Market Snapshot: Demand for Cincinnati Rentals to Rise in 2015

This year will bring more jobs to the Cincinnati metro area, and an even stronger demand for rental housing, according to the National Apartment Market Report released by Marcus & Millichap.

By Adrian Maties, Associate Editor

2015 will bring more jobs to the Cincinnati metro area, and an even stronger demand for rental housing, as estimated in the National Apartment Market Report that was recently released by Marcus & Millichap.

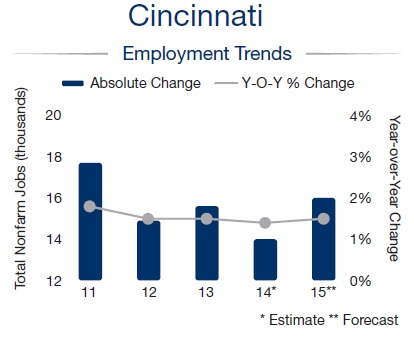

According to the real estate investment services firm, Cincinnati-area employers are expected to boost hiring by 16,000 jobs in 2015, which translates into an increase of 1.5 percent. The numerous new jobs will lead to an increase in demand for both luxury rentals in the major employment hubs and Class B/C units throughout the city—and developers are already responding.

Gaslight Properties is one such developer. The company recently announced its plans to construct an upscale $16.5 million apartment community in Cincinnati’s Clifton neighborhood. It will have 117 units. An even larger project is planned for nearby Maddisonville, where real estate developer Ray Schneider is looking to start work this year on a $25 million luxury community with 250 units. Two other projects, announced last month, will bring almost 500 apartments.

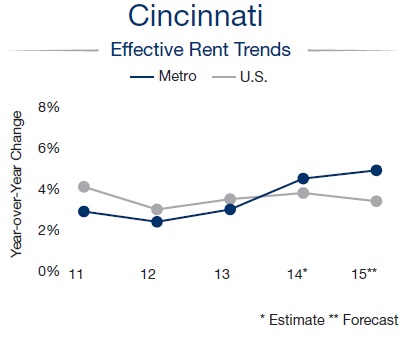

Developers are expected to complete 1,550 units in 2015, increasing supply by 1 percent. In spite of this, apartment vacancies will still drop due to the larger demand. Vacancies are expected to reach five percent by the end of the year, according to Marcus & Millichap. As a result, rents in the Greater Cincinnati area will expand, reaching reach $860 per month in 2015. This is an increase of 4.9 percent year over year.

The strong apartment operations are also expected to bring more buyers to the Cincinnati area this year. Marcus & Millichap reports that investors see the Queen City as a a safe haven for growth of their capital thanks to its high first-year returns as opposed to coastal markets. The high investment demand for available listings in the area is already pointed out by a four-year trend of compressing cap rates, which are expected to continue to fall at a moderate pace.

Charts courtesy of Marcus & Millichap.

You must be logged in to post a comment.