Miami’s Healthy Climate

With substantial job gains and above-average population growth, the metro continues to foster positive fundamentals for multifamily.

By Evelina Croitoru

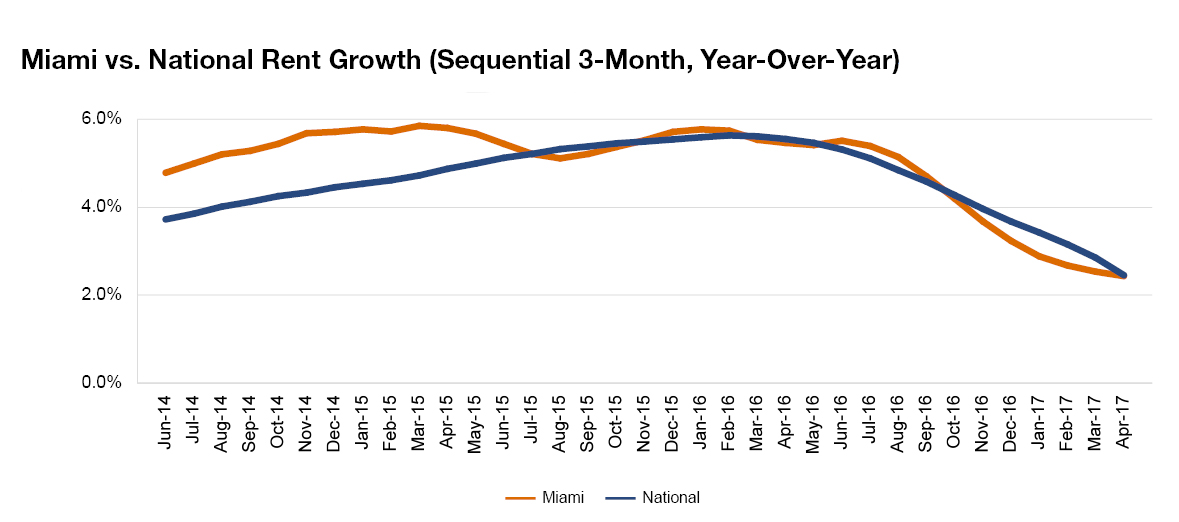

With substantial job gains and above-average population growth, Miami continues to foster positive fundamentals for multifamily. However, as with much of the country, rent growth has decelerated to long-term averages, as the overwhelming amount of new supply begins to take its toll.

Employment gains continue to drive demand for housing, with 50,500 jobs added in the year ending in February. The $295 million Terminal 1 modernization at Fort Lauderdale-Hollywood International Airport and Mana Group’s 10 million-square-foot center that would facilitate commerce with Asia and Latin America point to further expansion, fueling construction and trade. Additionally, infrastructure improvements, such as the upcoming $3.1 billion Brightline Express train that will connect Miami to Orlando, will also help drive growth.

Despite moderating, multifamily fundamentals remain strong. Transactions crossed the $3 billion mark in 2016, and more than $600 million were completed in the first quarter of 2017. Multifamily development is robust, with roughly 5,600 units expected to come online by the end of the year. Concerns about oversupply may push some projects to later development cycles. As new units compete with existing stock, rent growth is bound to decelerate. However, with demand still strong, we expect rents to grow by 5.3 percent in 2017, a solid gain but below last year’s frothy levels.

You must be logged in to post a comment.