January 2015 – Briefs/Finance

The Chiofaro Co. Receives $500M in Financing for Boston Office Complex; Howard Hughes Corp. Lands $600M for Nation’s Largest LEED-ND Platinum Project; Meridian Arranges $737M for Brookfield, Urban American NYC Portfolio Buy; CBRE Secures $100M Loan for Netflix HQ in Silicon Valley; Metropolis Investment Holdings Gets $150M Loan for San Francisco Skyline Landmark; TRT, JMI Get $140M in Financing for Omni San Diego Hotel; Oyster Development, Tricon Net $144M in Financing for San Francisco Condo, Retail Development; Bucksbaum, Steiner Land $165M in Financing for Suburban Cincinnati Retail Center.

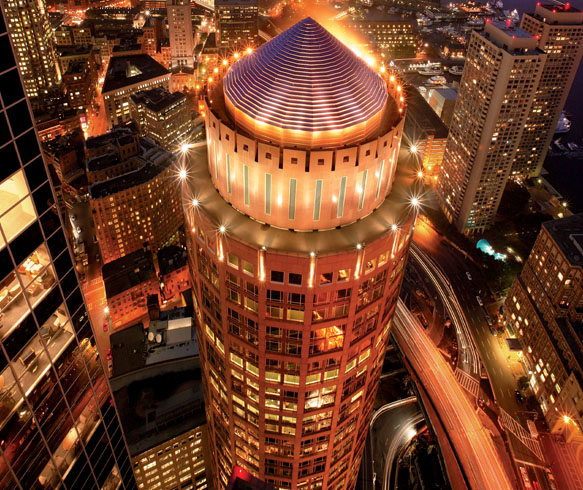

The Chiofaro Co. Receives $500M in Financing for Boston Office Complex

The Chiofaro Co. and an institutional partner have received $500 million in financing for International Place, a 1.8 million-square-foot, Class A trophy office complex located in Boston’s Financial District. HFF secured the fixed-rate loan with New York Life Real Estate Investors and Northwestern Mutual. Originally completed in 1992, International Place has been a big part of the Boston skyline with its two signature interconnected office towers in the heart of the Financial District. The property offers 360-degree unobstructed views and is considered to be the flagship of Boston’s downtown waterfront and the gateway to its historic Financial District and the emergent Seaport District. The building’s tenant roster includes Choate Hall & Stewart, PayPal, Eaton Vance and Proskauer Rose. It was 86 percent occupied at the time of the refinancing.

The Chiofaro Co. and an institutional partner have received $500 million in financing for International Place, a 1.8 million-square-foot, Class A trophy office complex located in Boston’s Financial District. HFF secured the fixed-rate loan with New York Life Real Estate Investors and Northwestern Mutual. Originally completed in 1992, International Place has been a big part of the Boston skyline with its two signature interconnected office towers in the heart of the Financial District. The property offers 360-degree unobstructed views and is considered to be the flagship of Boston’s downtown waterfront and the gateway to its historic Financial District and the emergent Seaport District. The building’s tenant roster includes Choate Hall & Stewart, PayPal, Eaton Vance and Proskauer Rose. It was 86 percent occupied at the time of the refinancing.

Howard Hughes Corp. Lands $600M for Nation’s Largest LEED-ND Platinum Project

Blackstone knows a good a project when it sees one. It doesn’t get much better than The Howard Hughes Corp.’s Ward Village, a mixed-use master-planned community that will rise on 60 acres situated directly between downtown Honolulu and Waikiki on Oahu. HHC announced that it has secured a $600 million non-recourse construction loan from Blackstone Real Estate Debt Strategies for the first two condominium towers at the project: Waiea and Anaha. The loan bears interest at one-month LIBOR plus 6.75 percent with a December 2019 final maturity date, according HHC’s third-quarter 2014 earnings report.

Meridian Arranges $737M for Brookfield, Urban American NYC Portfolio Buy

Meridian Capital Group has arranged $737 million in acquisition financing for Brookfield Property Partners and Urban American’s purchase of The Putnam Portfolio—a six property multi-family portfolio in the Big Apple. The big deal required two sources, New York Community Bank and Bank of China, as well as six separate mortgages. Meridian said there was broad competition due to substantial liquidity for New York apartments. The six properties total 24 buildings and 3,962 units, all in Manhattan, with 1,003 of those on Roosevelt Island.

CBRE Secures $100M Loan for Netflix HQ in Silicon Valley

The Debt & Structured Finance team of CBRE Capital Markets has secured a $100 million construction loan for The Grove, in Los Gatos, Calif. The project’s first phase, now under construction and slated for delivery in May 2015, consists of two office buildings that total 242,000 square feet and are preleased to Netflix Inc. The entire office park will consist of 485,000 square feet of Class A office space in three- and four-story buildings, developed by a joint venture between Sand Hill Property Co., of Menlo Park, Calif., and The Carlyle Group, of Washington, D.C. The financing, which features a variable, LIBOR-based interest rate, was provided by a syndicate of lenders led by SunTrust Robinson Humphrey with SunTrust Bank serving as administrative agent.

Metropolis Investment Holdings Gets $150M Loan for San Francisco Skyline Landmark

JLL’s Capital Markets has secured $150 million in refinancing for 345 California Center in San Francisco’s financial district. Cornerstone Advisers, on behalf of MassMutual, provided the loan to an affiliate of Chicago’s Metropolis Investment Holdings Inc. The 48-story, 600,000-square-foot building is the third-tallest in San Francisco. It was completed in 1986 and is unusual in that its top 11 floors, which are at 45-degree angles to the rest of the building, were originally intended as residential condominiums. That space is currently occupied by a luxury hotel, the Mandarin Oriental San Francisco.

TRT, JMI Get $140M in Financing for Omni San Diego Hotel

TRT Holdings and JMI Realty, owners of the luxury Omni San Diego in the city’s downtown Ballpark District, have refinanced the existing debt on the hotel with a $140 million loan secured through HFF. Working on behalf of the joint-venture owners, HFF arranged the 15-year, fixed-rate loan through AIG Investments. Built in 2004, the 511-key, 200,000-square-foot hotel was renovated in 2013. Located across from the San Diego Convention Center, it is attached to Petco Park, home of the San Diego Padres. The Padres former owner, John Moores, heads JMI Realty, which is a subsidiary of JMI Services Inc.

Oyster Development, Tricon Net $144M in Financing for San Francisco Condo, Retail Development

A joint venture between Oyster Development Corp. and Tricon Capital will receive $143.5 million in financing for Rockwell, a new condo development located at 1634-1690 Pine St. in San Francisco. JLL’s Capital Markets arranged the financing through National Real Estate Advisors. Rockwell will consist of two 13-story towers, totaling 260 units. The development will also include one level of below-grade parking for 201 cars and a 4,000-square-foot ground floor retail component.

Bucksbaum, Steiner Land $165M in Financing for Suburban Cincinnati Retail Center

A joint venture between Bucksbaum Retail Properties L.L.C. and Steiner + Associates, along with financial partner Mount Kellett Capital Management L.P., received $165 million in construction financing for Liberty Center, a 626,791-square-foot retail town center development in Liberty Township, a northern Cincinnati suburb. HFF secured the loan through a single capital source. The retail portion of the center is part of a larger mixed-use development that will include 75,000 square feet of office space, 241 multi-housing units and a 130-room AC Marriott Hotel. Dillard’s will also build a 200,000-square-foot department store to anchor the town center. Other tenants on board include Dick’s Sporting Goods, Cobb’s CinéBistro, Kona Grill, Cheesecake Factory and Brio Tuscan Grill.

You must be logged in to post a comment.