Market Snapshot: Phoenix Retail – A Mixed Bag

While the metro Phoenix retail market has had positive net absorption, other metrics have been less encouraging.

By Liviu Oltean, Associate Editor

The metro Phoenix retail market has been a mixed bag in terms of performance in Q1 2015, according to recent research data from Colliers International. While the market registered positive net absorption for the 14th consecutive quarter and vacancies have continued to decline, asking rents and sale prices have continued a downward spiral.

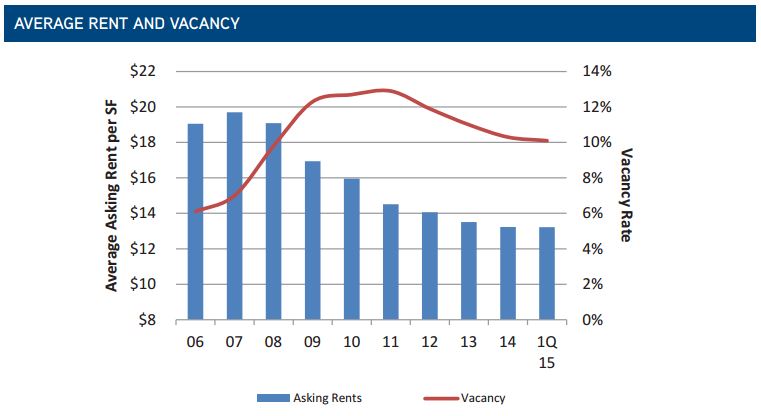

At the end of the first quarter, the vacancy rate reached 10.1 percent, which accounts for a 90-basis-point decline over the past 12 months. While vacancies have improved in most suburban areas, significant drops have been registered in the North Phoenix and East Valley submarkets. Analysts expect the metrowide vacancy to dip below the 10 percent mark this year, which would be a first after 25 consecutive quarters of double-digit performance.

While 2015 is the third consecutive year of positive net absorption, the retail market is not recovering at the expected pace. The first quarter ended with a positive net absorption of 383,000 square feet, well below the market’s 530,000-square-foot average.

In Q1 2015, asking rents reached $13.17 per square foot, having continued last year’s trend, when they dropped by 3.4 percent. The median price per square foot also took a significant hit in the first quarter, after a 35 percent rise between 2013 and 2014. The current price of $90 per square foot is 19 percent lower than 2014’s median price. This decrease has been attributed to the fact that over 40 percent of buildings sold throughout the first quarter had vacancy rates of over 25 percent.

Charts and data courtesy of Colliers International

You must be logged in to post a comment.