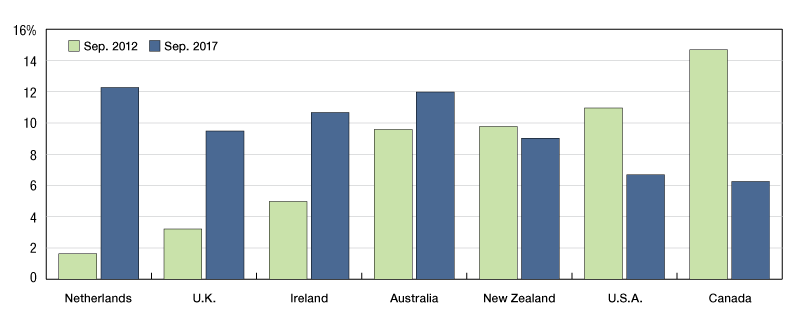

Performance Cycle Across International Markets

Retailer bankruptcies, department store struggles and empty malls have dominated recent headlines.

comparing 12-month total return over the past five years

As a fragmented global asset class, performance cycles across national markets are often quite distinct. Countries recording the highest returns at one point in time can find themselves at the opposite end of the spectrum just a few years later and vice versa. This phenomenon can be seen in the above chart which compares seven different national markets as of September 2012 and September 2017. Those countries with the highest returns in 2012 (Canada and the USA) now find themselves recording the lowest returns while the Netherlands which had the lowest return in 2012 has the highest return in 2017. This highlights the potential diversification benefits available to global real estate investors.

You must be logged in to post a comment.