Phoenix’s Industrial Market Sees Slower Deliveries, Strong Starts

The metro's industrial development continues to outpace national trends, according to Yardi Research Data.

Phoenix’s industrial market continued to post solid performance, supported by sustained construction activity, high-value transactions and resilient tenant demand.

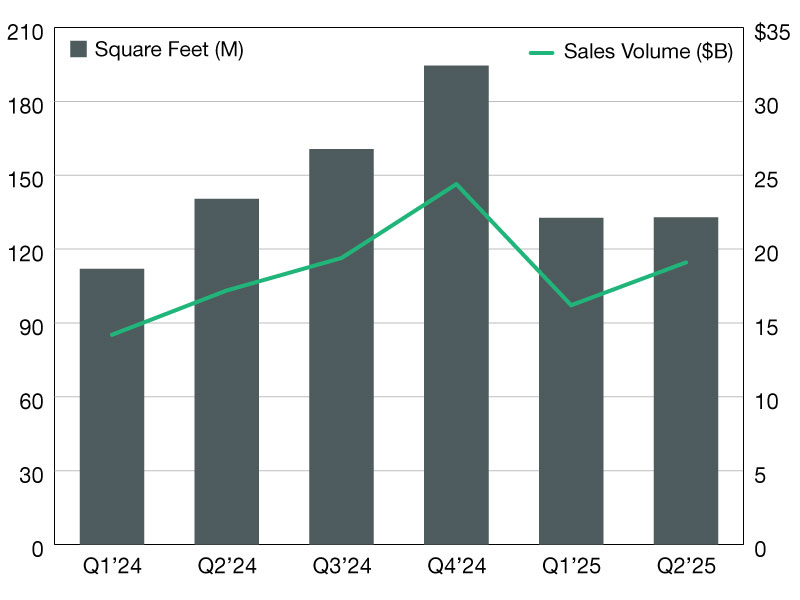

The metro recorded nearly $932 million in industrial sales year-to-date through May, with an average price of $198.30 per square foot—ranking among the highest in the nation.

Development remained active, with 6.6 million square feet breaking ground, accounting for 1.5 percent of total inventory and significantly outpacing the national average of 0.4 percent.

Although completions declined sharply compared to the same period last year, overall market fundamentals remained solid, driven by investor interest and steady leasing.

Development accelerates, outpaces national average

Industrial development in the West remained largely concentrated in Phoenix, which led the region with 17.7 million square feet of industrial space underway in May. Phoenix’s 90 under-construction projects accounted for 4.1 percent of the metro’s total inventory, much higher than the 1.7 percent U.S. index.

The pipeline more than doubled compared to the same period last year, when almost 7.3 million square feet of industrial space was under construction across 25 properties.

By the end of May, nearly 6.6 million square feet of industrial space had broken ground across 37 properties in the metro area—representing 1.5 percent of the total inventory, significantly outpacing the national average of 0.4 percent.

LG Energy Solution and U.S. Realty Advisors are currently developing LG Plant, a 1.4 million-square-foot plant to produce cylindrical EV batteries. This represents one of the largest-ever single investments for a stand-alone battery manufacturing facility in North America.

Upon completion, the LG Plant is set to include two separate facilities, with the company expecting to invest $3.2 billion in the EV battery plant and $2.3 billion to construct the ESS battery facility.

Completions slow down year-over-year, but major deliveries continue

Phoenix’s industrial completions at the end of May totaled 10.5 million square feet from the 46 developments that came online, according to Yardi Research Data. This marks a considerable decline year-over-year, when 95 projects spanning 18 million square feet were delivered.

Phoenix remained in the spotlight, followed by Kansas City (8.7 million square feet) and Chicago (4.3 million square feet). Indianapolis (752,500 square feet) was at the opposite pole.

Scannell Properties has delivered Building 3 of Mesa Gateway 202, a nearly 2 million-square-foot industrial and office park near the Phoenix-Mesa Gateway Airport. Spread on 166 acres, the development also features build-to-suit properties and retail space.

Nestle USA has also recently opened its new beverage factory and distribution center in Glendale, Ariz., a 630,000-square-foot facility. The company broke ground on the $675 million project back in 2022. Located at 8351 N. 150th Ave., the 139-acre property represents Nestle USA’s 20th food and beverage factory.

Industrial sales strong, with pricing outpacing most markets

Phoenix’s industrial sales volume reached $932.2 million year-to-date through May, with almost 5.7 million square feet of industrial space sold across 71 facilities. The metro’s sale price reached $198.30 per square foot.

Only New Jersey ($251.37 per square foot) and Inland Empire ($247.89 per square foot) recorded higher numbers, while metros like Chicago ($93.36 per square foot) and Kansas City ($69.13 per square foot) were at the lower end of the spectrum.

This April, BKM Capital Partners acquired a three-property portfolio totaling 778,000 square feet in metro Phoenix for $156.8 million. The properties included in the portfolio are Kyrene CommercePlex, Estrella Business Park II and Hohokam Industrial Park.

Link Logistics purchased Riverside @ 51, a 336,038-square-foot warehouse featuring 99 dock-high doors, six drive-in doors, 30-foot clear heights and a 135-foot truck court. Completed in 2007, the distribution center is at 2300 S. 51st Ave. in the Southwest Valley submarket.

Vacancy holds steady

Phoenix’s industrial vacancy rate at the end of April was 7.4 percent. The metro’s average in-place rent during the same month was $9.42, Yardi Research Data shows.

Gateway Classic Cars has signed to become Greystar’s first tenant at the Class A three-building Caliber by Greystar industrial development in Peoria, Ariz. Reportedly the world’s largest classic car sales company, the tenant will occupy 43,809 square feet in Caliber’s 122,863-square-foot Building B.

Caliber represents the industrial component of Greystar’s $500 million, 88-acre Peoria Place master-planned development. At full build-out, the mixed-use property will include luxury apartments, build-for-rent homes and ground-floor retail in Peoria’s historic downtown.

You must be logged in to post a comment.