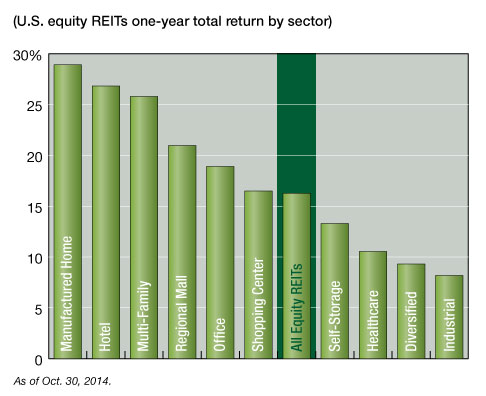

Outperforming the Index

U.S. equity REITs had a one-year total return of 16.26 percent as of Oct. 30. The SNL U.S. Manufactured Homes REIT index led all REIT indexes for the year through Oct. 30, with a total return of 28.9 percent. The SNL U.S. Hotel REIT index was next on the list, with a year-to-date total return…

U.S. equity REITs had a one-year total return of 16.26 percent as of Oct. 30. The SNL U.S. Manufactured Homes REIT index led all REIT indexes for the year through Oct. 30, with a total return of 28.9 percent. The SNL U.S. Hotel REIT index was next on the list, with a year-to-date total return of 26.82 percent. The multi-family, regional mall and shopping center sectors all also outperformed the SNL U.S. REIT Equity index in the second half of 2014.

For the 12-month period ended Oct. 30, four REIT sectors had total returns that underperformed the SNL U.S REIT Equity index, with self-storage posting a total return of 13.3 percent, followed by healthcare, diversified and industrial with total returns of 10.53, 9.32 and 8.19 percent, respectively.

Abdullah Ismaeel is a real estate research analyst for SNL Financial.

You must be logged in to post a comment.