Market Snapshot: Chicago’s Renaissance

The Windy City has recovered post-recession, for three different reasons.

By Ioana Neamt, Associate Editor

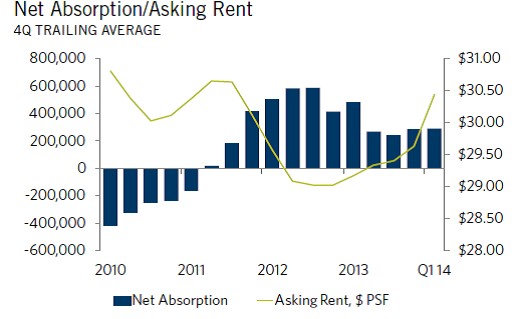

2014 was a strong year for investment in the Chicago metropolitan area. The office sector made a full recovery from the Great Recession, driven mainly by the tourism, technology, and logistics industries. The market experienced more net absorption in 2014 than was lost during the recession, DTZ reports, while investment activity exceeded $4 billion.

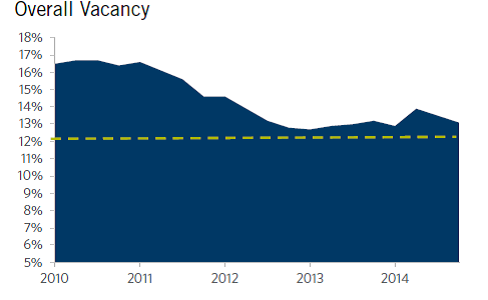

The pool of highly educated workers in the city has been driving many businesses to move to Chicago, causing the overall vacancy rate to drop to 13.3 percent, according to recent data from CBRE. Chicago’s Central Business District experienced the largest positive absorption total in seven years during the fourth quarter of 2014. The largest transactions in the CBD both took place at 150 N Riverside, where Hyatt signed a lease for 250,000 square feet of office space, and law firm Polsinelli signed up for 112,033 square feet. While there is increasingly high demand for Class A and B space, Class C office space is becoming more and more difficult to find, as many assets are being converted to alternative uses such as hotels, retail, and multifamily, CBRE reports.

Chicago’s office market is still positively influenced by the tech industry. DTZ research data shows that new leases and expansions in this sector exceeded 1 million square feet in 2014. Notable developments include 1KFulton, which will deliver over 500,000 square feet of Class A office space in 2015, and South Street Capital’s $90 million adaptive reuse project on Goose Island. 353 N Clark and 300 N LaSalle both broke transaction records, trading at $715 million and $850 million, respectively.

High demand for quality office space and strong investment activity are causing rental rates to rise in the central business district. Meanwhile, affordable office space is becoming scarce. The vacancy rate is expected to continue on a downward path in 2015. Nine properties were under contract for a total of $1.1 billion at the close of 2014’s fourth quarter, DTZ reports.

Charts courtesy of DTZ

You must be logged in to post a comment.