Investor Interest in Data Centers Ramps Up

Nearly all respondents to CBRE’s survey are planning to up their game in the property type this year.

Investing in data centers is something like a modern gold rush, with almost every investor surveyed by CBRE recently—95 percent—planning to increase their data center investments this year. Last year was a record for data center investment, and this year thus far isn’t far behind, according to the company.

CBRE’s global data center investor intentions survey, conducted earlier this year, found that interest in data centers is worldwide, but the vast majority of the survey’s respondents, 84 percent, are based in the U.S., with another 4 percent based in Canada. Overall, the company surveyed 92 investors of varying sizes, with 23 percent of them having more than $50 billion in assets under management.

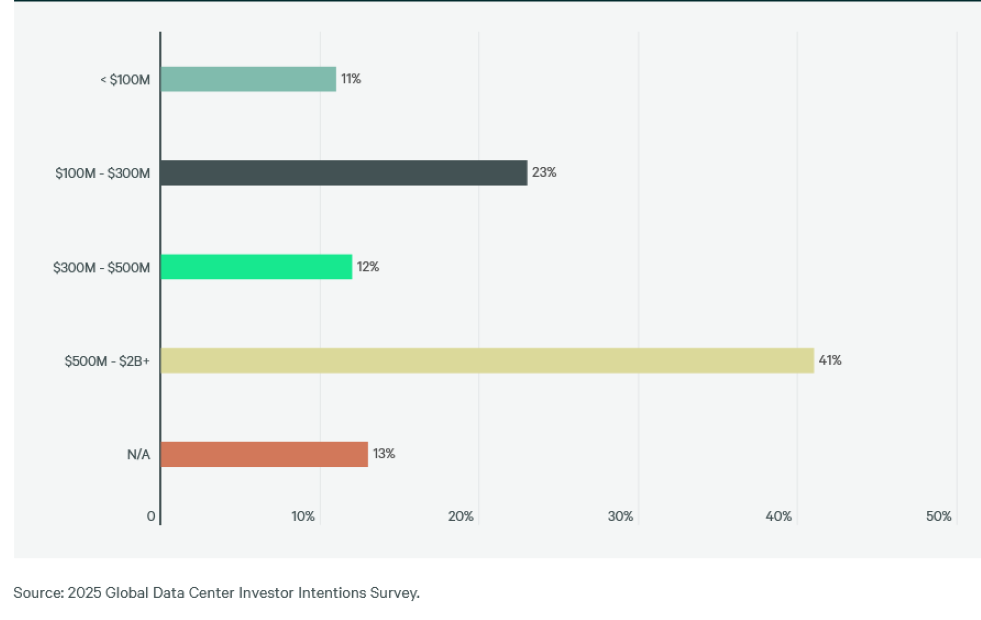

A growing number of investors plan large equity commitments to the data center sector, the survey noted. Some 41 percent of them plan to allocate $500 million or more this year, up from 30 percent who said that in 2024.

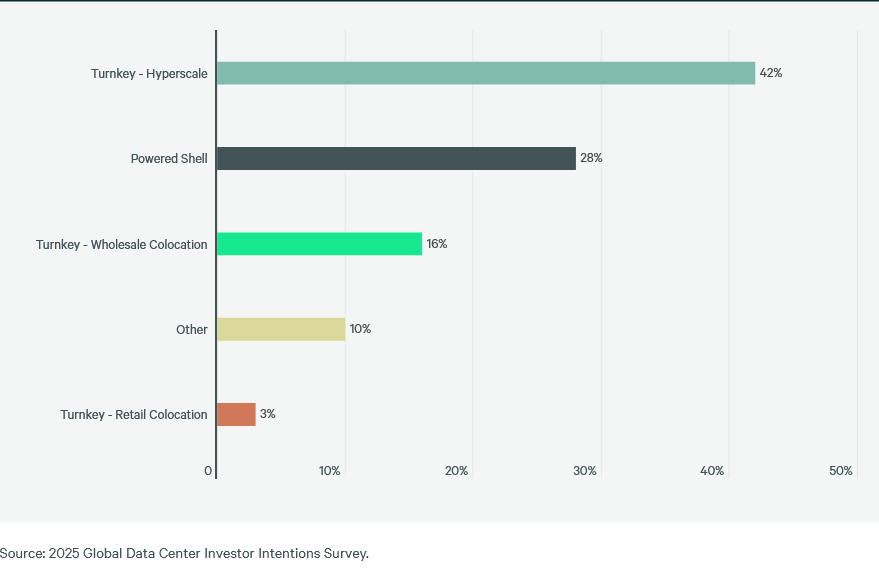

Demand from hyperscalers, driven by increased AI workloads, is attracting investor interest. “Hyperscale build-to-suit jumped to 49 percent from 31 percent of survey respondents last year as the top opportunity for data center investment over the next 12 to 24 months,” CBRE explained.

A small majority of investors, 53 percent, do not expect data center cap rates to change this year, while 28 percent expect an increase. The total expecting a cap rate increase was similar in 2024 at 24 percent, but 42 percent were expecting that in 2023, CBRE reported. Prices are resilient, in other words, despite broader market volatility, the respondents believe.

READ ALSO: Data Centers’ Power Crunch

There are risks, however, and investors are aware of them, though their assessment of those risks has shifted since last year. The respondents are now more worried about regulations and power availability than anything else, with 39 percent putting that as their top concern. Last year, debt availability was by far the top concern (59 percent put it at number one then). Debt availability as a top concern dropped to just 10 percent this year.

Still, most investors have a relatively high risk tolerance when investing in the sector, CBRE found. Some 62 percent of survey respondents said they favor opportunistic, new development strategies, as their top preference. Only 7 percent prefer investment in core (stabilized) assets.

Investment dipped in early ’25, but is poised to rebound

CBRE reported North American data center asset sales declined by more than half year-over-year in the first half of 2025 to less than $1 billion. “This slowdown was largely the result of delayed decision-making by investors due to economic uncertainty, geopolitical conflicts and power supply challenges,” the company noted.

Investment activity will probably rebound in the second half of 2025, fueled by the closing of delayed sales transactions and new investment opportunities, CBRE predicts.

Even so, data centers’ strong market fundamentals continue to attract a broad investor base in North America, including those who usually operate in more traditional real estate sectors, such as net lease and industrial. Also, fewer direct investment opportunities in the industrial sector means more investor interest in data centers.

You must be logged in to post a comment.