Matt Hoberg: Five Steps to Data-Centric Corporate Real Estate

“How much do we spend on real estate globally?” “How many leases do we have across the world?” “Which buildings could we exit in the next 12 months?” If you are a typical corporate real estate executive, these simple questions may be difficult to answer because the data is not easily available. Today, data lets…

“How much do we spend on real estate globally?” “How many leases do we have across the world?” “Which buildings could we exit in the next 12 months?” If you are a typical corporate real estate executive, these simple questions may be difficult to answer because the data is not easily available.

“How much do we spend on real estate globally?” “How many leases do we have across the world?” “Which buildings could we exit in the next 12 months?” If you are a typical corporate real estate executive, these simple questions may be difficult to answer because the data is not easily available.

Today, data lets real estate talk in a whole new way. It tells us more about productivity, growth opportunities, talent retention and sustainability. It helps real estate communicate with business strategy, sales, operations, HR and IT.

Most companies are not fully exploiting this potential. Yet, top-performing companies excel at the strategic use of data, according to a 2012 study of 330 publicly traded U.S. companies published in Harvard Business Review. The authors found that companies among the top third in their industry for data-driven decision making are, on average, 5 percent more productive and 6 percent more profitable than their competitors.

How can you measure productivity improvements? In one recent example, a multinational company used benchmarking data and analytics to drive an ambitious five-year plan to green its global corporate offices. It could not execute any major energy-related capital improvements in its leased, multi-tenant facilities—only the property owners could make these investments.

The company opted to use a benchmarking database and associated software to track its adoption of approximately 100 detailed, best green practices related to resource use, employee wellbeing and productivity (such as thermal comfort, acoustics, and indoor air quality). These visible metrics inspired and empowered employees to pursue additional cost savings and productivity gains that were tracked and measured. Capturing and analyzing this vast amount of data enabled the company to improve performance scores across its global portfolio by five percent over two years.

Some corporate real estate teams have started to capitalize on sophisticated data gathering and analytics tools. Seventy-eight percent of companies have improved their ability to extract corporate real estate metrics since 2010, according JLL’s 2013 Global CRE Trends report, which interviewed 600 corporate real estate executives around the world.

In fact, almost a third of the survey participants said the provision of data and insights will be the most important future contribution of corporate real estate within their organizations.

The need for investment in data analytics tools is a recurring challenge throughout large organizations. In the Global CRE Trends report, 48 percent of corporate real estate executives reported financial constraints as hindering their teams’ strategic contribution to the broader business and 34 percent cited specific constraints on data and analytics.

Where do I start?

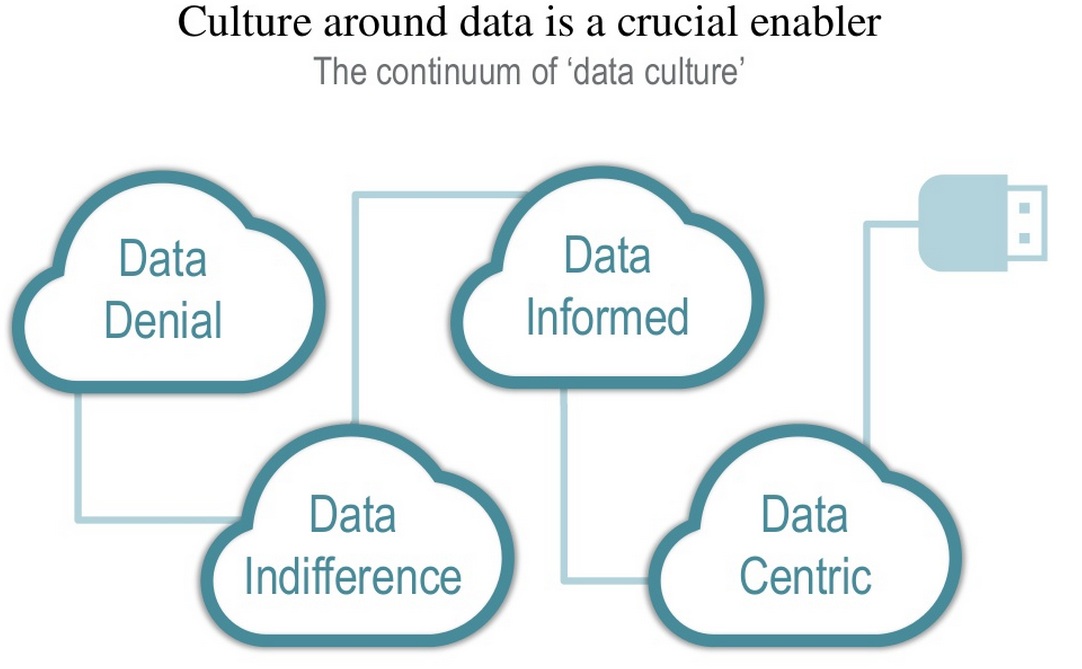

The good news for corporate real estate executives is there are some easy steps to start harnessing data in the future. Here are five to help jumpstart the journey to data-centricity:

- Capture to capitalize. Make a concerted effort to add structure to existing data that may be incomplete or inconsistent. Explore ways to create new data internally or draw on relevant external data sets.

- Don’t separate, integrate. Work with other functions, such as HR, IT and finance, to align and integrate your data. Collaboration will provide rich, new insights.

- Be a change agent (version 2.0). Take the lead in becoming data-centric. By building bridges with other data initiatives across your company and collaborating on new ones, you can establish a stronger context for your own actions.

- Embrace analytics. Turn data into insights. Those at the leading edge are moving quickly beyond data and harnessing the power of analytics.

- Track metrics with impact beyond CRE. In the Global CRE Trends report, corporate real estate executives cited the following as most valuable: occupancy planning data (46 percent); portfolio dashboards (33 percent), financial modeling (33 percent) and rental benchmarking (31 percent).

Why start now? For one thing, the potential savings are real. Take, for example, the case of the global business division of a multinational consumer goods company, which sought to reduce energy usage in all aspects of its operations by 20 percent by 2020. By using cloud-based, smart building management technology in a pilot program encompassing 12 buildings totaling 3.2 million square feet of space, the company found that it could achieve average combined savings of 10 percent in just 11 months with a three month break-even on investment. Within a year, the company had reduced energy costs by 8 to 13 percent, eliminating 4.4 kilowatts of energy usage.

The tools are here today to include real estate data in corporate data-driven decision-making. Data-centricity—placing better, deeper, more accessible and more relevant data at the heart of decision-making—is the key to boosting corporate real estate productivity and relevance to the C-suite.

Matt Hoberg is Global Business Intelligence Manager for JLL. He can be reached at Matt.Hoberg@am.jll.com.

You must be logged in to post a comment.