Market Snapshot: Office Hot in Charlotte

Charlotte is poised for another banner year in 2015, with the office market reaching pre-recession markers.

By Eliza Theiss, Associate Editor

Charlotte is poised for another banner year in 2015, with the office market reaching pre-recession markers. This growth is the natural result of a great 2014, a year in which the Queen City was named the top entrepreneurial big city (Global Trade Magazine), the second best city for recent college graduates (Apartments.com), the second fastest-growing big city in the country based (U.S. Census Bureau), the number one city for high pay and low expenses (Yahoo Finance) and the fourth most cost-friendly business location (KPMG).

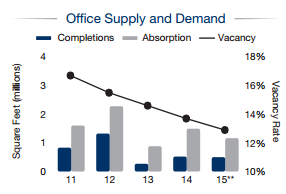

The Queen City’s job base is expected to expand by 2.4 percent in 2015, adding 22,000 new payrolls, after bolstering employment by 15,000 new jobs in 2014, recent Marcus & Millichap data shows. Close to half of 2015’s expected job growth—or about 10,000 new positions—will be created in primary office-using sectors, where employment will expand by 11 percent. As demand for space generates strong leasing activity, vacancies will dip below the 13 percent threshold for the first since mid-2008. 2015 will contract office vacancies by 80 basis points, reaching a 12.9 overall vacancy rate. The submarkets of Uptown and SouthPark will see the strongest leasing activity in the city.

The tightening office market will spur developers to break ground on speculative office projects, although overall deliveries will decelerate in 2015. 500,000 square feet of office space are expected to be delivered in 2015, following 2014’s 525,000 square feet. The year’s biggest project is the 240,000-square-foot, 10-story phase one of Capital Towers, which is expected to deliver in the second half of 2015, according to Marcus & Millichap. The Lincoln Harris project, which broke ground in mid-2014 in SouthPark, also includes a second tower. Upon completion, the entire project will bring approximately 500,000 square feet of Class A+ office space onto the market, along with 35,000 square feet of retail/restaurant space and a seven-level 1,633-space parking deck. Two sizeable office projects are expected to be delivered in Charlotte in 2016 and 2017 respectively.

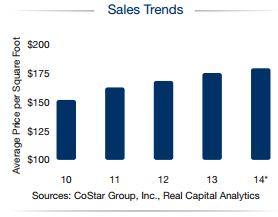

Slowed deliveries paired with dynamic leasing activity will lead to positive rent growth for the fourth consecutive year. Building off a 1.8 percent rent increase in 2014, this year will see rents expand by 2.5 percent, reaching a $21.45 per square foot average. Rising net operating incomes, paired with Charlotte’s high-growth economy and high returns for stable assets will attract significant investor interest across varying asset classes. Medical office assets listings will be outpaced by demand, as cap rates reach the 7 percent area for this asset class. Uptown Charlotte’s Class A properties will remain the preferred target of institutional buyers with initial cap rates in the low 6 percent spectrum. With initial yields 50 to 100 basis points higher than Uptown, stable assets in Midtown and Southpark will also attract investor interest. Smaller assets, in the $1 million to $5 million price range will experience increased investor interest and sales activity due to private buyers sstaking advantage of easy access to capital brought on by relaxing financing restrictions.

Charts courtesy of Marcus & Millichap

You must be logged in to post a comment.