New Jersey Industrial Sales Lead Nation

Strong demographics continue to support the market’s demand, according to CommercialEdge.

New Jersey’s industrial sector continued to experience robust demand in the first quarter of this year, driven by the strong demographics of the surrounding area and bustling activity at nearby ports.

The metro’s investment volume led the country, with $832 million in assets changing hands, according to CommercialEdge data. The market’s average price per square foot during the same period ranked third nationally, clocking in at $255.6.

Additionally, New Jersey had the most significant year-over-year rent growth in the U.S., at 11.3 percent. In terms of construction activity, eight projects totaling roughly 1.3 million square feet broke ground year-to-date through March.

New Jersey’s sales activity ranks first

New Jersey’s industrial transaction volume took the lead nationally in the first quarter of the year, clocking in at $832 million—a sharp increase from the $250 million registered last year during the same period. Other peer markets with strong sales activity during the same period were Dallas ($711 million) and Chicago ($616 million), while Indianapolis ($111 million) was at the other end of the spectrum.

Assets in the metro traded for $255.6 per square foot, more than double the $126 national average and well above markets like Phoenix ($176.9 per square foot) and Indianapolis ($110.9 per square foot). Chicago ($95.4) posted one of the lowest average sale prices in the country.

In the biggest sale of the year in the market so far, Prologis purchased a 600,000-square-foot industrial asset in South Brunswick, N.J., for $166.8 million. ARC Realty sold the 2008-completed warehouse.

During the same month, Taconic Partners acquired a 360,000-square-foot facility for $74.3 million. The North Brunswick, N.J., asset is the developer’s second industrial acquisition in the market.

Construction activity remains steady, still behind peers

New Jersey’s industrial development pipeline at the end of the first quarter clocked in at 6.3 million square feet, according to CommercialEdge. Dallas-Fort Worth continued to lead the nation with 24.8 million square feet underway, followed by Phoenix (15.1 million square feet) and Houston (14.7 million square feet).

The New Jersey under-construction projects accounted for 1 percent of the metro’s total inventory, slightly below the 1.7 percent U.S. index. When factoring in projects in the planning stages, the market’s share reaches 2.4 percent, still below the 3.7 percent national rate, but above peer markets such as Chicago (1.7 percent) and Orange County (1 percent).

Russo Development is currently working on the first phase of Kingsland Meadowlands, a 932,763-square-foot industrial facility in Lyndhurst, N.J. The development is expected to come online this year. Upon full build-out, the campus is set to feature seven buildings totaling about 3.4 million square feet.

Industrial completions decrease year-over-year

New Jersey’s industrial completions in the first quarter amounted to roughly 2.1 million square feet, down almost 1 million square feet year-over-year. The six properties that came online accounted for 0.6 percent of the metro’s total inventory.

Among peer markets, Pheonix (8.6 million square feet) and Chicago (2.3 million square feet) fared better, while Indianapolis (752,500 square feet) and Kansas City (1.7 million square feet) were at the opposite end of the spectrum. This year, 2020 Acquisitions completed three buildings within the Central 9 Logistics Park in Old Bridge, N.J. The facilities total almost 1.6 million square feet and are part of a three-phase development.

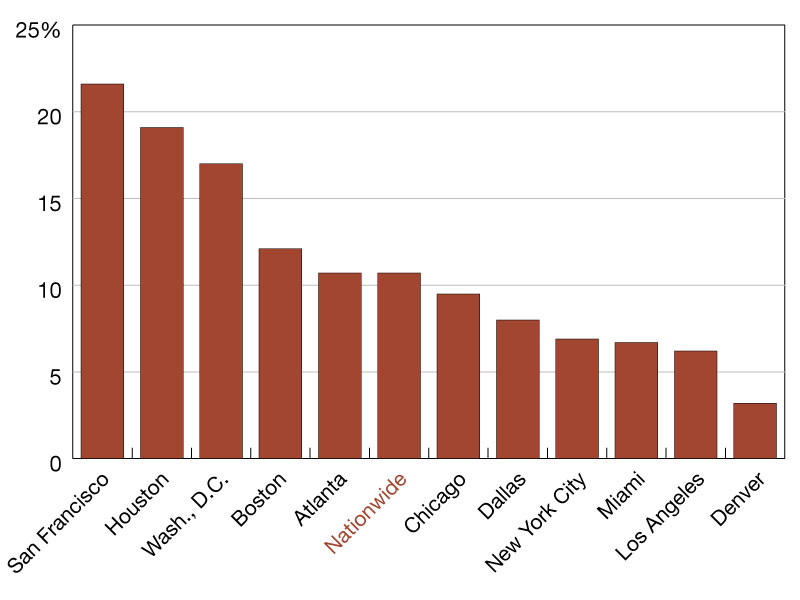

New Jersey’s industrial rent growth is highest in the U.S.

New Jersey’s industrial vacancy rate at the end of the first quarter clocked in at 9.6 percent, 110 basis points above the national average, but below Dallas (10 percent) and Chicago (10.6 percent). From 2022 to 2024, the market saw more than 36 million square feet of come online, resulting in increased available space. As development slows and demand remains strong, vacancies are expected to decrease once leasing activity accelerates.

The market’s average listing rate in March clocked in at $11.7, more than $3 above the U.S. figure. Additionally, New Jersey posted the higher year-over-year rent growth, an 11.3 percent increase. Orange County ($16.7) was the most expensive market, followed by Los Angeles ($15.2) and the Bay Area ($13.6).

You must be logged in to post a comment.