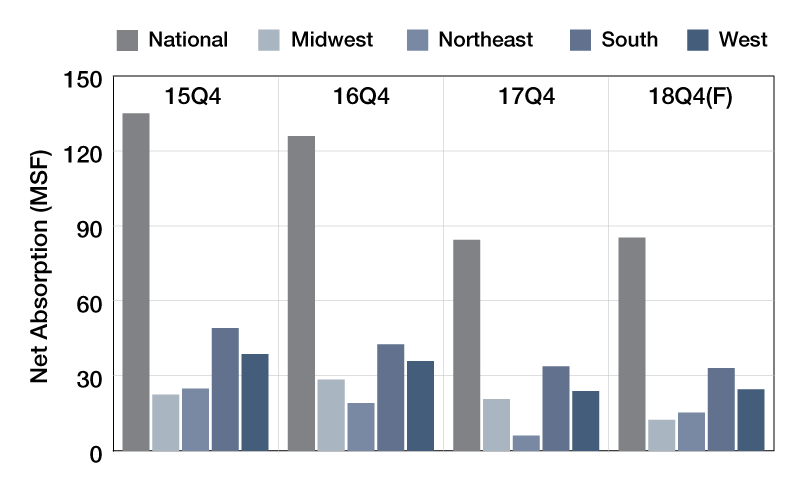

2018 National Office Absorption

Year-over-year office market conditions compared nationally and by region, updated quarterly.

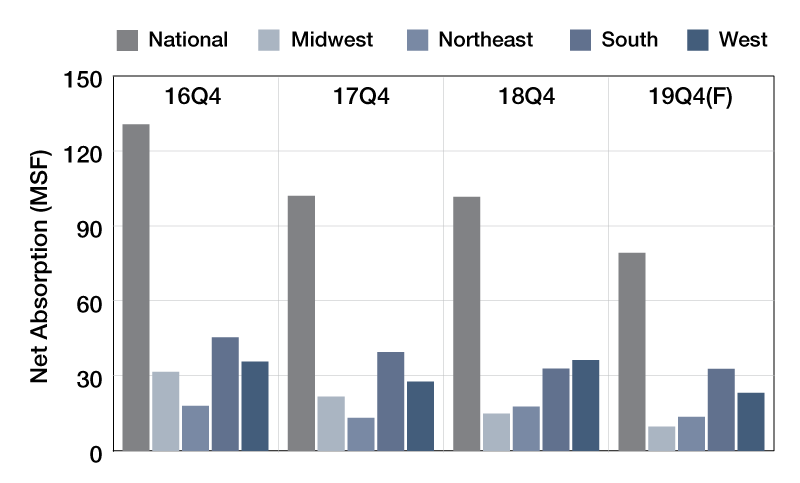

Net absorptions increased year-over-year for office markets in some regions in the fourth quarter of 2018. The most significant growth came from the Northeast, up by 34.4 percent, followed by the West with a 30.9 percent uptick. The biggest drop in absorption came from the Midwest—a 31.8 percent decrease compared to the same period in 2017. The South followed with a 16.7 percent decline. Office net absorptions dropped by 40 basis points on a national level. Compared to the same interval in 2016, national rates fell by 22.2 percent.

Forecasts for the fourth quarter of 2019 show that office net absorptions are projected to decrease in every region. The most significant drop is expected to come from the West (down by 36.1 percent), followed by the Midwest (down by 34.8 percent) and Northeast (down by 23.3 percent). The smallest decrease is expected to come from the South, which is projected to fall by 20 basis points. Net absorption rates are expected contract by 22.1 percent on a national level.

—Posted on Feb. 13, 2019

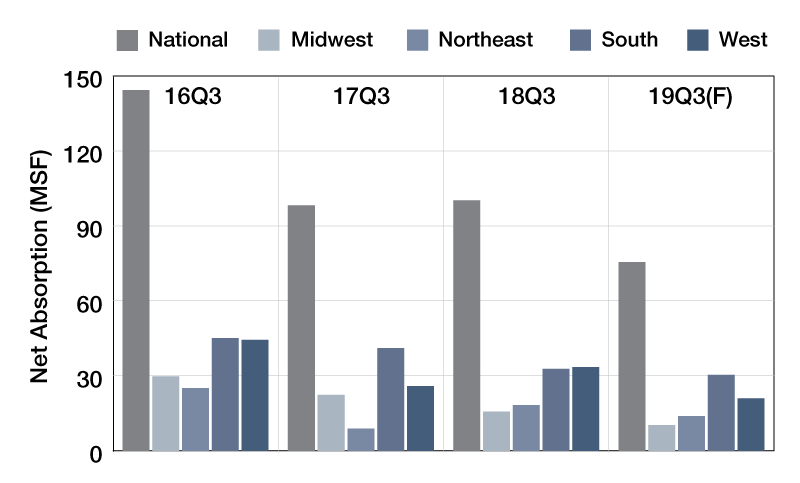

Year-over-year, net absorptions decreased for office markets in certain regions in the third quarter of 2018. The most significant decline came from Midwest, down by 30 percent, followed by the South, with a 20.2 percent decrease. The most notable growth came from the Northeast, with a 106.3 percent increase compared to the same period in 2017, while the West posted a 30 percent increase. On a national level, office net absorptions expanded by 2.1 percent. Compared to the same interval in 2016, national rates dropped by 31 percent. Forecasts for the third quarter of 2019 show that office net absorptions are projected to decrease in every region. The most considerable drop is expected to come from the West, with a projected decrease of 37.5 percent, followed by the Midwest (down by 34.4 percent). The Northeast is set to experience a decrease of 23.8 percent, while the South is projected to drop 7.3 percent. Net absorptions are expected to inch down by 24.6 percent on a national level.

—Posted on Nov. 9, 2018

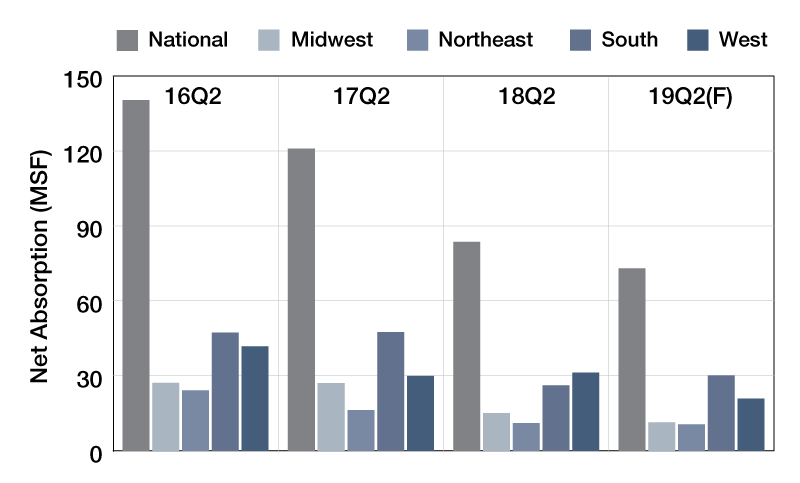

Year-over-year, net absorptions decreased for office markets in most regions in the second quarter of 2018. The most significant decline came from the South, down by 45 percent. The only growth came from the West—a 4.2 percent increase compared to the same period in 2017. Office net absorptions dropped by 30.9 percent on a national level. Compared to the same interval in 2016, national rates inched down by 40.5 percent. Forecasts for the second quarter of 2019 show that office net absorptions are projected to decrease in almost every region, except the South (up by 15.4 percent). The West is projected to experience the largest decline at 33.4 percent, followed by the Midwest with a 24.3 percent drop. The Northeast is set to experience a slight decline of 4.3 percent, while net absorption is expected to decrease by 12.6 percent on a national level.

—Posted on Aug. 15, 2018

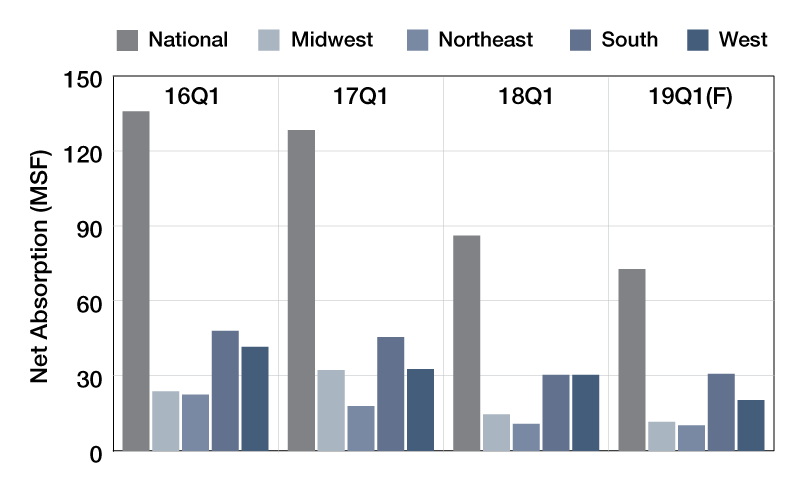

Net absorptions decreased for office markets in every region in the first quarter of 2018, compared to the same period in 2017, the most notable decline coming from the Midwest by 54.9 percent, followed by the Northeast (down by 39.5 percent). The most minor change came from the West, with only a 7.2 percent decrease year-over-year. Office net absorptions inched down by 32.9 percent on a national level. Compared to the same interval in 2016, national rates dropped by 36.6 percent. Forecasts for the first quarter of 2019 show that office net absorptions are projected to decrease in almost every region. The most significant change is expected to take place in the West (down by 33.1 percent), followed by the Midwest (down by 20.8 percent). The South is set to experience a slight increase of 1.2 percent, the only forecasted growth for the first quarter of 2019.

—Posted on May 15, 2018

—Posted on Feb. 21, 2018

You must be logged in to post a comment.