North Texas, Corporate Juggernaut

Dallas-Fort Worth has 48,000 multifamily units under construction, but the metro is expected to absorb its substantial pipeline due to rapid demographic expansion.

By Bogdan Odagescu

The Dallas-Fort Worth metro continues to achieve some of the fastest job and household growth rates in the U.S. The area is among the most diverse economies in the country and added 145,000 residents in 2016 alone.

Benefiting from a business-friendly climate and no state income tax, Dallas is a regional hub that attracts both domestic and foreign capital. There are also 25 colleges and universities in the metro, which enroll nearly 350,000 students that fuel a deep talent pool and attract large employers. With the $3.2 billion Legacy West development nearing completion, the metro will house new headquarters for Toyota, JP Morgan Chase, Liberty Mutual and Boeing. The $3 billion Dallas Midtown project is also moving forward. In Fort Worth, Ed Bass is leading a public-private partnership to build a $450 million multi-purpose arena and Facebook is building a $1 billion data center. The DFW data center market is the second-largest in the country, according to CBRE, and includes fast-growing companies such as RagingWire, Digital Realty, Softlayer, CyrusOne and T5.

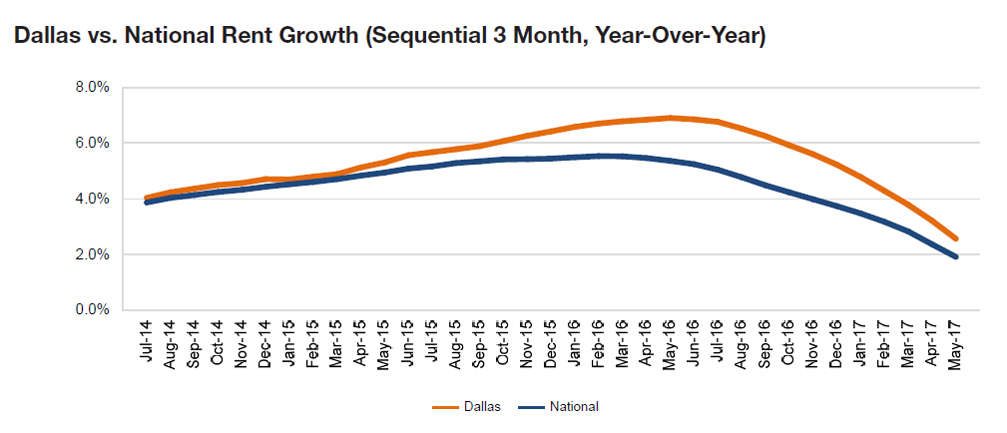

Property investors remain bullish, with $1.5 billion worth of multifamily assets trading in the first five months of 2017. Dallas-Fort Worth has 48,000 units under construction, but the metro is expected to absorb its substantial pipeline due to rapid demographic expansion. Area rents are forecast to rise by 4.3 percent in 2017, as job growth and domestic migration drive rental demand.

You must be logged in to post a comment.