Market Snapshot: Millennials Push Multi-Family Demand

As Charlotte remains an attractive destination for young professionals, demand for apartments continues to be high.

By Eliza Theiss, Associate Editor

As Charlotte remains an attractive destination for young professionals, demand for apartments continues to be high, spurring rent growth and new developments. Employers continue to expand their presence in the city, lifting employment levels notably higher than pre-recession peaks, according to recent market data collected by Marcus & Millichap.

The Queen City’s job base is expected to expand by 2.4 percent in 2015, adding 22,000 new payrolls. By comparison, in 2014 employers added 15,000 new positions. New employment options are appearing in diverse areas of the city—as a consequence, apartment demand is also growing across the city, not only in one specific submarket. For example, Daimler and GKN Driveline’s several hundred new jobs are expected to increase suburban apartment demand, while the new headquarter and 600 employee expansion announced by AvidXchange in Uptown will contribute to further demand in Charlotte’s CBD. Employment options similar to the latter are driving apartment demand in Charlotte’s urban core, especially among Millennials, a particularly high-profile presence in the Queen City. The millennial population, who represents the largest renter group, is expected to grow by 2.1 percent in 2015 in Charlotte, increasing demand for rentals in the city’s amenity-rich urban core.

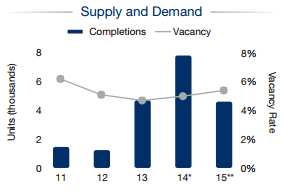

Charlotte’s construction pipeline is expected to slow significantly in 2015 compared to previous years, adding 4,600 new units this year and reaching a 3.4 percent stock expansion. Regardless of the slowed construction pipeline, vacancy will increase in the city by 40 basis points, according to Marcus & Millichap. This comes as a result of the high-paced development and delivery activity in the previous three years. 2014 was of especial significance delivery-wise, with 7,800 new units added the market, marking a 30-basis-point vacancy expansion. Although vacancies are set to reach 5.4 percent over the course of the year, the inflation will be temporary as demand continues to grow within a more limited-supply market.

Increased demand will not only lower temporarily increased vacancy rates, it will also allow operators to boost rental rates. Average rents in Charlotte will reach $925 per month in 2015. While the 3.1 percent projected rent expansion is lower than 2014’s 3.6 percent increase and is slightly under the national average, Charlotte’s post-2010 rent growth averages out to 4 percent per year. This is due to notably above national average rent growth experienced in 2011 and 2012.

Charlotte’s projected long-term rent growth, coupled with some of the lowest yields in the East Coast’s large markets is expected to appeal to a host of investors. Increased investor competition paired with low interest rates will push up the number of transactions, Marcus & Millichap’s research shows. Institutional buyers will target best-in-class properties in Uptown, which trade in the low- to mid-5 percent range, while yield-oriented buyers will invest in suburban assets that can exceed 7 percent return in the first year. A good example of Charlotte’s expected sales activity in 2015 is Cortland Partners’ $274 million purchase of nine communities totaling over 3,200 units.

Chart courtesy of Marcus & Millichap

You must be logged in to post a comment.