Law Firm Leasing Hits Record High, Targets Premium Assets

Over the past five quarters, volumes have considerably exceeded 2019 levels, a new Cushman & Wakefield report notes.

The legal sector is one of the most office-centric industries, with leasing momentum that has grown in the last two years, leading to the strongest first quarter of leasing on record. Law firms leased 4.6 million square feet of office space in the first quarter, a 25 percent year-over-year increase from 2024, according to a new Cushman & Wakefield report.

The 2025 Bright Insight report noted legal sector leasing volumes exceeded 2019 levels by 35 percent over the past five quarters, in stark contrast to broader office leasing trends which remain below pre-pandemic numbers.

David Smith, head of Americas Insights and one of the authors of the report, said there are several factors that may be buoying legal sector office leasing. Top drivers of law firm leasing include hybrid strategies that are now largely implemented, giving firms more confidence in their long-term space needs, and employment gains. Smith said 56 percent of firms require attorneys to be in the office at least three days per week.

“Expectations for in-office presence have increased, especially for junior associates,” Smith told Commercial Property Executive.

Smith noted law firms have experienced sustained revenue and employment growth, especially in recession-resistant practice areas like bankruptcy and employment law.

“Law firms are bullish on revenue and headcount growth, which supports continued leasing activity,” Smith said.

READ ALSO: Office Users’ Top Priority Today

Many law firms also seek out high-quality spaces for reasons such as branding purposes, recruiting and retaining talent, building culture and providing mentors. They are increasingly committing to long-term leases in top-tier buildings.

“Law firms continue to be willing to pay for quality because it supports the primary purposes of the legal sector office: a showcase for meeting with clients, a differentiator in attracting and retaining top talent, and a place where attorneys can both collaborate and be productive with focus and individualized work,” Smith said.

Construction shrinks, limiting future options

While they are not getting bargain prices at these top-tier properties, Smith said it is better for law firms planning on making moves to do it soon because the amount of new construction is shrinking and there will be fewer options in the second half of the decade.

Only 26 million square feet of new office space is under construction, compared to 136 million square feet in early 2020, according to the report. North American new construction deliveries will likely be below 10 million square feet in the second half of the decade. That’s well below the more than 13 million square feet of space that was delivered every quarter earlier in the decade. Cushman & Wakefield states some firms may need to explore renewing current leases or seeking partnerships with well-capitalized owners capable of repositioning Class A or A-minus properties in prime locations.

“We are seeing the renovation and upgrade pipelines increasing in response to more limited new construction activity, and we would expect this trend to continue,” Smith told CPE.

Downsizing has slowed

In the early 2010s, many law firms were downsizing their space either when they renewed by taking less space at their current building or leasing smaller quarters in a new location. The report states the dramatic square footage reductions of the 2010s have slowed and even plateaued in some areas. Since 2023, lease sizes on renewals have declined by less than 2 percent. Smith said many firms may have already realized large efficiency gains when they densified their space and reduced the square footage per attorney in the 2010s.

Smith said law firms, which have been experiencing revenue and job growth lately, may expect to see further growth in 2025.

“This growth can push up office square footage requirements,” he said.

Smith noted the downsizing that is occurring often comes in new leases, likely because firms moving into new buildings can design more efficient floorplans. But he noted many firms are also finding it may be more cost-effective to renew in place and keep the same amount of square footage. That is likely why renewals have not been experiencing significant downsizing on average over the past two years, Smith shared.

READ ALSO: CPE Midyear Outlook

In February, Bond Schoeneck & King signed a seven-year lease extension at 600 Third Ave. in Manhattan’s Midtown East submarket where it occupied the whole 22nd floor with 12,505 square feet. That same month, another law firm, Aaronson Rappaport Feinstein & Deutsch LLP, decided to keep its headquarters at the same 42-story tower. The firm signed a 15-year lease extension for a total of 55,269 square feet, including 42,764 square feet on the fifth and sixth floors.

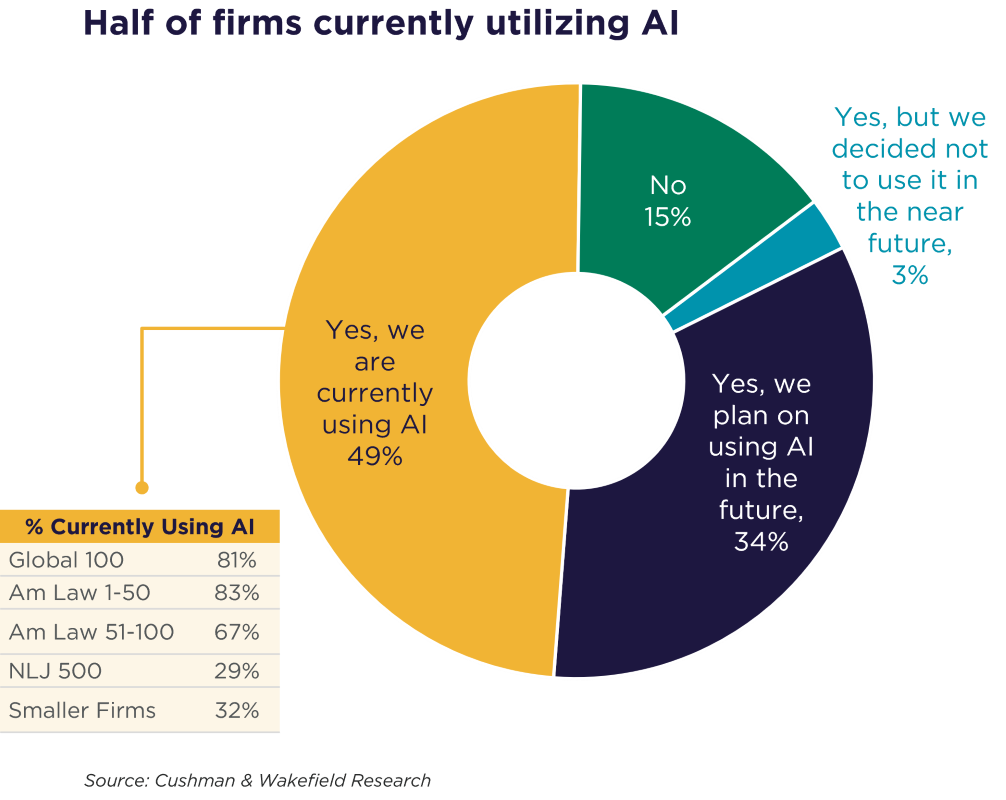

AI and technology impacts in law firms

The report looks at how investments in artificial intelligence and digital infrastructure are influencing law firm strategy. With tech budgets expected to grow from 4 percent to 5.5 percent of revenue, firms are adapting both staffing models and space designs to align with increasingly tech-driven operations. Smith noted law firms have not been altering long-term decisions based upon AI. But he notes it’s possible that AI will create more legal sector employment opportunities than it disrupts. For example, BLS data shows law firms are increasing their hiring of attorneys with knowledge of AI and increasing their search for non-attorney, tech talent that works with AI, including coding and training.

You must be logged in to post a comment.