MCB Real Estate JV Eyes Brooklyn Retail Redevelopment

The partnership will invest $100 million in the asset's revamp.

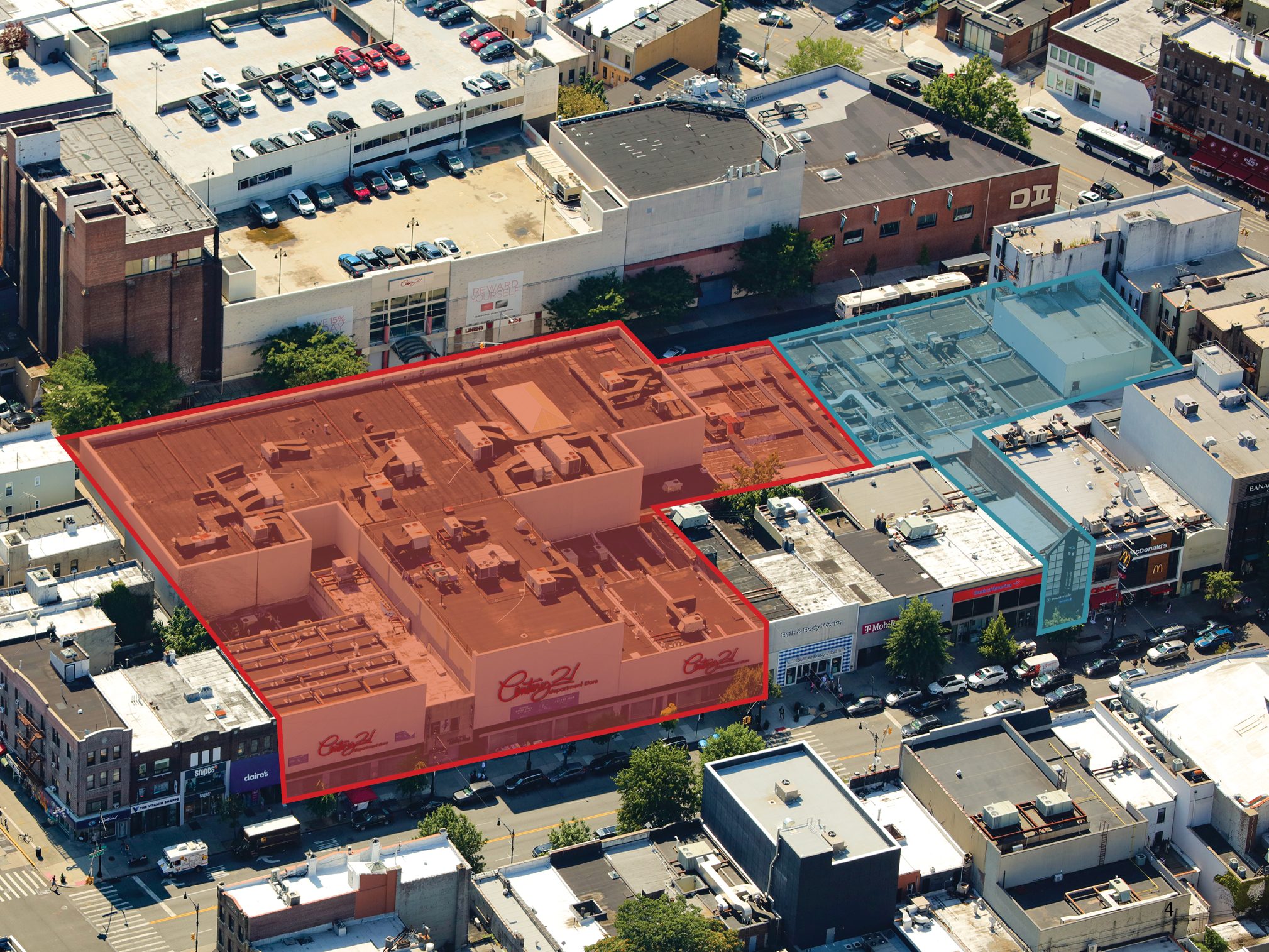

A joint venture between MCB Real Estate and Osiris Ventures has acquired the site of the former Century 21 department store in Brooklyn, N.Y., from ASG Equities. The partnership paid $47.5 million for the 14-lot assemblage at 458 86th St. in Bay Ridge. JLL represented the seller.

The joint venture plans to invest $100 million in the property’s redevelopment into Century Marketplace, a 95,000-square-foot, grocery-anchored store. Plans call for the complete reconstruction of the multi-story structures facing 86th Street into a two-story building, as well as the addition of a new interior atrium. The project is scheduled to break ground next year.

Investors are increasingly drawn to grocery-anchored retail centers, for such properties are “high-performing, low-risk investments,” MCB Principal Drew Gorman told Commercial Property Executive earlier this year. These properties saw a surge in demand in 2024, with $7 billion in transactions and record-high pricing per square foot.

A Bay Ridge retail center

Completed in 1961, the Bay Ridge site served as the original location for a Century 21 Department Store, which later expanded across New York City. The store closed in 2020 due to the pandemic and has since remained vacant. Prior to its shuttering, the property drew more than 4 million visitors during the course of 2018.

The asset is part of a retail corridor where vacancies average 5 percent. Sephora, Foot Locker, Gap, Planet Fitness, Banana Republic, Snipes, Aldo and Victoria’s Secret are among the area’s retailers.

The property is close to the 86th Street subway station and three blocks from Interstate 278. Downtown Brooklyn is some 10 miles northeast.

JLL Senior Managing Directors Ethan Stanton, Jeffrey Julien and Brendan Maddigan, together with Managing Director Michael Mazzara, arranged the sale.

In the first seven months of the year, Brooklyn saw $175.8 million in retail investment sales, with five properties trading at an average per-square-foot price of $698, according to Yardi Research Data. The figure is significantly lower than the one registered in the first seven months of 2024, when four properties changed hands for an average $2,922 per square foot.

You must be logged in to post a comment.