New Supply Keeps Rent Growth Tepid in Baltimore

Thanks to the revival of its core and the emergence of the Baltimore-Washington corridor as a strategic location, the metro’s multifamily fundamentals have stabilized.

By Bogdan Odagescu

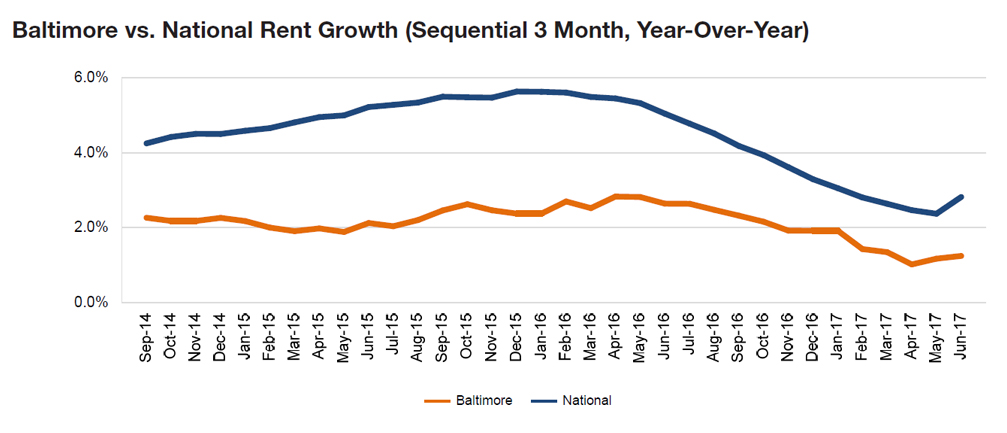

Spearheaded by the revival of its core and by the emergence of the Baltimore-Washington corridor as a strategic location, the metro’s multifamily fundamentals have stabilized. Baltimore’s economy is slowly diversifying and once again adding residents after a decades-long demographic drop. However, with rents up 1.2 percent in the year ending in June, progress is slow and Baltimore continues to underperform the nation as a whole.

Anchored by academic institutions, health-care facilities and research centers, Baltimore is generating white-collar jobs, while also losing positions in traditional working-class sectors, including manufacturing and trade, transportation and utilities. However, the city continues to draw developers and several large projects are under construction or on the drawing board. Alongside Sagamore’s $6.5 billion Port Covington master-plan, the list includes the 3,100-acre TradePoint Atlantic, the 3 million-square-foot Harbor Point, the 500-foot-tall 414 Light St. residential high-rise and the multi-phase, $800 million Center/West redevelopment project.

Almost $750 million in assets traded in the first two quarters, marking a slight deceleration after three years of bullish investor activity. There were 8,238 units under construction as of June, 30 percent of which are slated to come online in the second half of 2017. As inventory growth remains solid, while population gains stay tepid, we expect a 1.4 percent rent increase for the year.

Read the full Yardi Matrix report.

You must be logged in to post a comment.