Is the Exuberance Irrational or Rational?

By Kenneth P. Riggs, Jr., Chairman & President, Real Estate Research Corp.: Typically, headlines such as these—“U.S. Economy Contracts in 4th Quarter,” “Eurozone Economy Dives,” and “Japan GDP Shrinks for 3rd Straight Quarter”—would cause the stock market to tumble.

By Kenneth P. Riggs, Jr., Chairman & President, Real Estate Research Corp.

Typically, headlines such as these—“U.S. Economy Contracts in 4th Quarter,” “Eurozone Economy Dives,” and “Japan GDP Shrinks for 3rd Straight Quarter”—would cause the stock market to tumble. Instead, the DJIA Index has been tiptoeing around 14,000 for the past week or two, the S&P 500 Index has increased 6.5 percent so far in 2013, and huge M&As (like the merger between American Airlines and US Airways, and Berkshire Hathaway’s and 3G Capital’s purchase of Heinz) are causing even the most cautious investors to consider returning to the stock market fold.

The exuberance in the market may not be completely irrational, as former Federal Reserve Board Chairman Alan Greenspan defined it more than 15 years ago, but it is not entirely warranted based on the fundamentals either, and the asset inflation ascribed to the third quarter is something to watch out for as these mega-mergers continue. According to Dealogic, the total value of M&As so far in 2013 is already approximately $160 billion, and according to The Wall Street Journal, such activity is expected to continue, particularly in the energy, real estate, and financial services markets, given the alignment of the debt and equity markets where cheap credit is available to buyers and acceptable prices are available to sellers.

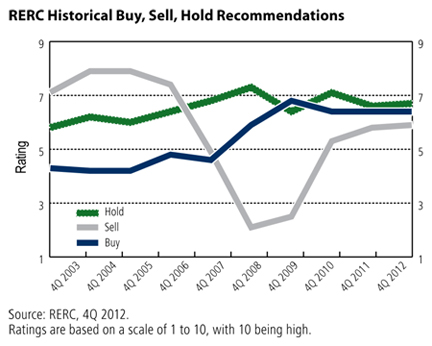

With the shift that in the broad equity markets over the past 12 months, there is evidence that we have turned the page on the credit crisis. Commercial real estate is connected to the capital markets, and although we have not seen the level of sales in commercial real estate catch up to the pre-credit crisis, we are seeing significant increases in the volume of transactions, and prices in top-tier markets equal or exceed those before 2007. We have been able to measure the this alignment of investment sentiment by reviewing RERC’s buy, sell, and hold recommendations for commercial real estate since the recovery began, as shown in the accompanying graph from the winter 2013 issue of the RERC Real Estate Report, A New Archetype.

This sentiment is not surprising to anyone who has been watching commercial real estate volume increase, particularly at the end of 2012, as buyers and sellers rushed to get transactions completed before the tax laws changed at the beginning of 2013. The result was $98 billion in total sales in fourth quarter 2012, according to Real Capital Analytics. On an annual basis, commercial real estate sales volume was $283.2 billion in 2012, a 24-percent increase over 2011 volume, and which given the nature of commercial real estate as an investment, was very rational.

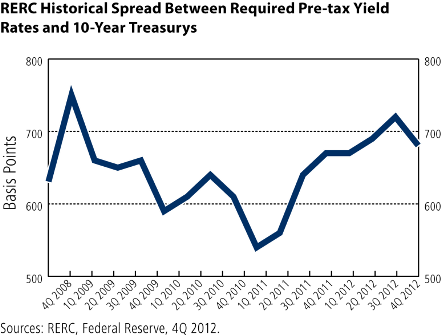

However, we are also seeing downward pressure on commercial real estate returns, with RERC’s required pre-tax rates declining 10 to 40 basis points for the office, industrial, retail, apartment, and hotel sectors, as reported in the winter 2013 RERC Real Estate Report. The yield on 10-year Treasuries also declined, ending the year at 1.8 percent, and the spread between RERC’s required pre-tax yield rates and 10-year treasuries was 680 basis points, down from 720 basis points in the previous quarter.

As the U.S. turns the page on its credit crisis and the rest of the world wrestles with various political and financial issues, the broad equity markets are making some big bets that the time is now and not in 12 months, and major institutional investors, Wall Street firms like Blackstone, and wealthy individuals and families have been quietly making similar bets with commercial real estate.

It is time to move forward and place your investment bets, and in the final analysis, commercial real estate is offering an attractive total return and high risk-adjusted return. Beyond the return metrics, commercial real estate provides a tangible asset with a straightforward accounting perspective, with 75 percent of its total return provided through annual income. That is not too shabby in this post-credit crisis environment, and we view its exuberance totally rational, particularly as we keep an eye out on the horizon for the big boogie man that impacts all investments—a spike in interest rates.

You must be logged in to post a comment.