Yardi Matrix: Multifamily Rents Steady in February

Rent growth for February looks strong despite a 50-basis-point decline from last year's figure.

By Mallory Bulman, Associate Editor

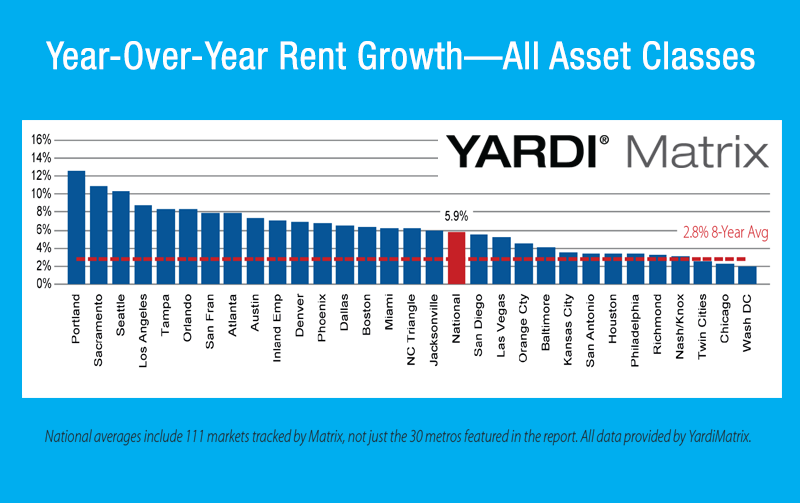

Rents made a solid increase in the past month, increasing $7 to an average national rental rate of $1,175, an all-time high, according to Yardi Matrix’s most recent Matrix Monthly report. This figure replaced January’s peak of $1,168. On a year-over-year basis, rents were up 5.9 percent in February, which is 6.4 percent less than a month earlier. The 50-basis-point decrease is not likely cause for concern, as the report chalks this up to the exceptionally strong numbers of February 2015 and the predicted moderation of rent growth this year. “Even though the year-over-year declined 50 basis points, February was still a pretty good month and we’re still seeing good rent increases. The reason it declined is because last February was even better,” said Paul Fiorilla, editorial director of Yardi Matrix.

Rents made a solid increase in the past month, increasing $7 to an average national rental rate of $1,175, an all-time high, according to Yardi Matrix’s most recent Matrix Monthly report. This figure replaced January’s peak of $1,168. On a year-over-year basis, rents were up 5.9 percent in February, which is 6.4 percent less than a month earlier. The 50-basis-point decrease is not likely cause for concern, as the report chalks this up to the exceptionally strong numbers of February 2015 and the predicted moderation of rent growth this year. “Even though the year-over-year declined 50 basis points, February was still a pretty good month and we’re still seeing good rent increases. The reason it declined is because last February was even better,” said Paul Fiorilla, editorial director of Yardi Matrix.

Year-over-year increases in most metros are reported near 6 percent, but some areas are exhibiting signs of slowing. Slightly declining growth in recent months in tech-focused markets like Portland, San Francisco and Denver may yet prove to be a concern, as those metros are still at the top of the year-over-year rankings. “The tech sector has cooled,’’ the report states, “with some public offerings canceled and smatterings of layoffs.”

The trailing three month numbers, which may or may not yet be indicative of future trends, revealed large shifts from only a month ago. Seattle, where growth had been leveling off, recovered to the top of the ranking with a 1.1 percent increase, while previous underachievers Jacksonville, Fla. and Baltimore rounded out the top three after being near the bottom of last month’s trailing three-month ranking. Boston also climbed significantly, from bottom third to top third in one month. On the other hand, Atlanta and Miami entered the bottom third after being in the top third last month.

A steadier indicator, the year-over-year rents grew a sound 10 basis points over January. Demographically, the report finds that U.S. renters are still eschewing pricier lifestyle apartments for those in the rent-by-necessity category. A handful of markets demonstrate the discrepancy between the rent-by-necessity (RBN) and lifestyle segments, including Denver (13.1 percent RBN versus 7.8 percent lifestyle) and Houston (6.8 percent RBN versus 3.3 percent lifestyle).

“In most markets, the difference isn’t that pronounced, but there are a handful of markets where, like we mentioned in the report in Denver and Houston, where there’s a lot of high-end supply but demand is mostly on the lifestyle side,” said Fiorilla.

You must be logged in to post a comment.