Loan Losses for Life Insurers to Outpace 2007-2008: Fitch

Coronavirus-related loan shortfalls could rise 50 percent above the levels seen during the Global Financial Crisis, according to Fitch Ratings.

Despite a moderate level of forbearance activity on their commercial mortgage loans, U.S. life insurers are still bracing for deficits 50 percent higher than during the Global Financial Crisis, according to a new Fitch Rating report.

READ ALSO: CPE’s Coronavirus Coverage

The 17-page U.S. Life Insurers’ Commercial Mortgage Update stated that loan losses could amount to 180 basis points, up 50 percent from GFC levels. The timing of the losses on commercial mortgages, which tends to lag behind asset classes like equities and bonds, could extend into next year due to regulatory forbearance actions.

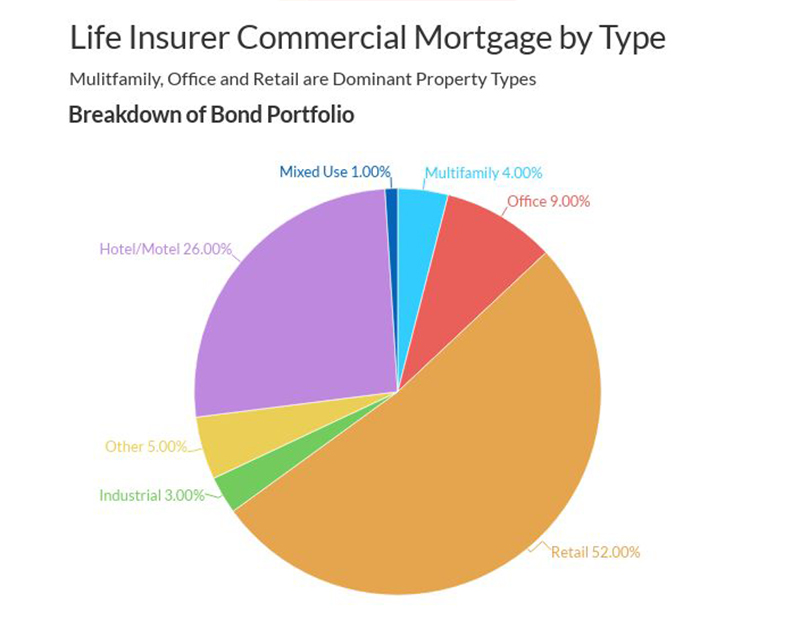

The report noted that on average, U.S. life insurers granted relief measures on 9 percent of commercial mortgages by outstanding balance, with the retail and hotel borrowers accounting for 52 percent and 26 percent, respectively, of all mortgage loans held by life insurers with approved relief measures.

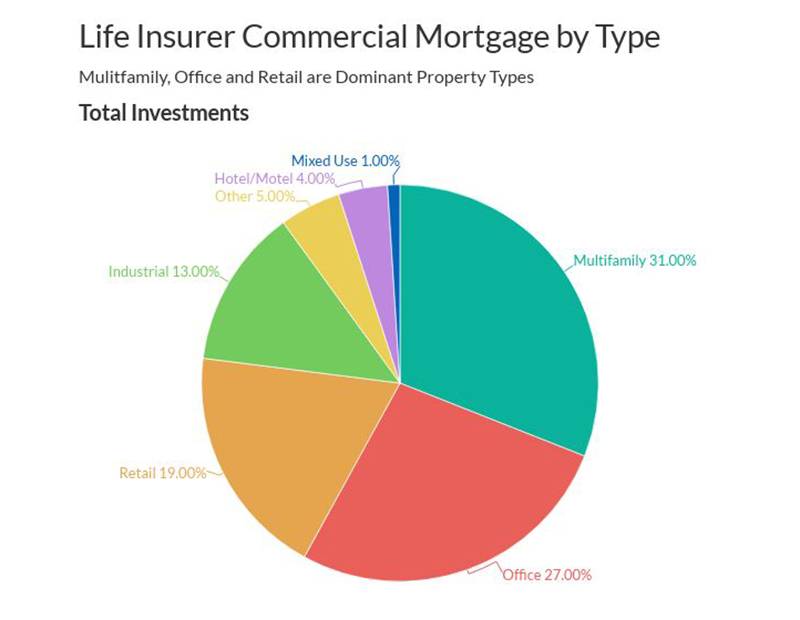

Although hotel loans were more affected by the pandemic, retail loans account for a much larger share—19 percent—of the total commercial mortgages held by U.S. life insurance companies, compared to hotel loans at 4 percent. As of the second quarter, multifamily borrowers represented the largest portion of life insurer commercial mortgage portfolios at 31 percent, followed by office at 27 percent and retail at 19 percent. Industrial loans represented 13 percent of the loan portfolios; other, 5 percent; hotels/motels, 4 percent; and mixed-use, 1 percent.

Relief for borrowers

The most common form of relief granted by life insurers to commercial mortgage borrowers is a temporary period of reduced debt service payments, including short-term principal and interest forbearance and reduction in principal amortization. Other common forms of relief were temporary modifications to loan terms to waive covenants, deferrals on capital reserves and use of furniture, fixture and equipment reserves to pay debt service, and loan maturity extensions, generally for one year.

Fitch said it expects the losses to begin to emerge on the life insurance companies’ third-quarter statutory statements. In the second quarter, life insurance companies held $574 billion, or 15 percent, of commercial and multifamily mortgages, placing third behind banks and government-sponsored enterprises, according to the Mortgage Bankers Association. Fitch noted that as of the second quarter, the majority of life insurers granted relief to borrowers for three to six months, with a smaller percentage of lenders offering relief from six to 12 months.

Despite the pandemic’s impact on the life insurance companies’ commercial mortgage loans and uncertainty over the longer-term economic impact, Fitch determines “commercial mortgage loans to be a core asset class for the U.S. life insurers,” Nelson Ma, director, Fitch Ratings, told Commercial Property Executive.

“While we expect underwriting standards to be tighter and a shift away from property types that are directly impacted from the pandemic going forward, we expect life insurers will remain an active participant in the commercial mortgage loan market,” Ma said.

Read the full report by Fitch Ratings.

You must be logged in to post a comment.