MARKET REPORT: Richmond’s Strengthening Economy Drives All Sectors of Real Estate

The first half of 2014 shows positive growth for Richmond's multi-family and commercial markets, according to recent reports from Real Data and CBRE.

By Adrian Maties, Associate Editor

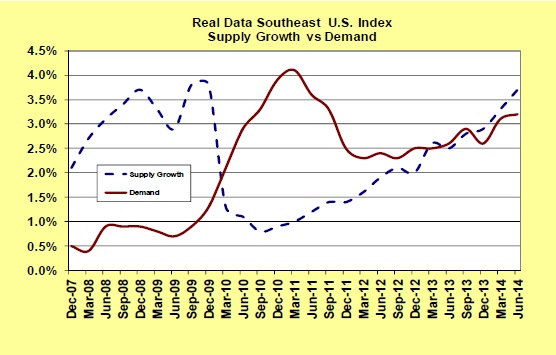

The Metro Richmond apartment market started 2014 off on the right foot. In January, Real Data, an apartment market research firm based in Charlotte, N.C., said that demand in the area was at a three-year high, with more than 1,200 units absorbed over the previous six months. Occupancy was at 94 percent and the average rent hit $909 per month.

In the following six months, demand in the Richmond area slowed down, but another market report released by Real Data in August revealed that the region’s vacancy rate was still at a very healthy 6.2 percent. The average rental rate increased over the same period, reaching $933 per month.

Most of the new construction wave is located in Richmond’s Central submarket. It includes almost half of the units currently underway in the entire metro area, as well as one-quarter of the proposed units. Over the next 18 months, the new construction projects are estimated to outpace the demand for new housing units, which will result in increased apartment vacancies. But this will not stop rent growth: Over the next year, apartment rents in the Richmond area will continue to grow slowly but steadily. Real Data’s market forecast for Richmond estimated that demand will remain strong through 2015.

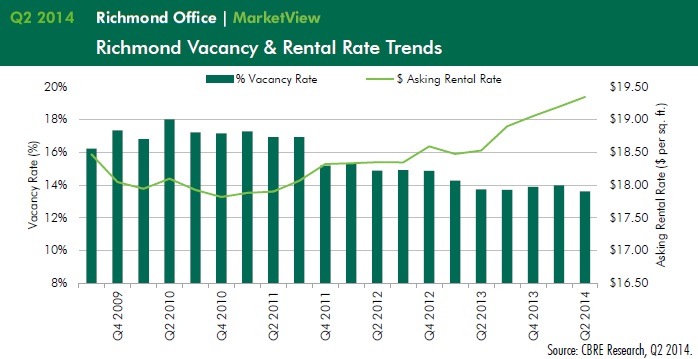

The strong demand for apartments is a result of the healthy local economy. According to CBRE, the Richmond metro area’s unemployment rate was 5.6 percent in the second quarter, lower than the national average. This also had a positive influence on the area’s office market.

In its market report for the second quarter, CBRE revealed that Richmond’s office vacancy rate fell to a new five-year low of 13.6 percent after absorbing 91,467 square feet of space. The bulk of this activity was located in the Northwest quadrant, which reclaimed the lowest vacancy rate in Richmond from the city’s Central Business District. This area’s vacancy decreased to 12.6 percent in the second quarter, while its average asking rent increased to $17.85 per square foot. The Richmond metro area’s average office rent climbed 14 cents to $19.34 per square foot.

According to CBRE’s market data, there were no deliveries in the second quarter, but developers were working on projects expected to deliver more than 440,000 square feet of space. The healthcare industry continues to drive new development in the region.

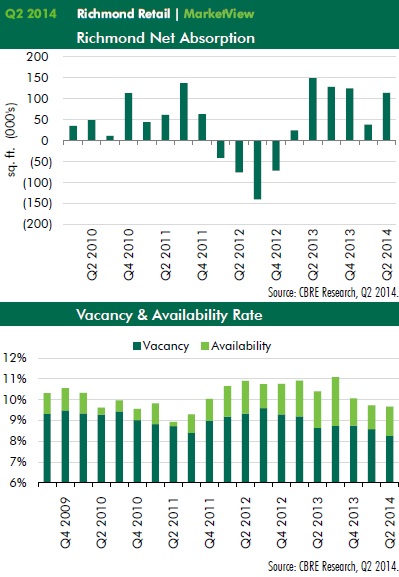

The city’s retail market also experienced a tremendous amount of activity in the first half of the year, with the grocery industry being one of the key drivers. Kroger has added two Marketplace stores in the area in the past 12 months and is currently working on a third retail facility. Meanwhile, other companies such as Wegmans or Walmart also plan to open new locations in the near future.

Richmond’s overall retail vacancy dropped 30 basis points, reaching 8.3 percent, compared to the same period last year. The area saw a slight increase in its average asking rent. It rose two cents per square foot, to $16.13 per square foot.

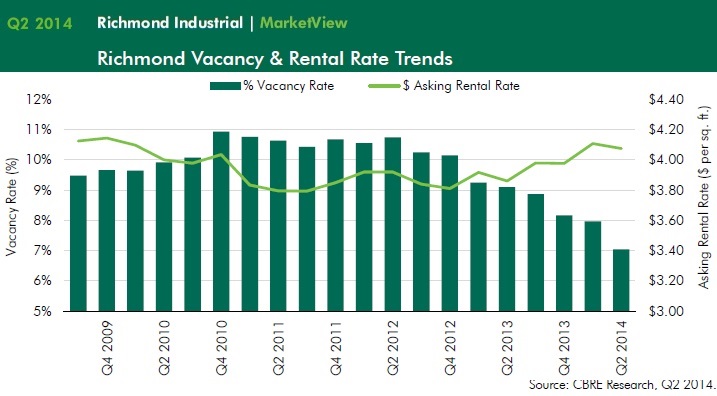

Though the industrial market in Richmond experienced a slower start of the year, it quickly recovered and absorbed 797,337 square feet of space in the second quarter due to tremendous tenant growth. According to CBRE, the region’s vacancy continued its downward trajectory, improving for the eighth consecutive quarter. It fell 1 percent, reaching 7 percent in the second quarter, the lowest it has been since early 2008.

The warehouse market registered the largest improvement, with vacancy rates dropping 1.1 percent, to 6.7 percent. Richmond’s flex market only saw a 0.2 percent decrease, reaching 9.6 percent.

In spite of the massive second-quarter gains, the overall industrial average rents dropped by four cents per square foot in the second quarter, to $4.07 per square foot. This is because much of the quality warehouse space, which commands the highest rates, came off the market. However, CBRE anticipates that the growing demand and the scarcity of supply will cause an increase in rents over the next two quarters.

You must be logged in to post a comment.