MARKET SNAPSHOT: Jobs Improvement Benefits Las Vegas’ Residential, Hospitality Sectors

Steadily improving employment is driving both residential and hospitality market improvement after a number of difficult years for Sin City.

By Alex Girda, Associate Editor

By Alex Girda, Associate Editor

Steadily improving employment is driving both residential and hospitality market improvement after a number of difficult years for Sin City.

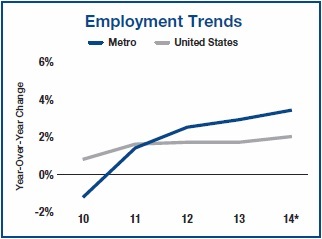

This year, the city will see the addition of approximately 29,600 jobs, as major hotels are added to its roster, according to Marcus & Millichap Real Estate Investment Services. Set for an estimated 3.4 percent increase in employment, metro Las Vegas is currently outpacing the national average in job creation. The increase will represent a 2.9 percent improvement over the previous 12 months, which saw a rise in payroll of 24,500 new jobs.

Trade, transportation and utilities had the strongest growth over the past year, adding 8,800 jobs, while the leisure and hospitality sector followed with 8,100 new jobs. Other sectors are slowly becoming more visible as a result of sustained efforts at diversification, the best example being the relocation of Zappos to a new, larger headquarters in the city’s downtown. The ongoing conversation about bringing a brand-new sports franchise to the city, with most reports pointing toward a Major League Soccer team, would also contribute to the area’s improving economy.

The city added just 510 apartments to its housing stock in the past year, a far cry from the 1,200 units that were completed during the previous 12 months. There were only two high-profile completions, including the 296-unit Edge at Traverse Point, which was recently acquired by a joint venture between The Bascom Group and funds managed by Oaktree Capital Management L.P. Four more apartment properties are set to contribute to the city’s apartment stock, though, including the 320-unit Chandler Apartment Homes.

The city added just 510 apartments to its housing stock in the past year, a far cry from the 1,200 units that were completed during the previous 12 months. There were only two high-profile completions, including the 296-unit Edge at Traverse Point, which was recently acquired by a joint venture between The Bascom Group and funds managed by Oaktree Capital Management L.P. Four more apartment properties are set to contribute to the city’s apartment stock, though, including the 320-unit Chandler Apartment Homes.

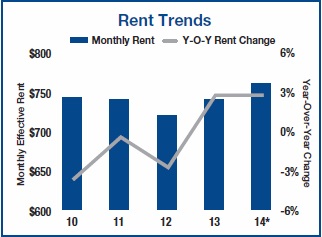

The limited stock has helped landlords, with monthly rents recently hitting the $740-per-month mark on average, a 1.8 percent hike. Submarkets such as Sunrise Manor/Northeast, Summerlin/The Lakes and Central Las Vegas achieved better results than expected, and Marcus & Millichap’s prediction for the end of 2014 is that rates will stand at around $761, essentially a 2.8 percent rise—and similar to 2013’s performance. Apartment vacancy rates rose by 70 basis points during the first quarter of the year, but accelerating job growth and restrained development will drive the rate lower, toward a 6.6 percent average.

The hospitality sector’s growth was reflected in a room revenue hike of 16.5 percent for all of Nevada in the first quarter, while occupancy and property sales also increased, the latter mostly due to deals that were part of the Downtown Project created by Zappos CEO Tony Hsieh.

The hospitality sector’s growth was reflected in a room revenue hike of 16.5 percent for all of Nevada in the first quarter, while occupancy and property sales also increased, the latter mostly due to deals that were part of the Downtown Project created by Zappos CEO Tony Hsieh.

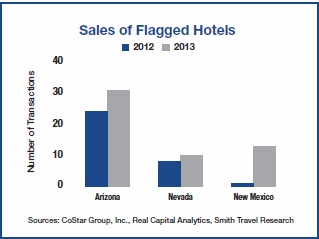

Overall, the Southwest area experienced an increase in RevPAR of 12 percent, as well as a rise in transaction volume. According to Marcus & Millichap, by the end of the first quarter, the area—which consists of Arizona, Nevada and New Mexico—went up 380 basis points to 65.1 percent as business and leisure flowed in from other parts of the country. Nevada led the area in statewide occupancy, full-year RevPAR and sales of flagged hotels, driven by the appeal of Las Vegas and Reno.

You must be logged in to post a comment.