NYC Spotlight: Bought Up

By Amalia Otet Real estate remains a hot commodity in New York City, with investors flocking to take a bite out of the Big Apple. All five boroughs have seen increased transaction activity in the four weeks ending on Nov. 30, with Manhattan attracting the largest deals by value. According to the latest PropertyShark market…

By Amalia Otet

Real estate remains a hot commodity in New York City, with investors flocking to take a bite out of the Big Apple. All five boroughs have seen increased transaction activity in the four weeks ending on Nov. 30, with Manhattan attracting the largest deals by value.

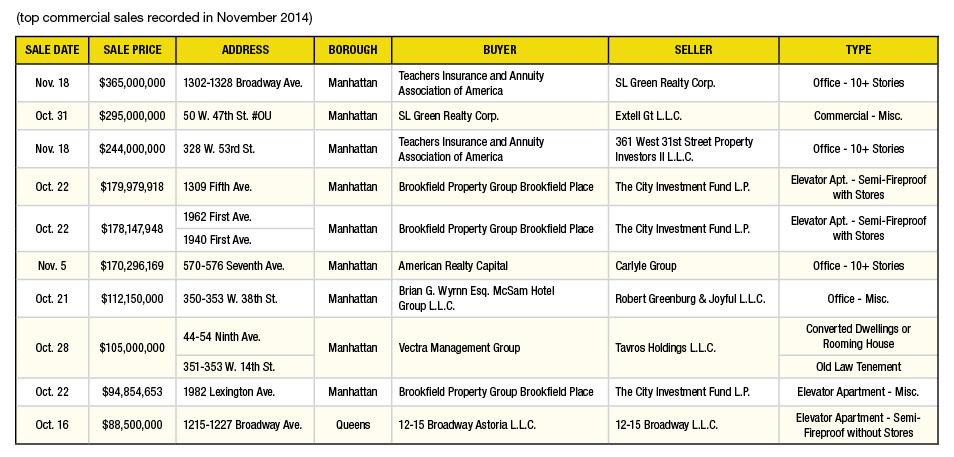

According to the latest PropertyShark market report, which features month-to-month tracking of the biggest commercial sales in New York, nine of the top 10 purchases were in Manhattan, where increased demand for both office and residential space has kept rents at an elevated level.

The biggest transaction recorded in November was the purchase of 2 Herald Square by TIAA-CREF in joint venture with Norges Bank Investment Management. The partnership acquired SL Green Realty Corp.’s leased fee interest in the 362,191-square-foot commercial office building at 1302-1328 Broadway for $365 million. The asset is unencumbered by debt, and boasts a solid tenant roster, including H&M and Victoria’s Secret, which occupy the ground-floor retail space.

Apparently on a buying spree, TIAA-CREF also closed on 21 Penn Plaza, a 16-story, 338,962-square-foot office building at 360 W. 31 St. The financial services giant purchased the property from Savanna and the Feil Organization in a $244 million deal, PropertyShark data records show.

The property was 98 percent leased at the time of the sale. Office tenants include Saks & Co., Langan Engineering and Amtrak.

The multi-family sector is attracting large amounts of investment capital, as well. In one of the most recent transactions, Meridian Capital Group arranged $737 million in acquisition financing for the purchase of The Putnam Portfolio by Brookfield Property Partners, along with operating partner Urban American.

—Amalia Otet is an associate editor with PropertyShark.

You must be logged in to post a comment.