Net Lease Market Beats Expectations

A late-year rally drove one of the strongest quarters on record, according to new research from Stan Johnson Co.

Significant pent-up demand from investors in the fourth quarter of 2020 helped the overall single-tenant net lease sales volume surpass $60 billion, with more than $20.5 billion in activity coming in the last three months of the year, according to a report from Stan Johnson Co.

READ ALSO: Industrial Real Estate Clear Leader in Moody’s Report

It was the fifth-strongest quarter for activity in history and helped the single-tenant net lease sector beat predictions of only about $50 billion in investment sales for the year.

Private investors were the largest group of investors at 38 percent, followed by U.S.-based institutional investors that drove 28 percent of the overall fourth-quarter sales.

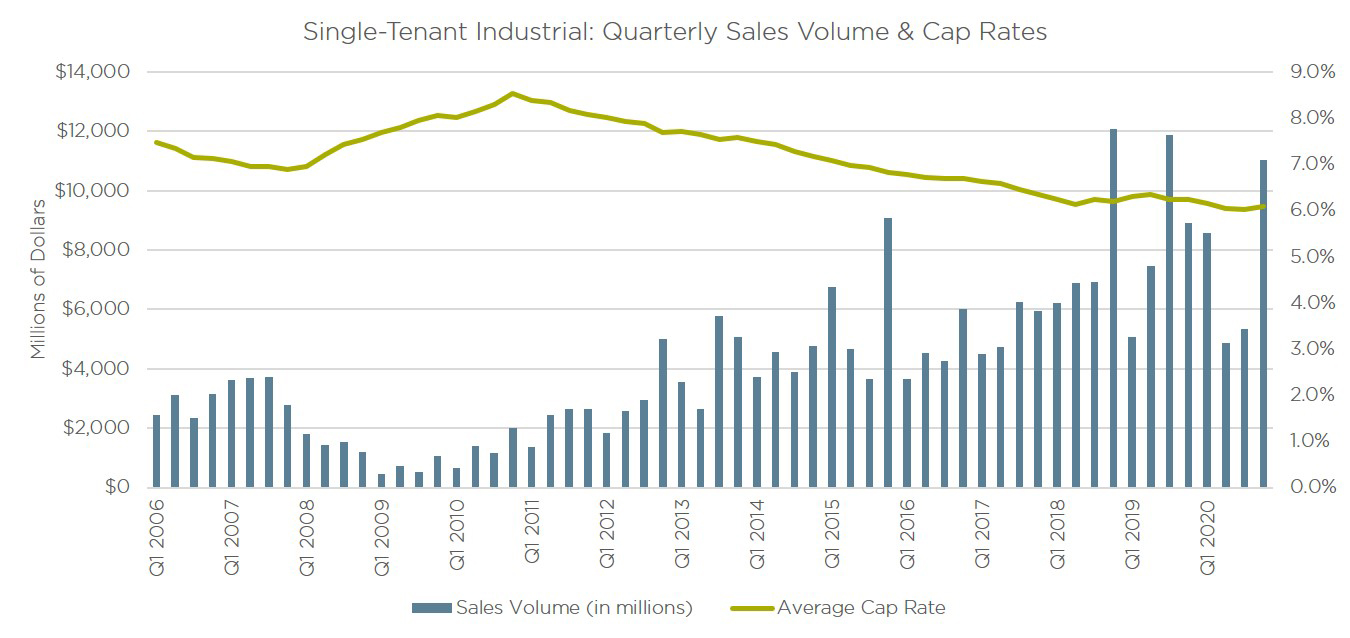

Q4 2020 Industrial Sales and Cap Rates. Chart courtesy of Stan Johnson Co., Real Capital Analytics (analysis includes sales greater than $2.5 million).

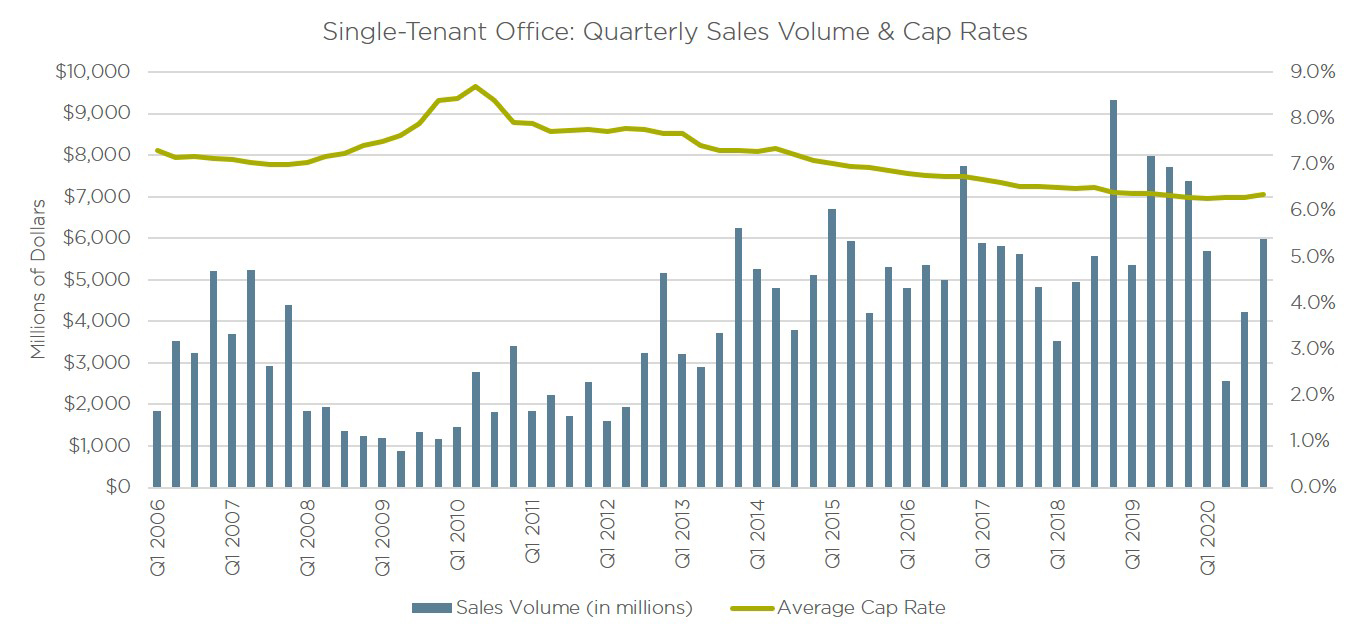

The Stan Johnson Co. Q4 Net Lease MarketSnapshot report also stated the average cap rate for the single-tenant net lease investment sales was 6.19 percent in the fourth quarter, with both office and industrial sectors reporting slight increases quarter-over-quarter. Lanie Beck, director of corporate research at Stan Johnson Co., noted the market had been at or near the bottom for quite some time and further cap rate compression was expected. Industrial cap rates, which had finished the third quarter at an average of 6.02 percent, had been projected to possibly drop into the 5 percent range, but instead ended the year at 6.10 percent, Beck said. The office sector reported a 7-basis-point jump to 6.34 percent in the fourth quarter.

2020 overall sales down

While the single-tenant overall market—which includes retail net lease sales—improved in the fourth quarter, it was clear the pandemic took a toll on sales earlier in the year resulting in the lowest sales volume since 2017, when it was approximately $59 billion. In 2018, the total increased to approximately $70 billion and jumped to nearly $80 billion in 2019. Beck notes in the report that it’s not known yet whether that pent-up investor demand that kicked in for the fourth quarter will carry over to the first quarter of 2021. She does state, however, that there’s a good chance the fourth-quarter uptick in cap rates was temporary.

Q4 2020 Office Sales and Cap Rates. Chart courtesy of Stan Johnson Co., Real Capital Analytics (analysis includes sales greater than $2.5 million).

“For the industrial and retail sectors, cap rates are likely to compress further or at least stay stagnant over the next several quarters, while office remains a bit more of a question mark,” Beck wrote. “High quality medical assets and sale leaseback activity may help keep office cap rates from rising dramatically in the coming months, although the gap in average rates is expected to widen when compared to industrial and retail averages.”

A closer look at industrial, office

The report notes industrial and office transaction volumes combined for 81 percent of the single-tenant net-lease investment market’s sales activity in 2020. In the fourth quarter, industrial sales reached $11.03 billion, up from approximately $5.3 billion in the third quarter. Office sales were nearly $6 billion in the fourth quarter, up from about $4.2 billion in the third quarter.

U.S.-based institutional investors and REITs were more active in the industrial and office sectors than retail in 2020, although private buyers invested heavily across all sectors. In the office sector, 35 percent of the transactions were by domestic institutional investors, 30 percent by private buyers, 10 percent by REITs and 12 percent by international buyers. Private buyers made most of the industrial investments (32 percent) followed by domestic institutional investors (29 percent), REITs (19 percent) and international buyers (15 percent).

Read the full report by Stan Johnson Co.

You must be logged in to post a comment.