Nerves of Steel

By Kenneth P. Riggs, Jr., Chairman & President of Real Estate Research Corp.: Uncertainty is still the name of the game in the investment world, including commercial real estate, as the nation gears up for November election results, possible European bailouts and probable government stimulus from the Federal Reserve.

By Kenneth P. Riggs, Jr., Chairman & President of Real Estate Research Corp.

By Kenneth P. Riggs, Jr., Chairman & President of Real Estate Research Corp.

Uncertainty continues to dominate the investment environment—uncertainty about the outcome of the November elections and the “fiscal cliff” facing our nation at the end of the year, uncertainty over whether the Federal Reserve will throw another round of quantitative easing into the economic mix, uncertainty about which European country will need a bailout next or whether the euro will survive, to name a few—it is going to be hard to balance the return investors require and the risk that is getting harder and harder to stomach.

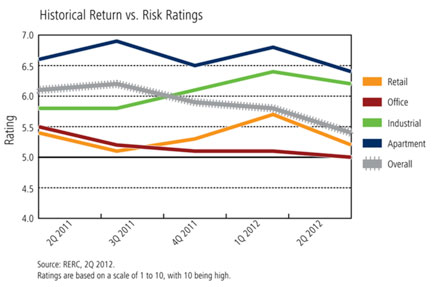

Even prime commercial real estate, which as an asset class on an institutional basis is considered a relatively “safe” investment and has been clearly holding its own during the ups and downs of the recession and recovery, is becoming more risky as prices have been bid up in the major markets. In fact, Real Estate Research Corporation’s (RERC’s) return versus risk ratings, as reported in the recent issue of the RERC Real Estate Report, declined for commercial real estate as an asset class and for each of the individual property sectors during second quarter 2012. This reflects the recent run-up of prices for core properties and the major markets and the lack of rebound for properties located in the secondary investment markets.

For the major markets, while the retail, industrial, and apartment sectors have shown modest volatility during the past year (see accompanying graph), RERC’s return versus risk ratings for the office sector and for commercial real estate in general have steadily declined during the past 18 months. Further, the risk of investing in the office sector has increased such that there is no view of a return advantage over risk. This decline in return versus risk ratings to the point of equilibrium is not surprising, as the demand remains tepid, given the weak job growth during the recovery and the bid-up of prices for well-located and well-leased office properties.

Interestingly, RERC’s required pre-tax yield rates or total return expectations, as reported in the summer 2012 RERC Real Estate Report, remained steady for the office, industrial, and retail sectors in second quarter, and declined only slightly for the apartment sector (which most investors consider to be fully priced). In addition, RERC’s required going-in capitalization rates further compressed for the office, industrial, and retail sectors, and remained unchanged for the apartment sector.

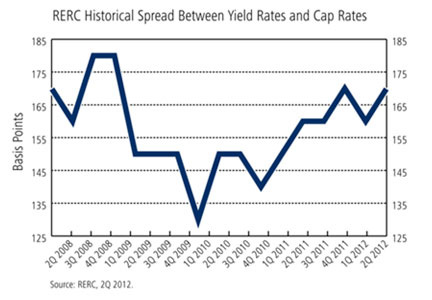

In fact, as shown in the graph below, the spread between RERC’s required pre-tax yield rates and the required going-in cap rates is at a very healthy level, having recovered about 50 basis points from its low, and in the second quarter of 2012, the spread is only about 10 basis points from the 2008 high.

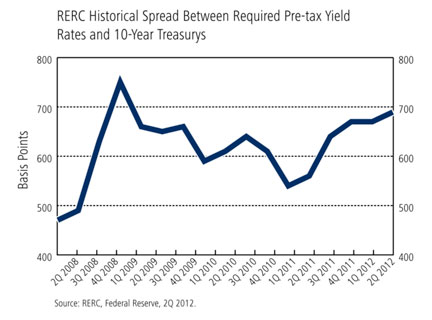

The compression of cap rates and total returns staying flat reflects that investors are pricing growth into their future investment equations. The view is that commercial real estate investment calculus, along with slow growth and the passing of time, is getting us closer to sustainable rental growth. Maybe equally important is that short- and long-term treasuries are at generational lows, and commercial real estate offers amazing return spreads over government bond rates, as shown below, where the spread between RERC’s required pre-tax yield rate and 10-year Treasurys has increased approximately 150 basis points over the past year and a half and stands at around 700 basis points, which is very attractive on a risk-adjusted basis.

With continuing weak employment and economic growth forecasted for the rest of the 2012 and for 2013, one can expect these trends for commercial real estate to continue (barring any new major pitfalls to jar the investment environment). Despite these intensely risky times and near-havoc in the world around us, one has to admire the nerves of steel that this asset class reflects quarter after quarter. Commercial real estate is offering relatively attractive income and yield spreads over 10-year Treasurys. That is the name of the game today.

You must be logged in to post a comment.