Market Report: Nashville’s Living it Up

Music City ended 2014 with a bang!

By Eliza Theiss, Associate Editor

2014 was a banner year for job growth in Nashville, with over 100 business announcing expansions or relocations, adding up to over 2 billion in capital investments, 14,388 new jobs and more than 8.4 million square feet of newly leased or sold space, according to Colliers International.

As a result, Music City ended 2014 with a 6.7 percent overall office vacancy rate, a 130 basis point reduction compared to 2013 year-end. It also marked the lowest vacancy in seven years, according to recent market data by Colliers International. Vacancies were lowest in Class C product, with 5.2 percent, followed by Class A with a 5.4 percent. Class B posted the highest vacancy at 9.6 percent, 0.1 percent lower than the previous quarter.

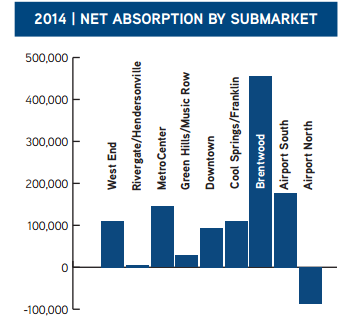

The overall drop in vacancies yielded a year-to-date net absorption of 1,037,864 square feet. Of this, Class A product generated the highest absorption in terms of square footage, with 630,960 square feet. At 1.8 percent, Rivergate/Hendersonville posted the lowest submarket vacancy with Downtown Nashville at the other end of the spectrum with 11.1 percent. However, Downtown’s inventory totals 12.38 million square feet with an additional 442,400 square feet under construction. Overall, 2014 ended with 716,391 square feet under construction.

As vacancies tightened across all product classes, Nashville’s overall rental rates clocked in at $19.3 per square-foot, with Class A product averaging $23.32 per square-foot, Class B $19.35 and Class C $15.23. Green Hills/Music Row posted the highest rental rate at $24.29 per square-foot, followed closely by the Brentwood with $24.23 per square-foot. Downtown Nashville posted the fifth-highest rate with $21.26 per square-foot, preceded by Cool Springs and West End.

Sales activity was also dynamic in 2014, amassing $519 million in investments. The year’s most notable sales included the $98.75 million, 6.8 percent cap rate sale of One Nashville Place, picked up by TA Associates Realty. Fifth Third Center, Nashville’s fourth largest office property, also sold in 2014. It was purchased for $89 million by Lincoln Property Trust at a 6 percent cap rate. Among the year’s most notable deliveries was the 272,000 Class A One Franklin Park in Cool Springs. 2015 is expected to kick off multiple high impact projects, such as Two Franklin Park and Gulch Crossing and, most notably, Bridgestone America’s new 514,000-square-foot headquarters in Downtown Nashville.

Chart courtesy of Colliers International

You must be logged in to post a comment.