Office Conversions, Demolitions Outpace New Construction

Activity varies widely by market, according to CBRE’s latest report.

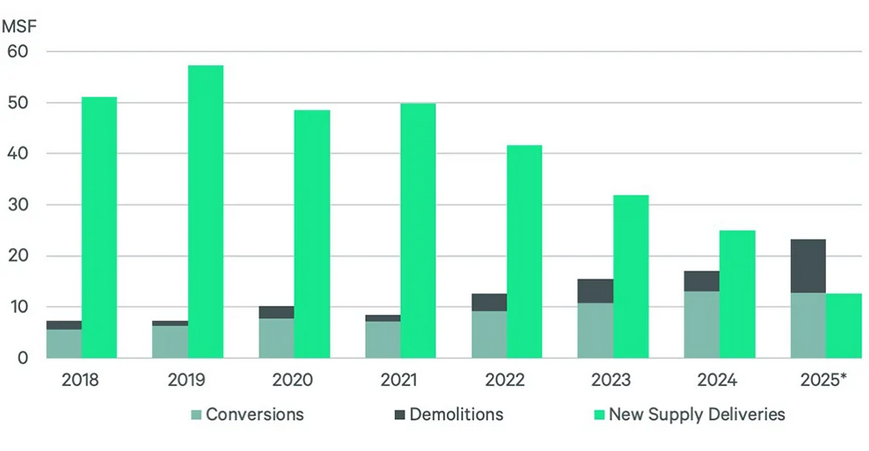

The amount of U.S. office space poised to disappear—either through demolition or conversion—will far exceed the amount of office space that will come online in 2025, according to a CBRE report. That’s a reversal from before the pandemic, when new construction far outpaced demolition and conversion combined.

More than 23 million square feet of office space in 58 markets tracked by CBRE is slated for demolition or conversion this year, while developers will complete only 12.7 million square feet of new space. As recently as 2019, nearly 60 million square feet of office came online, compared to less than 10 million square feet of repurposed space.

“We expected to see a big drop in new supply,” CBRE U.S. Office Thought Leadership Research Director Jessica Morin told Commercial Property Executive. “But the increase in conversions and demolitions … was something of a surprise, in that it’s the first time we’ve ever seen it in our data.”

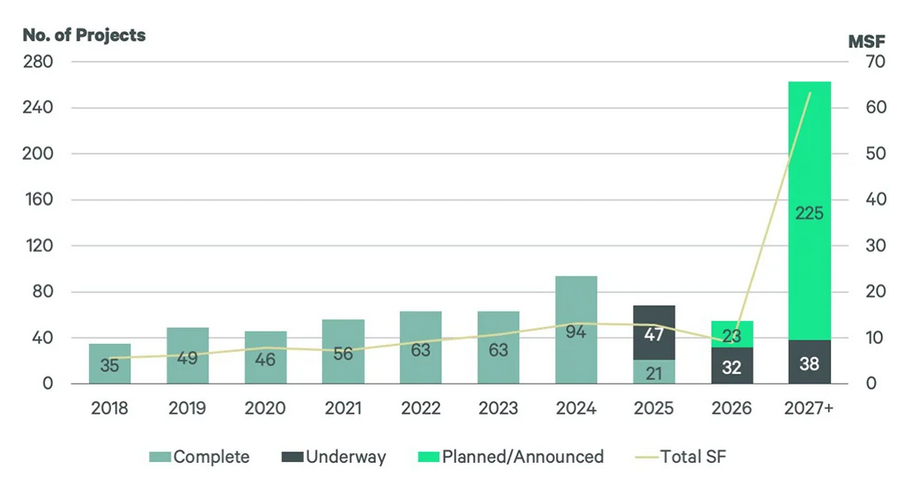

Conversion was hardly unknown before the pandemic, but it was much less common. From 2018 to 2024, the U.S. averaged 58 office conversions annually. In 2024, there were a record 94 conversion projects totaling 13.1 million square feet. This year, about 68 conversions totaling 12.7 million square feet are expected, according to CBRE projections.

READ ALSO: Top 5 Office Projects Under Construction in Manhattan

As office use started declining in the early 2020s, conventional wisdom held that conversion wasn’t the answer to high vacancy. The process was believed to be too expensive and complicated in most cases.

Conversion is an expensive proposition, but nevertheless has gained ground. Since 2018, such projects have delivered over 28,500 housing units, CBRE noted.

“Conversion is still hard to do, and not a lot of buildings are good candidates for it,” said Mike Watts, CBRE’s president of investor leasing in the Americas. “But in many markets, what didn’t pencil out before might be a little bit closer to it because apartment rents have steadily increased.”

Office buildings constructed in the 1970s and 1980s typically have large floorplates that are poorly suited for multifamily use. These properties account for more than half of demolitions and only 35 percent of conversions, the report found. By contrast, buildings predating the 1970s often offer distinctive architectural features and are frequent subjects of conversion.

Morin pointed out that growing expertise in conversion is also a trend. “There used to be only a very few players who knew how to do these projects,” she said. But now we’ve seen growing expertise and awareness.”

Cities encourage conversions

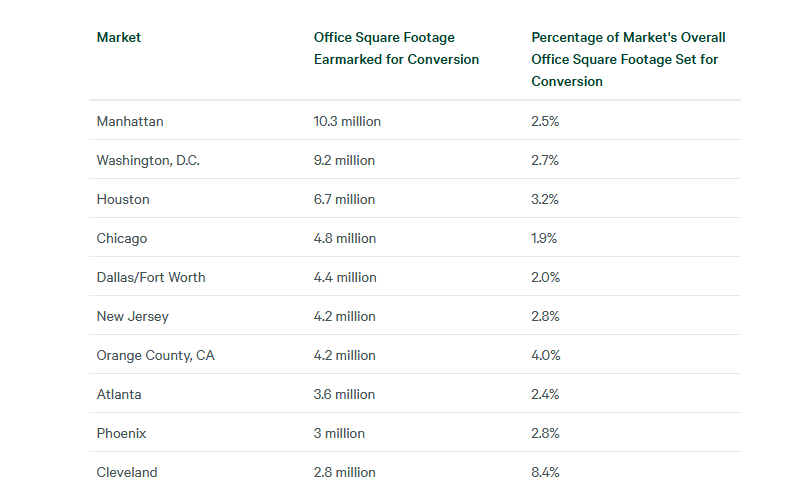

Another factor boosting conversions is that some local governments are introducing new incentives or removing barriers. “Washington, D.C., Chicago, and Manhattan have all recently introduced some kind of legislation or incentive, or even specific districts where they’re asking developers to convert some of these underutilized buildings.”

Manhattan and D.C. lead in total square footage of conversions underway or planned with 10.3 million square feet and 9.2 million square feet, respectively, CBRE reported. Conversions in those places are being spurred by programs like the “City of Yes for Housing Opportunity” zoning reform in Midtown Manhattan and the “Office to Anything” program in Washington, D.C.

Among smaller markets, Cleveland stands out for having 8.4 percent of its office inventory either undergoing or planned for conversion, the highest percentage of any city reviewed by CBRE. High construction costs, low office rents and limited land availability have historically pushed Cleveland developers toward conversions, even before the pandemic, so the trend isn’t new for the city.

READ ALSO: Who’s Buying Distressed Office Buildings?

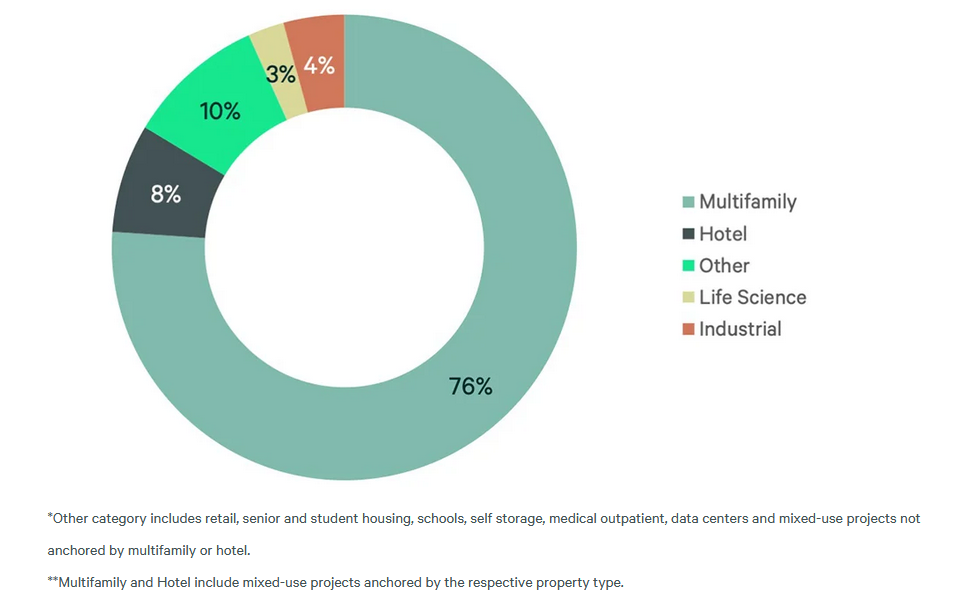

Most conversions are into multifamily—just over three quarters by square footage (76 percent), according to the report. A brief vogue for conversion to life science has settled down, and only 3 percent of conversions in 2025 will be to that specialized property type. Small percentages of office space will become hotels and industrial as well.

In some cases, Watts said, an older office building will give way via demolition to new office space, because the demand for Class A or new trophy space exists.

“If you have a building that’s got a very good office location, then it’s viable, at the appropriate time, for new office construction,” he says. “In a lot of our major markets, if you delivered a brand-new building in a good location, it would lease up right now.”

You must be logged in to post a comment.