October – Briefs/Sales & Development

Wood Partners Begins 298-Unit Seattle High-Rise; Cousins Acquires 844 KSF Tower in Dallas; Kimco Buys Connecticut Retail Asset for $39.7M; McCarthy Breaks Ground on $73M Transit Center; CubeSmart Completes $560M Purchase from Storage Deluxe; DDR Buys Tucson Shopping Center for $124.5M; Retail Properties of America Completes 1 MSF Distribution Disposition; First Potomac Sells D.C. Office Development JV Interest.

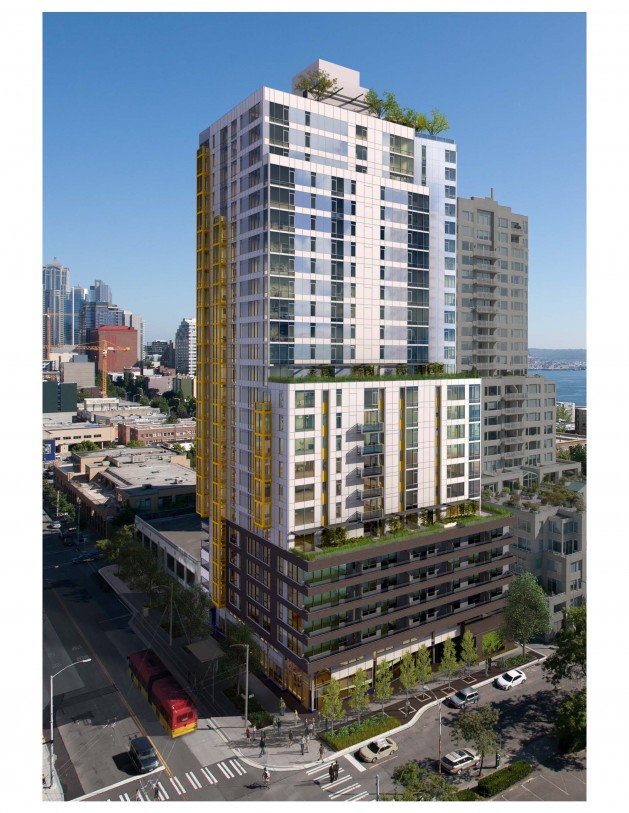

Wood Partners Begins 298-Unit Seattle High-Rise

Developer Wood Partners is primed to commence construction of Third & Cedar, a 298-unit high-rise that will sprout up in Seattle’s bustling Belltown neighborhood. Prudential Mortgage Capital Co. is onboard as equity partner and JPMorgan Chase & Co. has come through with financing for the 27-story tower. The project, which is designed by architectural firm Hewitt, is located near South Lake Union and will offer Class A residential space, 3,800 square feet of ground-level commercial space and a six-level underground parking facility.

At the close of the second quarter, the average occupancy for Class A apartments was 96.8 percent in Seattle, according to apartment research firm Axiometrics. Demand is particularly strong–and growing stronger–in the South Lake Union area, where Amazon is attracting a lot of attention with its relocation and plans for a new office development. Builders are taking heed. Pine Street Group L.L.C.’s 654-unit Via6 is edging closer toward completion, with crews having recently topped out the $200 million development.

Cousins Acquires 844 KSF Tower in Dallas

Cousins Properties Inc. has completed its purchase of 2100 Ross Ave., an 844,000-square-foot, Class A office building located in the Arts District of Dallas. The tower was purchased at a foreclosure auction for a net purchase price of $59.2 million, as Cousins had previously bought a $10 million B note backed by the asset in an off-market transaction. The property is currently 67 percent leased, with a tenant base including CBRE Group Inc., Prudential Mortgage Capital Co. and Bank of America Merrill Lynch.

Kimco Buys Connecticut Retail Asset for $39.7M

Kimco Realty Corp. has picked up Wilton Campus Shops, a 97,000-square-foot grocery-anchored retail center in Wilton, Conn. The asset, which is part of a larger mixed-use complex known as Wilton River Park, was acquired for $39.7 million, including $20.9 million in mortgage debt. Kleban Properties was the seller. The asset is currently 98 percent occupied and anchored by a 47,000-square-foot Stop & Shop. The grocer is flanked by more than 20 specialty shops and restaurants.

McCarthy Breaks Ground on $73M Transit Center

McCarthy Building Cos. has commenced construction on a $72.7 million transit center in Burbank, Calif. The 520,000-square-foot asset, known as the Bob Hope Airport Regional Intermodal Transportation Center, is being developed by the Burbank-Glendale-Pasadena Airport Authority. The center will qualify for LEED Silver certification and should be completed in the summer of 2014.

CubeSmart Completes $560M Purchase from Storage Deluxe

Storage Deluxe has sold a 1.6 million-square-foot self storage portfolio in the Northeast to CubeSmart for $560 million. The transaction was orchestrated by Holliday Fenoglio Fowler L.P. on the seller’s behalf. CubeSmart Inc., the REIT formerly known as U-Store-It Inc., has now enhanced its holdings by more than 22 facilities in New York, Pennsylvania and Connecticut. The self-storage market is on the upswing across the country and in the Northeast, as supply constraints and the migration of households to major employment centers continue to strengthen demand, according to a mid-year report by Marcus & Millichap Real Estate Investment Services.

DDR Buys Tucson Shopping Center for $124.5M

DDR Corp. has added a 709,811-square-foot Arizona open-air power center to its purchases this year, closing Wednesday on the $125.4 million acquisition of the Tucson Spectrum Shopping Center. The Ohio-based REIT bought both Phase I and Phase II of the regional retail center located off Irvington Road and Interstate 19 from an affiliate of the Phoenix-based Barclay Group and Creswin Properties Inc., a Canadian real estate company. Including Target and Home Depot, which both own their land and buildings, Tucson Spectrum encompasses more than 1 million square feet of retail space on 122 acres.

Retail Properties of America Completes 1 MSF Distribution Disposition

Retail Properties of America Inc. has sold a 1 million-square-foot distribution center in Stockton, Calif., to American Realty Capital Trust III for approximately $63 million. RPAI described the site as the Cost Plus Distribution Center, though the tenant in the two buildings for the past several months has been Bed, Bath & Beyond Inc., which bought Cost Plus World Market in May for about $495 million. American Realty Capital Trust III purchased the Stockton distribution center around the same time it bought a Williams Sonoma distribution facility in Olive Branch, Miss., for $52.4 million.

First Potomac Sells D.C. Office Development JV Interest

First Potomac Realty Trust has sold its 95 percent interest in 1200 17th St., N.W., for $43.7 million. The company had been in a joint venture with Akridge to develop a new office building on the site. The buyer of the joint venture stake is Japanese real estate giant Mitsui Fudosan, acting through its U.S. subsidiary, Mitsui Fudosan America Inc. 1200 17th St. is a Washington, D.C., CBD site, and development plans call for an office building of about 168,000 square feet.

You must be logged in to post a comment.