Market Snapshot: Retail Rent Growth Peaks in Charlotte

Charlotte’s continually rising employment levels and booming population are spurring consumer spending and driving retailers toward expansion.

By Eliza Theiss, Associate Editor

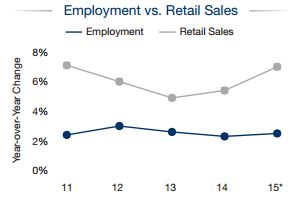

Charlotte’s continually rising employment levels and booming population are spurring consumer spending and driving retailers toward expansion. The city’s job base is expected to expand by 2.4 percent in 2015, adding 22,000 new payrolls, Marcus & Millichap data shows. Ample employment options are being created in Metro Charlotte, both in the city’s urban core and the suburbs, with employers such as Daimler, AvidXchange, GKN Driveline and RingCentral adding hundreds of new positions. Job growth continues to spur positive migration trends in the city—especially in the millennial population—, which are expected to boost their ranks by 2.1 percent in 2015. As employment levels significantly surpass pre-recession levels, household formation is on a rising curve, boosting retail spending, especially in high-priced household items.

Charlotte’s retail spending is expected to outpace the national average, spurring retailers to expand, although new construction is expected to focus heavily on single-tenant, build-to-suit developments. While retail development will continue in 2015 with the addition of 400,000 square feet of new retail space, construction will be significantly lower than in 2014, which saw the completion of 890,000 square feet of new retail space. This includes the 398,421-square-foot Charlotte Premium Outlets, the city’s first mall in nearly a decade. The $90 million high-end outlet shopping center is a joint venture between Simon Property Group and Tanger factory Outlet Centers Inc. 2015’s retail expansion include Cabela’s recently-opened 104,000-square-foot location in Fort Mill, S.C. Grocery chains will also heat up the market, with Publix continuing its aggressive expansion into Metro Charlotte. Following the eight new locations it added in 2014, including the 63,000-square-foot location in Rock Hill, S.C., the Florida-based chain will open a further six location before the year is out.

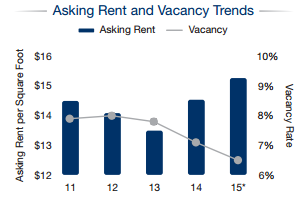

As development focus falls away from speculative constructions and retail activity continues to grow, retail vacancies will tighten by 60 basis points, reaching 6.5 percent. This is expected to be Charlotte’s lowest vacancy level since mid-2008. As a result, asking rents will climb upwards, reaching $15.26 per square-foot. Charlotte’s 5 percent rent gain is double the national average rent growth of 2.5 percent, according to Marcus & Millichap data. This follows a 7.7 percent rent gain registered by Charlotte in 2014.

Sporting more attractive initial yields than other large East Coast urban centers and an expanding economy, Charlotte will attract a wide range of buyers in 2015. National investors will continue to focus on newer, upper-tier assets in prime location, such as the one-million-square-foot Northlake Mall, which traded hands in late 2014 as part of $1.4 billion portfolio sale and the 108,000-square-foot Northlake Commons, which was acquired by Lincoln Property Co. for $31.5 million. First year returns on upper-tier assets in core locations start in the mid-6 percent range, while suburban assets start in the mid-7 percent range. Out-of-state buyers will also gravitate towards single-tenant assets. Depending on lease terms and tenant quality, cap rates can slip below 6 percent for this asset category. According to Marcus & Millichap, soaring prices will redirect local buyers towards neighborhood and strip centers with a strong tenant base, where cap rates move within the low-8 to mid-9 percent range.

Charts courtesy of Marcus & Millichap

You must be logged in to post a comment.