Market Snapshot: People Want to Live in Nashville

Apartment-sales numbers don't lie--Nashville is on fire.

By Eliza Theiss, Associate Editor

As Nashville’s multi-family market topped $1 billion in sales in 2014 for the first time ever, the city looks forward to another strong year for the apartment industry. According to the Bureau of Labor Statistics, Metro Nashville has averaged an annual job growth of 3 percent or about 25,000 new jobs over the past five years, surpassing national averages. This continues to attract high-quality talent and young professionals, pushing the 20- to 34-year-old demographic to over 20 percent of the total population and resulting in outsized apartment demand, Marcus & Millichap research shows.

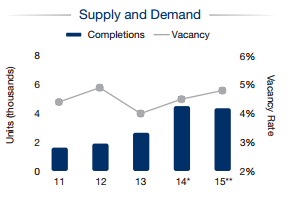

According to Colliers International, 2,987 units were delivered in 2014, resulting in 60 basis point increase in vacancies. However, Nashville’s 95.5 percent occupancy rate remained above the Southeast’s average of 94.3 percent, as well as the 95.3 percent national average. Music City’s occupancy rates have remained above the 95 percent threshold since Q3 of 2011. The highest occupancy rate in 2014 was posted by West Nashville with 97.3 percent, followed by Sumner County with 96.8 percent. Rents also increased in 2014, expanding by 0.3 percent for a monthly average of $955 or $0.989 per square-foot. Downtown Nashville posted the highest rent, $1,381, followed by the dynamic Franklin/Williamson County submarket’s $1,235 monthly rate.

Sales activity was dynamic throughout 2014. Southstar’s $95.1 million sale of Elliston 23 set new records for Nashville in both overall sale price, as well as per-unit price ($287,000 per unit). Other significant transactions closed in 2014 include the $83 million sale of Wyndchase Aspen Grove, the $81.1 million disposition of Dwell at McEwen, the $53 million sale of Vista Germantown and the $47.75 million sale of Aventura at Providence.

2015 is shaping up to be another banner year for Nashville’s apartment industry. Marcus & Millichap forecasts a 3.7 percent expansion of Nashville’s inventory. This will result in a 0.3 percent increase in vacancies for an overall 4.8 percent vacancy rate. Rents will also be on the uptick, increasing by 4.8 percent for a $998 monthly average. Marcus & Millichap expects institutional-grade investors and REITs to continue dominating sales activity for high-end products in Nashville’s CBD and affluent southern suburbs, while 100- to 250-unit assets selling below $15 million are expected to attract interest from private buyers.

Chart courtesy of Marcus & Millichap

You must be logged in to post a comment.