Market Snapshot: Industrial Picks Up in Charlotte

As Charlotte’s employment base continues to expand, the city’s industrial market is seeing the positive effects.

By Eliza Theiss, Associate Editor

As Charlotte’s employment base continues to expand, having ended 2014 with 15,000 new jobs and looking forward to 22,000 new jobs in 2015, the city’s industrial market is feeling the positive effects. The booming population, increasing job base and growing economy are pushing retail sales up, which in turn is positively affecting the area’s industrial market.

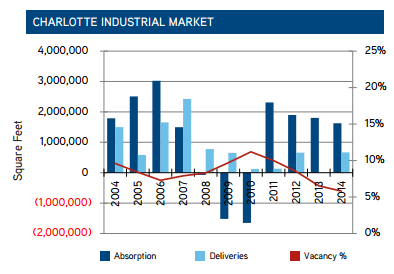

Charlotte’s industrial market closed the fourth quarter of 2014 with 133,145,101 square feet of total market inventory. The overall vacancy rate stood at 5.82 percent, while warehouse space had a 5.03 percent vacancy rate, Colliers International data shows. On a year-over-year basis, vacancy was up 71 basis points, with total inventory up 42 basis points. The lowest vacancy rate was registered in the Central submarket, which ended Q4 with a 4.14 percent vacancy rate and a 140 basis point quarter-to-quarter positive absorption. The highest rate was registered in the Northwest submarket, where vacancy stood at 9.23 percent—a complete turnaround compared to the previous quarter, when the Northwest submarket sported Charlotte’s lowest industrial vacancy rate at 4.98 percent.

The Northwest submarket also posted the lowest asking rental rate within Charlotte, clocking in at $3.71 per square foot. The Central submarket, Charlotte’s smallest submarket in terms of stock, posted the highest rental rate at $7.34 per square foot. Charlotte’s overall average rental rate at the end of Q4 of 2014 stood at $4.89 per square foot. This breaks down to a $4.21 per square foot average warehouse rent and $8.41 per square foot average flex space rent. Lease rates for Class A bulk buildings clocked in at $4.05 per square foot, while class B warehouses averaged out at $3.25 per square foot.

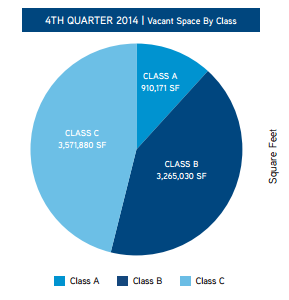

Supply for available industrial space continued to tighten in Q4 2014. As a result, developers are racing to deliver speculative projects. According to Colliers International, over 2.4 million square feet of industrial speculative space were planned at the end of Q4, with five buildings under construction. Moreover, Class A space supply was outstripped by demand.

As capital costs hit a record low in Q4 2014, cap rates continued to slide lower. Well positioned general purpose industrial buildings glided into the low 6 percent cap rates and lower, reaching $55 to $60 per square foot valuations. Q4 was marked by several notable sales, such as the $28 million sale of the 310,000-square-foot Perimeter Woods asset that fetched $90.32 per square foot, which is the highest price registered in the area. The largest sale was marked by the $44.2 million disposition of the $680,000-square-foot Lakemont Portfolio.

Charts courtesy of Colliers International

You must be logged in to post a comment.