Pharmaceutical Firm Snaps Up Boston-Area Tech Park for $165M

The premier biotechnology compound of office and lab space and 40 acres of preserved open space had been undergoing redevelopment at the hands of Patriot Partners, the partnership between Framingham, Mass.-based Atlantic Management Corp., Concord, Mass.-based Mohawk Partners L.L.C. and New York City-headquartered O'Connor Capital Partners that acquired the property in 2003.

July 1, 2010

By Barbra Murray, Contributing Editor

The life sciences industry continues to be one of the few businesses that are eagerly seeking commercial real estate space. Dublin-based Shire Plc, which maintains the U.S. headquarters of its Human Genetic Therapies (Shire HGT) unit in Cambridge, Mass., has ended its hunt for space to accommodate company growth with the acquisition of Lexington Technology Park in Lexington, Mass. The global biopharmaceutical concern paid Patriot Partners L.L.C. $165 million in cash for the 96-acre campus, which offers ample room for growth.

The former home of Raytheon Global Headquarters, Lexington Technology Park is located at 123 Patriot Way, about 15 miles from Boston and 10 miles from Shire’s current home in Cambridge. The premier biotechnology compound of office and lab space and 40 acres of preserved open space had been undergoing redevelopment at the hands of Patriot Partners, the partnership between Framingham, Mass.-based Atlantic Management Corp., Concord, Mass.-based Mohawk Partners L.L.C. and New York City-headquartered O’Connor Capital Partners that acquired the property in 2003.

Commencing its search for larger accommodations in 2008, Shire did consider areas in the Carolinas and Rhode Island for its expansion, but the company ultimately settled on Lexington Technology Park for a bevy of reasons.

“We decided Massachusetts has the wealth of talent that we need, a lot of our peers are in the area, and we were offered great tax incentives to stay in the state,” Jessica Cotrone, Director of Communications with Shire, told CPE.

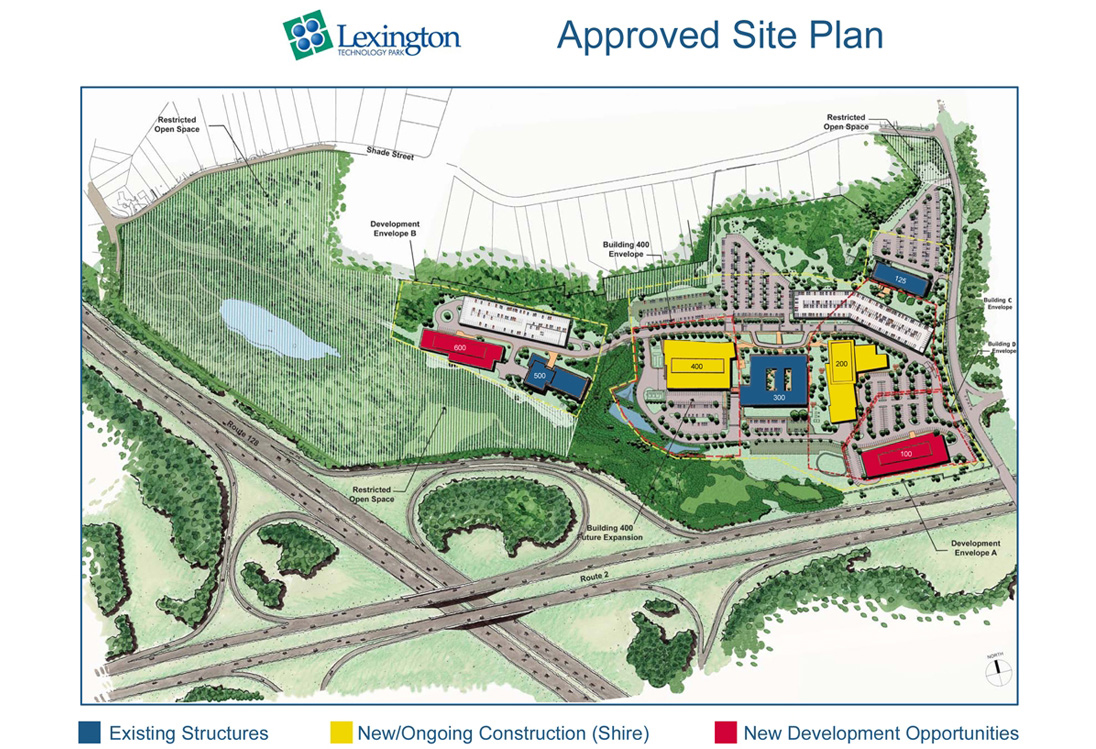

Additionally, Shire had already taken a shine to Lexington Technology Park. In 2007, the company began relocating some of its staff from Cambridge to the campus in order to address immediate space demands. Prior to the acquisition of the property, Shire had been leasing three buildings totaling 280,000 square feet and had developed a 200,000-square-foot manufacturing plant–recently completed–on a parcel of land the company already owned. “It made better sense to purchase the entire property so we could have contiguous space in one location,” Cotrone added.

Now, Shire owns Lexington Tech Park’s buildings and all of its land, which can accommodate an additional 570,000 square feet under a current permit; 170,000 square feet of that potential space is already in the construction phase. Commercial real estate services firm Richards Barry Joyce & Partners represented Shire in the transaction, while Cushman & Wakefield stood in for Patriot Partners.

The Boston area appears to be in little danger of falling from the top spot of the biggest life sciences hubs in the U.S. Boston’s commercial real estate market hardly escaped the ravages of the country’s financial crisis, so the pace of development activity is sluggish, to say the least, except in the biotech industry. In June, Alexandria Real Estate Equities received final zoning approval for the approximately $560 million Binney Street Project, a 1.7 million-square-foot mixed-use office and laboratory development in East Cambridge. Additionally, Boston Properties is developing 350,000 square feet for Biogen Idec in Weston, and Cubist Pharmaceuticals is expanding its digs in Lexington by 110,000 square feet.

You must be logged in to post a comment.