Office Leasing Strategies for the New Landscape

What owners should expect in this uncertain environment, and how to tailor campaigns to today’s tenant needs.

The pandemic has brought a multitude of changes in office leasing. As year three of the pandemic starts, office owners, asset managers and property managers must adjust to changing circumstances to effectively lease properties.

800 Fulton, located in Chicago, features more than 460,000 square feet of office and retail space on 16 stories. It features a Smart Building Platform and was designed to meet LEED Platinum and WELL Silver certifications. Image courtesy of Stream Realty Partners

With the drastic increase in employees working from home, more companies have chosen to downsize their space. Although some businesses have gone back to the office, the omicron variant has halted these moves for others. In December, Apple announced that it was delaying its return to office indefinitely and giving each of its employees $1,000 toward home office expenses.

The emphasis on flexibility started when much of the office workforce went remote, but now that factor is moving into the office landscape for the longer term. While many companies are eager to get back into the office, there is plenty of caution on when business conditions will return to normal. Instead of committing to larger spaces, tenants want the flexibility to start small and expand if necessary. Given the unpredictability of the pandemic conditions, tenants are less likely to sign big leases or make long-term commitments. JLL estimates that the typical lease has shortened by 27 percent over the course of the pandemic.

“If you have shorter-term flex, coworking, or spec suites, that’s being looked at favorably,” said Preston Young, partner & national head of office investor services at Stream Realty Partners. “Over the last two years companies looked at space as a liability and now it’s moving back to being an asset.”

The firm recently secured a 100,000 square-foot lease at Illinois Center. Located near the Chicago River at 111 E. Wacker, the property offers such amenities as a conference center, retail, and food and beverage. Image courtesy of AmTrust Realty Corp.

Yet despite these, recent leasing trends suggest that occupants remain interested in returning to the office. In six major markets—Manhattan, Boston, Washington, D.C., Chicago, Los Angeles and San Francisco—expansions total 24 percent of leasing activity through the first three quarters of 2021, according to CBRE. That represents a 7 percent increase compared to the same period of the previous year. Relocations within the market increased from 23 percent to 33 percent, and contractions fell by half to 5 percent.

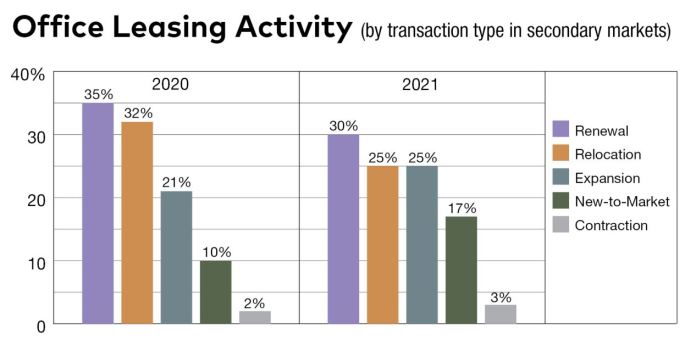

Both renewals and relocations ticked up year-over-year in 13 secondary markets surveyed by CBRE, which include such metropolitan areas as Atlanta, Dallas-Fort Worth, Denver, Philadelphia, San Diego and Seattle. A noticeable trend in those markets is the average lease size of 17 percent, a sign that office occupants in secondary locations are making larger space commitments. Although CBRE’s findings represent the period before the omicron variant emerged, they appear to show occupants’ openness to a larger footprint.

Fundamentals show that while it’s not an owner’s market, landlords are gaining ground for leasing. From the third to fourth quarters last year, leasing volume jumped 29 percent, according to Cushman & Wakefield’s most recent national office report. Asking rents increased in 52 of the 90 markets tracked by the study.

In 15 of the 90 markets, asking rents declined year-over-year and quarter-over-quarter, notably including the gateway markets of Boston, Manhattan and Washington, D.C. All told, asking rents declined 6.8 percent in 2021, but the pace of declines is slowing and Cushman & Wakefield projects that asking rents will stabilize by midyear.

Cautious About Commitment

Co-owned by Glenstar and USAA Rea Estate, Energy Square in Dallas comprises five buildings totaling 1.1 million square feet with a wide variety of configurations: pre-finished suites; a top-floor, single-tenant space; and spaces geared to smaller tenants and starting at 400 square feet. Image courtesy of JLL

Yet recent leasing trends suggest that occupants remain interested in returning to in-person work situations. In six major markets—Manhattan, Boston, Washington, D.C., Chicago, Los Angeles and San Francisco—expansions totaled 24 percent of leasing activity through the first three quarters of 2021, according to CBRE. That represented an increase from 7 percent during the same period of the previous year. Relocations within the market increased from 23 percent to 33 percent, and contractions fell by half to 5 percent.

In 13 secondary markets surveyed by CBRE, both renewals and relocations ticked up year-over-year. A noticeable difference emerged in those markets, which include Philadelphia, Atlanta, Dallas-Fort Worth, Denver, San Diego and Seattle. Although these findings represent the period before the omicron variant emerged, they show occupants’ openness to a larger footprint.

In the face of these challenging conditions, owners and property managers must adopt new strategies. “They are looking for flexible term options as well as the ability to adjust the size of space,” said Paul Gaines, chief asset officer at Accesso. “They might need X amount of space right now but then want the option to bring in larger groups for meetings or projects. So where do you put those people?”

By offering tenants the ability to downsize or increase rented space, landlords can better cater to their needs as well as keep a steady tenancy.

In addition to transforming space, owners and operators can be more competitive by staying adaptable. Supply chain delays are making it particularly challenging to get the drywall, windows, carpeting and other materials necessary tenant improvements. However, upgrading and enhancing properties buildings are more necessary investments than ever. The key is to focus on the current spaces and how they can be transformed to fit the needs of the tenant.

Virtual tours are a prime example, as spaces can be showcased to potential and current tenants. Spec spaces with flexible layouts, modular furniture and reconfigured uses help take the burden off the tenant and showcase a collaborative effort between occupants and landlords.

“Tenants are looking for prebuilt space, plug-and-play. They are not up for the huge obligation of taking on additional work,” said Eric Menkes, partner at Duval & Stachenfeld, a national real estate law firm. “If you can go into a premade space and go in for five years, that lowers the risk.”

Shifting Priorities

Austin’s RiverSouth offers green building measures such as a 7th-floor green roof that will reduce heat, absorb stormwater and provide biodiversity. The property includes a 15th floor sky lounge, amenity deck, fitness studio and onsite electric scooter and bike hubs. Image courtesy of Stream Realty Partners

When leasing office space, companies aren’t looking to check just the core boxes. While private offices and conference rooms are still a must, employers are looking to get more out of the return-to-office experience.

“In a more fluid hybrid arrangement, tenants are looking to offices that have the ability to be readily redesigned and that emphasize collaboration, sense of place, wellness, sustainability, and corporate culture to fill the gaps caused by a greater utilization of remote options, either fully or in hybrid set-ups,” said Jeff Eckert, president of U.S. agency leasing for JLL. “With return to work still in flux, employers are focused more than ever on creating spaces that people want to come to, even if (they’re) not mandated.”

These spaces include outdoor terraces, private meeting rooms and pods, coworking and hoteling areas, fitness centers, and food and beverage amenities. In addition to building features, the pandemic has placed an emphasis on cleaning and safety protocols. This means lower employee-per-square-foot ratios, touchless features, new air filtration devices, temperature controls, sustainable and biophilic elements, and thorough maintenance and cleaning.

RiverSouth in Austin is among the new wave of office buildings that is catering to tenant expectations with the latest in sustainability and technology. Stream Realty Partners’ transit-oriented asset opened recently at 401 S. First St. Key features are a 15th-floor sky lounge, fitness studio, bike valet and storage and panoramic lake, city and hill country views. Health and wellness features include daylight harvesting, advanced lighting controls, HVAC condensate recapture and storage for all-onsite irrigation. Stormwater is entirely treated on site by rain gardens and green roofs.

Another major difference in leasing comes down to location. Before the pandemic, office tenants were often hung up on being in the central business district. Now that has changed, with fewer workers taking public transportation and focusing more on social distancing.

“With COVID, people are looking for more rather than less space,” said Jonathan Bennett, president of AmTrust Realty Corp. “A trend for a while was cramming as many people as possible into an office space; now the way tenants think about space is different.”

New Tactics

Platinum Tower in Atlanta is situated between the neighborhoods of Buckhead and East Cobb. The property features 21,000-square-foot floorplates and is LEED certified. Image courtesy of Accesso

Whether the tenant is in technology, law or finance, it’s important to recognize what the occupant is looking for in the new office environment. “We’re seeing a lot of smaller tenant demand,” noted Young. “Smaller companies will be less constricted by the liability side that COVID brings, so they can make decisions faster.”

As giants like Facebook and Google keep employees remote, return-to-office decisions are more likely to face smaller firms who are located outside of central business district. Those tenants’ companies are more likely to drive to work and have a relatively smaller footprint.

Geographic distinctions are also becoming pronounced, with faster increases in leasing activity in secondary markets as companies follow the flow of talent into more affordable markets. In a telling indicator, the average lease size for tenants who were new arrivals in secondary markets increased 17 percent last year; that was up from 10 percent in 2020, according to CBRE’s office report. The finding suggests that office occupants in secondary locations are more likely to make larger space commitments than office tenants in primary markets, which increased lease size only 6 percent in 2021.

From a financial perspective, heightened concessions—particularly generous build-out allowances—will remain a core feature of the leasing market for the foreseeable future. “This will reduce the time from lease signing and occupancy and accommodate tenants with rapidly changing space requirements,” added Eckert.

More than ever, office space serves as a recruitment tool, as occupants rely on a physical environment to foster collaboration and a positive culture. Without on the job training during COVID, collaboration space is even more important as workers return.

Office space is also taking on more of a hospitality role, offering the latest in amenities and features so that tenants can experience that space away from home and ‘away’ from the office.

“It all goes back to that third space,” added Bennett. “You were working from home, now you’re back in an office, and that third space means different things to different people. You have to be thoughtful on how that is programmed and what it will be used for.”

You must be logged in to post a comment.