Job Growth Highlights Long-Lasting Recovery

With the pool of unemployed workers shrinking, Moody’s Analytics Chief Economist Mark Zandi predicts wage growth will pick up as the economy reaches full employment sometime this summer.

by Paul Fiorilla, Associate Director of Research, YardiMatrix

It’s about the jobs, stupid.

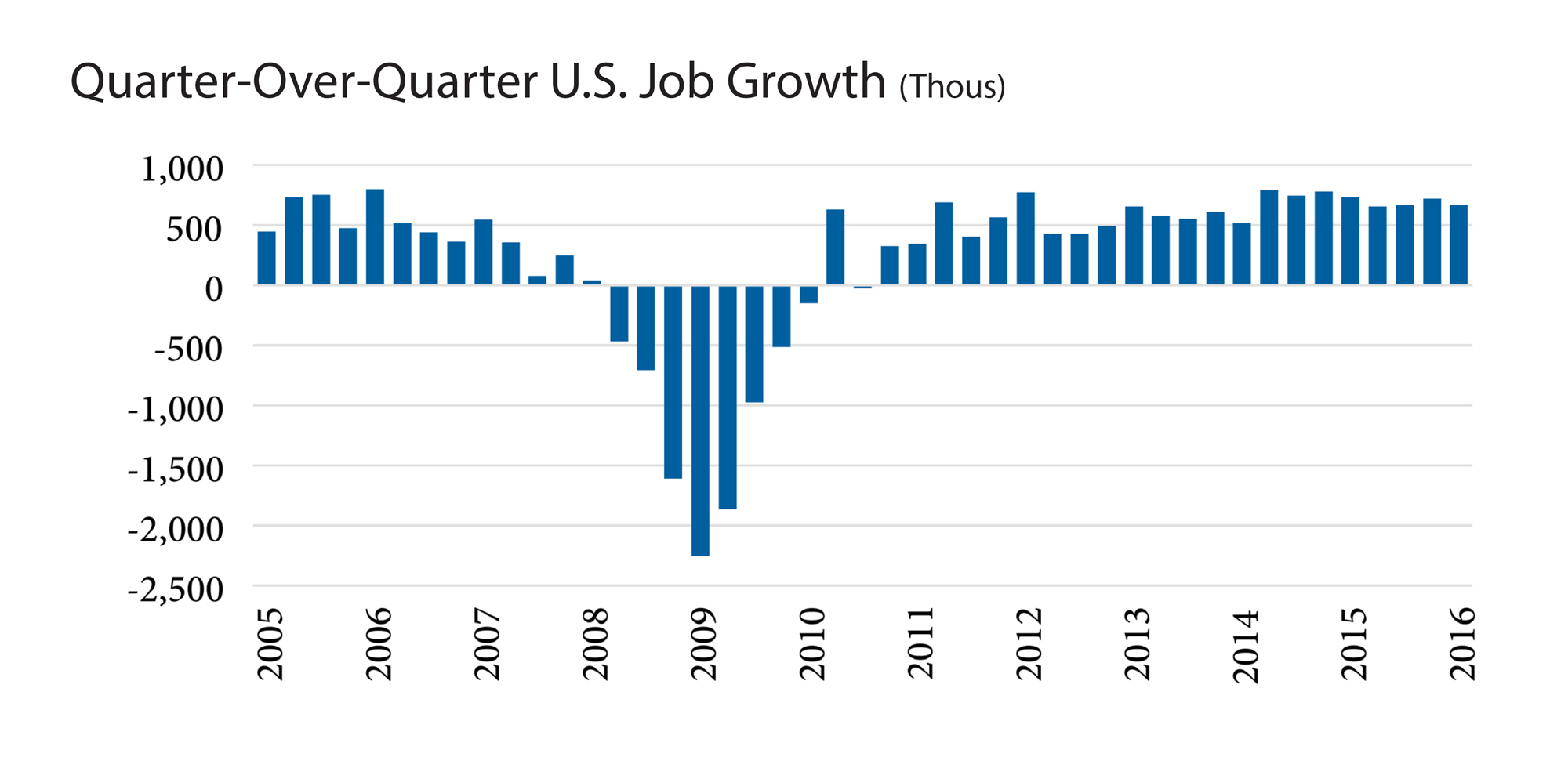

The presidential election primary season has highlighted the theme of the angry voter, which has the effect of overstating the U.S. economy’s weak points while failing to notice the remarkable consistency in job creation that has underpinned the recovery. Through April, the private sector has added jobs for 73 consecutive months—the longest such streak on record—encompassing 14.4 million new jobs, or a shade under 200,000 per month.

The presidential election primary season has highlighted the theme of the angry voter, which has the effect of overstating the U.S. economy’s weak points while failing to notice the remarkable consistency in job creation that has underpinned the recovery. Through April, the private sector has added jobs for 73 consecutive months—the longest such streak on record—encompassing 14.4 million new jobs, or a shade under 200,000 per month.

Employment growth has been strong across all pay scales and nearly all occupations, industries and regions. With the pool of unemployed workers shrinking, Moody’s Analytics Chief Economist Mark Zandi, speaking at the firm’s 2016 Economic Outlook Conference in Philadelphia last week, predicted wage growth will pick up as the economy reaches full employment sometime this summer.

Wage growth would be positive for commercial real estate, since it correlates to demand for properties including apartments, retail and hotels. It would enable Millennials to leave their parents’ homes or stop doubling up with roommates, increasing demand for apartments. Multifamily rents have far exceeded income growth since the recession, but higher wages would help alleviate concerns about affordability, increase renter mobility and enable owners to keep raising rents. Growing wages would also provide a boost to consumers, producing sustainable demand for industries such as retail and warehousing. All in all, the income gains create and support a continued positive investment environment.

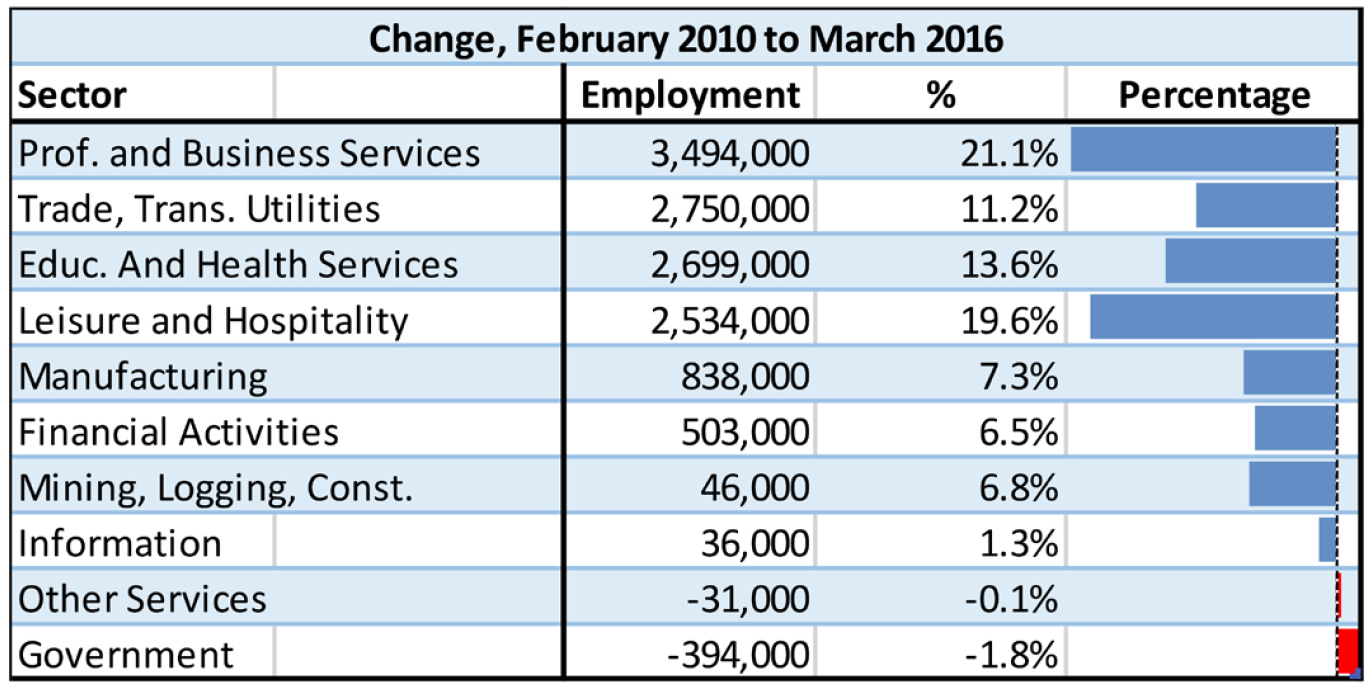

Segments featuring the greatest job creation since the recovery started include professional and business services (3.5 million); leisure and hospitality (2.5 million); health care (2.3 million); accommodations and food services (2.2 million); and construction (1.2 million). On a percentage basis, the biggest gainers include professional and business services (21.1%); leisure and hospitality (19.6%); transportation and utilities (15.5%); health care (13.7%); education (13.0%); and retail (10.7%).

Segments featuring the greatest job creation since the recovery started include professional and business services (3.5 million); leisure and hospitality (2.5 million); health care (2.3 million); accommodations and food services (2.2 million); and construction (1.2 million). On a percentage basis, the biggest gainers include professional and business services (21.1%); leisure and hospitality (19.6%); transportation and utilities (15.5%); health care (13.7%); education (13.0%); and retail (10.7%).

Some of the weaker segments over the course of the recovery include financial activities (up 503,000, or 6.5%) and information (up 36,000, or 1.3%). Financial activities encompass the banking sector, which has shrunk in the wake of the credit crisis as profits, originations and trading activities have been reduced, in part due to higher capital costs and new regulations. Information, which includes the technology sector, has exhibited surprisingly weak employment growth, pointing to a possible cooling in the segment.

Categories that are currently struggling include manufacturing, which added 838,000 jobs (7.3%) during the recovery but has lost 37,000 jobs over the past 12 months as the strong dollar has made U.S. exports more expensive, and mining, which gained 46,000 jobs (6.8%) over the past 73 months but has lost 191,000 jobs since September 2014 and will probably lose another 100,000 by the end of the year.

The one area that has shrunk during the recession is government. Combined, government at the local (down 245,000), federal (down 102,000) and state (down 45,000) level has cut 400,000 jobs over the past seven years. The cutbacks, which have shaved an average of 0.8% off of GDP per year, are largely over.

While some argue that jobs being created are focused in low-paying industries, an analysis by Moody’s found that growth was mixed almost evenly among low-paying (under $30,000 per year), mid-paying ($30,000 to $70,000) and high-paying ($70,000 and up) in the Northwest, West and Midwest. Only in the South was the number of low-paying jobs created significantly higher than the number of better-paying jobs, in part due to the loss of high-paying mining jobs. The West and South led in the number of jobs created, while the West is the clear leader in mid- and high-paying jobs.

Other metrics of the healthy employment market include the rise in the quit rate, which indicates that workers feel good about the prospects of gaining better jobs; the number of job openings and hires, which both were at 5.4 million in February, the highest levels since before the recession; the unemployment rate, which was 5.0% as of April; and the growing levels of participation. The labor force increased by 2.5 million over the past six months, an increase of 0.6 percentage points in the participation rate.

Other metrics of the healthy employment market include the rise in the quit rate, which indicates that workers feel good about the prospects of gaining better jobs; the number of job openings and hires, which both were at 5.4 million in February, the highest levels since before the recession; the unemployment rate, which was 5.0% as of April; and the growing levels of participation. The labor force increased by 2.5 million over the past six months, an increase of 0.6 percentage points in the participation rate.

The strength of the job market has a number of positive effects on commercial real estate:

■ Wage growth, which has basically tracked inflation at about 2% through the recovery, should pick up as the slack in the labor market is diminished. Using data from payroll management firm ADP, Moody’s found in the year through the first quarter of 2016, job holders’ salaries rose 4.8%, while job switchers increased pay by 2.4%. The biggest gains came from workers under 35 years old, a sign that a growing number are finding jobs commensurate with their skills and education.

■ Consumer spending will continue to rise steadily. Consumers are increasing spending at roughly a 3% rate per year, in line with wage increases and more pocket change due to lower energy costs. They aren’t borrowing to fuel even higher levels, and the saving rate is hovering at 5%. Increased use of credit would stimulate the economy, but also pose a risk in putting household finances in a more precarious position.

■ Household formation will be strong for the next several years. Growth of new households plummeted in the wake of the last recession, but is likely to top 1.2 million over the next five years, according to Moody’s estimates. The growth is driven by the rising number of Millennials reaching their 20s, and to a lesser extent the increasing number of Baby Boomers.

There remain a number of downside risks to the outlook. Certainly the jobs recovery is not universal. The last recession was severe, enough so that many individuals and communities are still feeling the effects. Financial markets have been volatile due to concerns about (among other things) growth outside the U.S and energy prices. Inflation has been a non-factor for a long time, but is expected to grow. That will likely prompt the Federal Reserve to tighten policy in an attempt to put a lid on inflation.

Although the expansion is in its seventh year, well above the historical longevity of recoveries, there are few indicators pointing to a recession. A few industries, particularly technology, in select metros show signs of overheating, but most industries and metro economies show characteristics of being in the middle of the cycle. Leverage remains far more conservative than in the last cycle due to tighter regulation of the industry and banks’ fresh memory of the cycle. By and large, the types of overdevelopment and bubbles that lead to downturns are not in evidence at the moment.

In any event, the steady growth of the job market—characterized by low unemployment, higher participation and burgeoning wage growth—more than offsets the downside risks and creates an environment in which commercial real estate fundamentals should remain healthy.

Log on to YardiMatrix for further bulletins, as well as national and metro-specific market reports.

You must be logged in to post a comment.