Market Snapshot: Phoenix Industrial on the Mend

The Greater Phoenix industrial market started the year off on a positive note.

By Liviu Oltean, Associate Editor

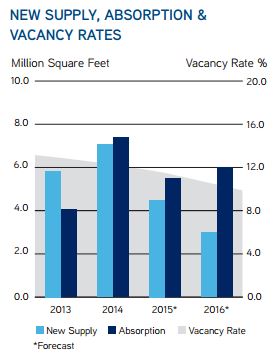

The Greater Phoenix industrial market started the year off on a positive note, according to research data compiled by Colliers International. In Q1 2015, the industrial market in the Phoenix metro area reached a vacancy of 11.8 percent; absorbed more than 1.5 million square feet; added more than 1.1 million square feet of new product; and reached an average asking rate of $0.53 per square foot.

For the first time since 2008, vacancy in the industrial sector dipped below 12 percent, having reached 11.8 percent by the end of March. This accounts for a 180-basis-point decline since 2014. According to Colliers, all of the Valley’s submarkets have performed well in terms of vacancy, with the most significant drop registered in the Southeast Valley submarket, where vacancy decreased by more than 300 basis points to 12.2 percent.

More than 1.5 million square feet of industrial space was absorbed in Q1 2015, marking the fourth consecutive quarter with an absorption rate above the one million mark. The current absorption rate is 400,000 square feet higher than the previous quarter and almost 780,000 square feet higher year-over-year. Speculative developments will total 2.4 million square feet this year, the largest project being the first phase of the 924,000-square-foot Airport I-10 Business Park.

Asking rates have continued to increase in the metro area, albeit at a very moderate pace. In the first quarter, the average asking rate reached $0.53 per square foot, the eight consecutive quarter of growth. Colliers’ analysts do not expect significant rent growth until vacancy dips below the 10 percent mark.

Charts and data courtesy of Colliers International

You must be logged in to post a comment.