International: Hilton, Marriott Dominate in Africa

W Hospitality Group has released the 7th edition of its annual survey that sizes up the international hotel chain development intentions and activities in Africa.

By Balazs Szekely, Associate Editor

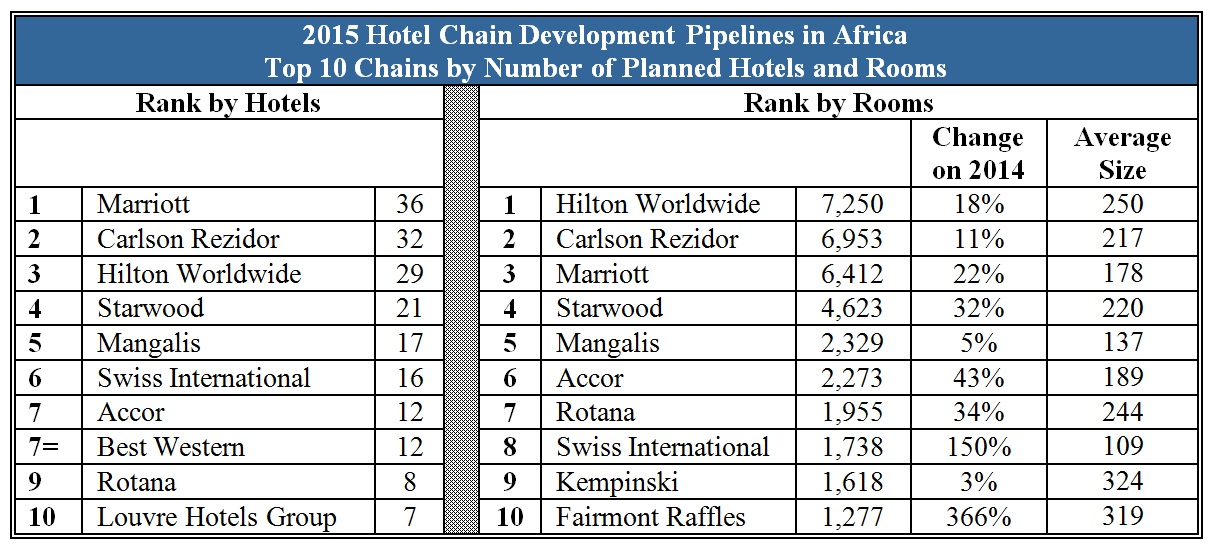

W Hospitality Group has released the 7th edition of its annual survey that sizes up the international hotel chain development intentions and activities in Africa. The highlights of this year’s results are that the total pipeline reaches close to 50,000 keys, spread across 270 hotels, and that sub-Saharan Africa clearly took the lead and exceeded North Africa by almost 70 percent. This is especially thought-provoking, knowing that the two regions were neck and neck only two years ago. As the survey conducted by the Lagos-based consultancy revealed, Hilton and Marriott are leading the race to develop new hotels in Africa, closely followed and from certain viewpoints even outpaced by Carlson Rezidor.

Hilton has 29 new properties in the making, a total of 7,250 rooms which equates to an 18 percent improvement from the chain’s 2014 pipeline. While Hilton is bringing the most amount of rooms, Marriott tops the list by the number of hotels with 36 facilities in development. Although Carlson Rezidor is ahead of both in the separate comparisons, 6,953 new rooms across 32 hotels landed them in second place overall. Yet Kempinski and Fairmont are nowhere near the top of this list, they make up for the fallback with room sizes that leave all the other competitors in the dust.

However, if we look at individual brands, Carlson Rezidor’s Radisson Blu occupies the first position both in terms of the number of hotels and rooms planned on the plateau continent. Hilton and Marriott have also made it to the podium in both rankings with their signature brands.

Carlson Rezidor also ranks first by the number of rooms actually under construction – the Belgian group has started field work on 5,250 keys, which makes up 76 percent of its total pipeline. Mövenpick is the only one on the list below that has broken down on all of its scheduled developments.

Hyatt and Kempinski are set to double their African presence soon, but it is the smaller chains that produce the most impressive growth percentages. But the one that stands out among these is Swiss International which will more than quadruple its footprint once it completes the – otherwise relatively modest – 1,738 rooms that it has in its current pipeline, more than half of which is set to go up in Nigeria.

You must be logged in to post a comment.