NAREIT: September Rebound for U.S. Equity REITs

An inside look at the driving factors of the rebound.

By Gail Kalinoski, Contributing Editor

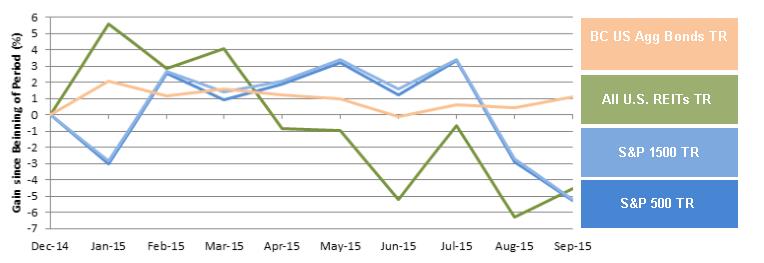

U.S. equity REITS, which have struggled most of the year, recovered in September as investors may have finally realized they were undervaluing them, delivering gains while other major market indices were down for the month and third quarter, according to NAREIT.

Brad Case, NAREIT’s senior vice president for research and industry information, said “growing investor perceptions that REITs have been undervalued” may have been a driving factor in the rebound.

“Investors may have felt these are honestly undervalued assets and they are not going to remain undervalued forever” and decided to act on those concerns, Case told Commercial Property Executive.

He said the Federal Reserve Bank’s decision not to increase interest rates in September likely did not play as big a role in the strong REITs results although fear of rising interest rates helped depress the REIT share prices earlier in the year.

The FTSE NAREIT All REITs Index, which contains equity and mortgage REITs, was up 1.9 percent for September and 0.76 percent in the third quarter on a total return basis. The increase was mainly due to the strength of the FTSE NAREIT All Equity REITs Index, which rose 2.13 percent for the month and nearly 1 percent for the quarter. The FTSE NAREIT Mortgage REITs Index was down 2.37 percent in September and 2.96 percent for the quarter.

The FTSE NAREIT All REITs Index included 223 REITs with a combined equity market capitalization of $890 billion, according to NAREIT.

By comparison, the S&P 500 declined 2.47 percent in September and 6.44 percent for the third quarter. The S&P Composite 1500 was down 2.57 percent in September and dropped 6.69 percent in the third quarter.

Self-storage led the U.S. equity REIT market with a 6.19 percent total return for the month followed by the apartment sector with a 5.46 percent gain and manufactured homes with a 5.21 percent increase. Year-to-date those sectors were also the top performing with self-storage again leading the pack with a 20.46 percent gain, followed by manufactured homes with 15.20 percent and apartments with a 7.52 percent increase.

For September, shopping centers delivered 4.35 percent in gains. Free-standing retail rose 3.98 percent, followed by industrial up 3.97 percent, office up 3.78 percent, healthcare up 3.58 percent and mixed industrial/office up 3.52 percent.

The strong September showing for the equity REITs was not enough to make up for the struggles earlier in the year so year-to-date numbers through Sept. 30 show the total returns of the FTSE NAREIT All REITs Index decreased 4.52 percent. The FTSE NAREIT All Equity REITs Index did better than the FTSE NAREIT Mortgage REIT Index but both were still down for the first 9 months of the year with the equity REITs declining by 4.51 percent and the mortgage REITs dropping by 7.90 percent. Those declines were deeper than the overall stock market with the S&P 500 down 5.29 percent through Sept. 30 and S&P Composite 1500 down 5.23 percent.

While he believes the U.S. economy will continue to slowly improve, recent concerns about the global economy in places like China may have played a role in boosting U.S. equity REITs in September, Case noted.

“Most U.S. REITs do not have exposure to global real estate markets at all,” Case said, adding that when investors have concerns about the economy overseas, “then you want to bring your capital home.”

Another trend to watch in the coming months is concern that private valuations may be too high. He noted that private valuations of properties tend to lag behind the public REITs.

“During the fourth quarter and first quarter of next year we are more likely to see the tempering on the private side that we’ve already seen in the public side this year,” Case told CPE.

In the meantime, we are likely to continue seeing more private equity purchases of REITs because the investment managers have a lot of capital to deploy.

“The quickest way is not to buy one property at a time but to buy a REIT at a time,” he said.

You must be logged in to post a comment.