Where Business Growth Meets Affluence: Nielsen Retail Research

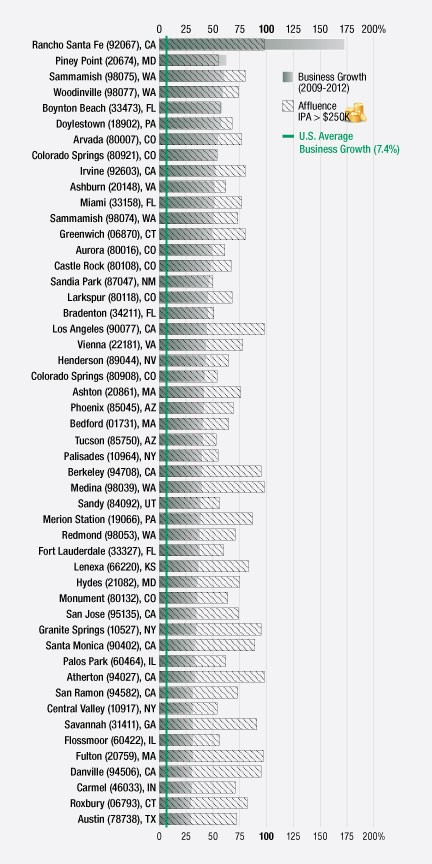

Nielsen identifies the top 50 markets where a high incidence of affluent households and new business creation could suggest retail real estate investment opportunity.

For our May issue, CPE teamed up with The Nielsen Co., the research and consulting firm, to explore the influence of affluence and business creation rates on retail real estate opportunities. Nielsen, CPE‘s longtime partner in a series of special reports on demographics and retail real estate, set out to identify retail trade areas that are demonstrating unusually rapid economic recovery.

In order to locate these markets at a granular level, Nielsen identified Zip codes with exceptionally high scores in each of two demographic and economic categories. First, in each of these Zip codes, at least 50 percent of households have $250,000 or more in liquid assets. Moreover, the number of businesses must have increased at least 30 percent between 2009 and 2012.

While not meant to be prescriptive, the roster of locations below may warrant a closer look for retail investment, redevelopment or development opportunities. Moreover, Nielsen’s strategy of identifying areas where affluence coincides with pockets of rapid business growth could offer new criteria to consider.

For more about affluence, business creation and retail real estate investment, read the complete special report in the May issue of CPE.

You must be logged in to post a comment.