Market Snapshot: Nashville Retail Rocks!

Retail growth in Music City is coming up roses.

By Eliza Theiss, Associate Editor

Retail growth was spurred throughout 2014 by Nashville’s record-breaking apartment sales, above national average job growth, net in-migration and a strong hospitality industry. Nashville’s retail market ended 2014 with an overall rental rate of $16.09 per square foot, Colliers International data shows. This resulted in a yearly rental average of $14.28 per square-foot for 2014, marking the fifth consecutive year of growth. Green Hills/Belle Meade posted the highest rental average with $23.73 per square-foot, followed by Downtown with $23.12 per square-foot.

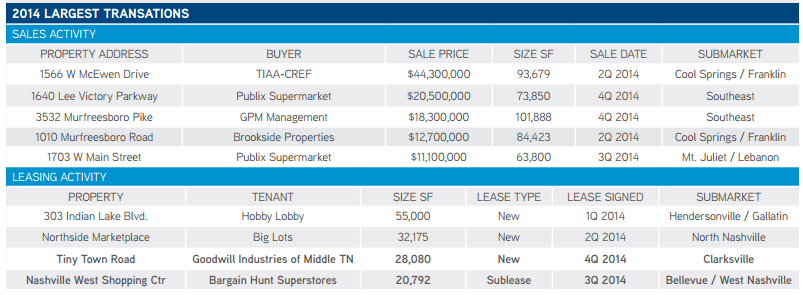

Growing rental rates attracted institutional grade investors to Nashville, with the year’s largest sale fetching $44 million. The deal targeted the 95,000-square-foot Southside at McEwen, a retail trophy asset located in the growing Cool Springs market, which was purchased by TIAA-CREF from Amstar.

Occupancy levels were also on the rise in Nashville’s retail market. The fourth quarter of 2014 ended with a 6.1 percent vacancy rate, marking the lowest rate since the first quarter of 2009. The lowest submarket vacancy rate—which reached 1.6 percent—was posted by Brentwood, followed by West End with 2.2 percent and Green Hills/Belle Meade with 3.2 percent. Supply in the top three submarkets was extremely limited, totaling only six properties with 10,000 square feet up for lease at the end of 2014. Overwhelmingly, Nashville’s submarkets ended with vacancy rates below 5 percent, with the exception of the Southeast Corridor (14 percent) and Bellevue/West Nashville (17.3 percent). The year-to-date net absorption for Nashville’s retail market in 2014 was 880,523 square feet, with the positive absorption trend expected to continue in 2015, according to Colliers International.

2015 is also expected to bring a number of live-work-play developments to Nashville, adding to the metro’s retail inventory, which currently stands at 56,842,698 square feet. Projects such as Crescent Music Row will add street-level retail space in mixed-use residential developments, while large-scale mixed-use projects such as Ovation, Capitol View and Hill Center Brentwood will ultimately expand the region’s retail inventory by several hundred thousand square feet. Ovation alone will generate 500,000 square feet of retail upon completion. A highlight of the year will be C1TYblox, the retail component of Cambridge Holding Inc.’s oneC1TY mixed-use development. As reported by the Jetson Green, C1TYblox will be assembled from 21 repurposed shipping containers, a first for Nashville.

Chart courtesy of Colliers International

You must be logged in to post a comment.