Market Snapshot: Phoenix Multi-Family Picking Up Steam

The Phoenix metro area multi-family market received a clean bill of health in the first quarter of the year.

By Liviu Oltean, Associate Editor

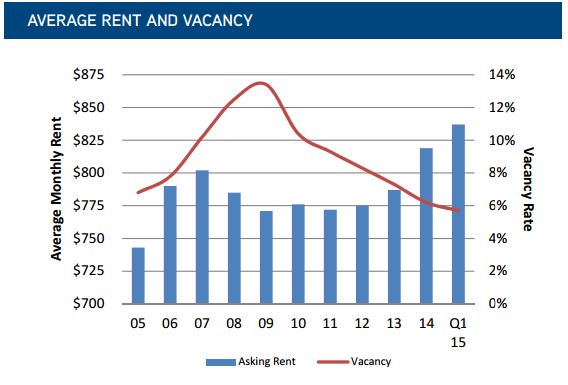

The Phoenix metro area multi-family market has received a clean bill of health in the first quarter of the year, according to recent research data from Colliers International. In Q1 2015, the Greater Phoenix multi-family market registered a vacancy rate of 5.7 percent; absorbed more than 2,800 units; reached an average rent of $837 per month; and clocked in a median sale price of $73,100 per unit.

Healthy market fundamentals lowered the vacancy rate in metro Phoenix to 5.7 percent, a 50-basis-point quarter-over quarter decline and 80 basis points lower than in Q1 2014. Twelve submarkets boasted vacancies under the 5 percent or lower mark, with Ahwatukee Foothills, Chandler and Gilbert in the lead. More than 2,800 units have been occupied by renters in the first quarter of the year, representing a five-year quarterly high. While almost all Valley submarkets experienced positive absorption, the most significant rates were recorded in Scottsdale, Chandler and in Gilbert.

Surging demand and a tightening market incentivized landlords to increase asking rates at a considerable pace. In the first quarter of 2015, average rents rose by 2.2 percent to $837 per month, the strongest quarterly increase ever recorded by Colliers. On account of the momentum gained in 2014, when the median price per unit increased by 10 percent, and an increased sales volume on the upper-end spectrum of the market, the median price per unit reached $73,100 in Q1 2015.

Charts and data courtesy of Colliers International

You must be logged in to post a comment.