Investment Sales

April 14, 2017

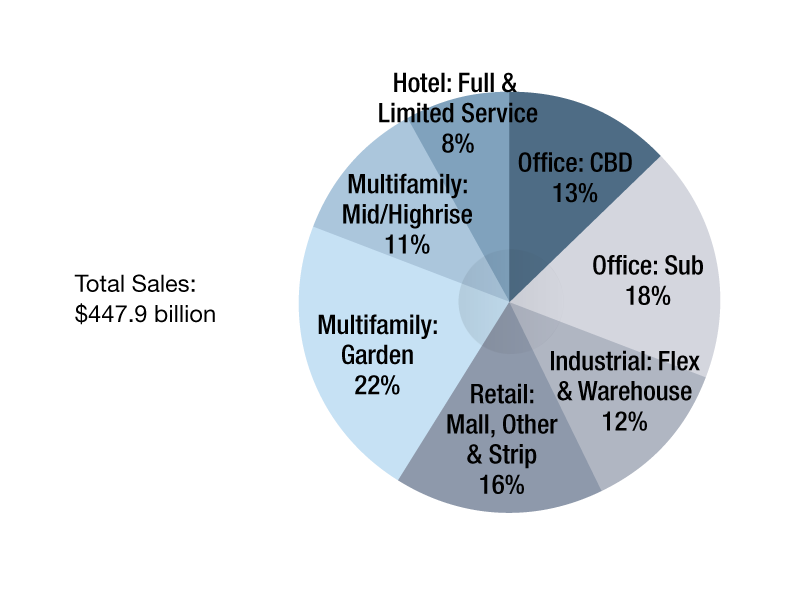

CBD and suburban office represented 31 percent of the total transaction volume, and mid- and high-rise and garden apartments represented 33 percent in the past year.

Based on independent reports of properties and portfolios of $2.5 million and greater; 12 months ending Feb. 28, 2017

Transaction volume value in the prior 12 months for all the property types was $447.9 billion, with garden apartments and suburban office commanding the highest values of $97.5 billion and $79.4 billion, respectively. Full-service and limited-service properties’ transaction volume represents only 8 percent of the total value, followed by 11 percent for mid- and high-rise apartment properties and 12 percent for flex and warehouse. CBD and suburban office represented 31 percent of the total transaction volume, and mid- and high-rise and garden apartments represented 33 percent in the past year.

You must be logged in to post a comment.