

Cincinnati’s affordable industrial assets

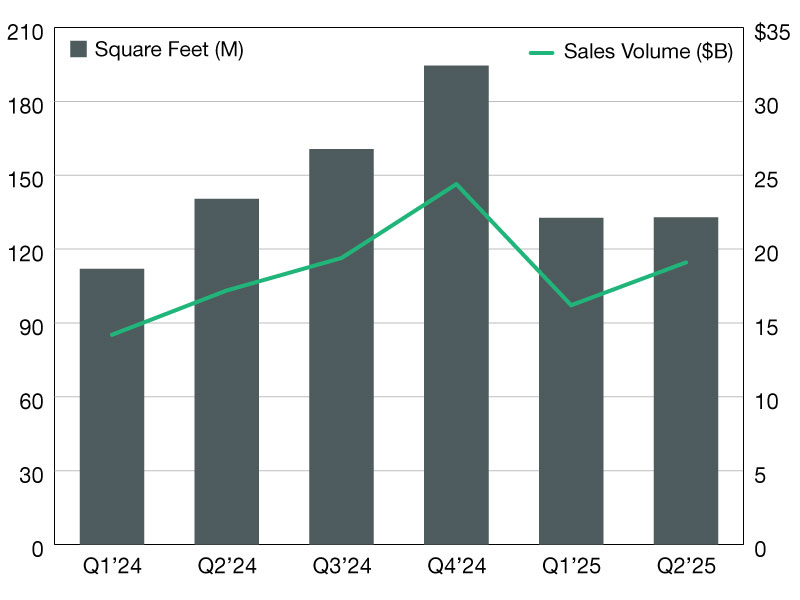

Metro Cincinnati’s industrial investment volume stood at $137 million during the first four months of 2025, according to a CommercialEdge report. Assets traded for $59.5 per square foot, substantially below the national average of $129.

The market was also among the most affordable throughout the Midwest. Only Detroit recorded a lower industrial price per square foot—$45.26—the same source shows. Other metros that fared better than Cincinnati included Kansas City, Mo. ($74.85 per square foot), Columbus, Ohio ($96.21) and Chicago ($96.32), among others.

Cincinnati’s industrial vacancy rate stood at 8.9 percent in April, just 10 basis points above the national average, CommercialEdge reveals. The market’s asking rents clocked in at $5.08 in April, up 4.3 percent year-over-year, below the 6.7 percent national rate.

You must be logged in to post a comment.