Market Snapshot: Music City’s Industrial Market Follows Suit

The industrial sector has caught up with Nashville's upward trajectory in all other sectors.

By Eliza Theiss, Associate Edit

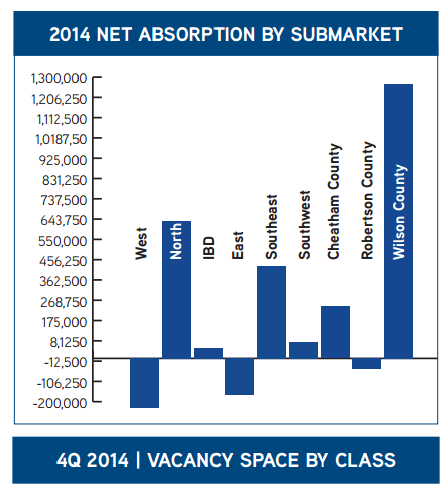

A record-breaking apartment market, as well as tightening retail and office markets and a steady job growth have led Nashville’s industrial market to reach a 7.1 percent vacancy rate in Q4 2014—the lowest since the fourth quarter of 2008—Colliers International data shows. As a result, 2014’s overall vacancy rate averaged 8.1 percent, the lowest in five years. Thanks to industrial relocations and manufacturing and job gains, the annual net absorption reached 2,250,502 feet in 2014. The year’s most significant leases were signed by B&G Foods, who took over 445,942 square feet, Integrity Nutraceuticals with 328,050 square feet, and Music City Productions with 286,404 square feet. However, most absorption was generated by tenants ranging between 100,000 and 400,000 square feet.

Low vacancy rates coupled with market growth led to multiple built-to-suit projects. Under Armour, one of 2014’s high-profile relocations, broke ground on a million square foot distribution center in late 2014, with an early 2016 expected delivery. Overall, 2014 ended with 1,237,500 square feet under construction and built-to-suit projects are expected to remain popular in 2015, Colliers predicts.

The healthy Nashville industrial market also garnered the attention of investors. TPA Group made the biggest industrial investment of the year, paying $38 million for a 556,404-square-foot flex portfolio in the Southeast submarket. TPG Capital followed close behind with a $35.7 million acquisition of a 1,212,800-square-foot portfolio, while Angelo Gordon dropped $26.5 million for the 188,818-square-foot Nordic Nashville Refrigerated asset. According to Colliers data, $709.6 million worth of industrial deals were signed in 2014, a notable increase from 2013’s $589 million.

Rental rates were also on the rise. The fourth quarter’s $3.5 per square foot rental rate brought 2014’s average to $3.4 per square foot, marking the highest rate in three years. Class A product posted the highest rate with $3.63 per square foot in Q4, while also generating the highest vacancy rate at 10.2 percent. Class B product averaged a 7.4 vacancy and a $3.42 asking rate. C class product posted 4.6 percent vacancy and $3.36 rental rate. The highest rents and lowest vacancy rates were posted by Southwest with $5.14 per square foot and a 4.2 percent vacancy, the Industrial Business District with $4.43 per square foot and 4.9 vacancy and East Nashville with $4.12 per square foot and 3.6 percent vacancy.

Chart courtesy of Colliers International

You must be logged in to post a comment.