Interest Rate Risk to Increase as Fed Weans Economy Off QE3

By Kenneth P. Riggs Jr., Chairman & President, Real Estate Research Corp.: Whether it is the leaking of the agenda for the annual Jackson Hole symposium sponsored by the Federal Reserve, or the recent opinions offered by the individual members of the Board of Governors, or even the newly released economic indicators on unemployment and inflation, all eyes and ears seem to be focused on any hint from the Fed about when tapering will begin.

By Kenneth P. Riggs Jr., Chairman & President, Real Estate Research Corp.

Whether it is the leaking of the agenda for the annual Jackson Hole symposium sponsored by the Federal Reserve, or the recent opinions offered by the individual members of the Board of Governors, or even the newly released economic indicators on unemployment and inflation, all eyes and ears seem to be focused on any hint from the Fed about when tapering will begin. Many investors believe that tapering, or the gradual unwinding of the Fed’s third round of quantitative easing (QE3), is long overdue and are anxious for the markets to begin to clear. Other investors, as demonstrated by the rapid sell-offs in the stock market indices and the decline in bond prices, fear an increase in interest rates when tapering begins.

According to the institutional investors polled for Real Estate Research Corporation’s (RERC’s) summer 2013 issue of the RERC Real Estate Report, “Operation Unwind,” the majority of investment survey respondents expect tapering to begin yet this year, with 20 percent of respondents expecting tapering to begin in third quarter 2013 and 36 percent of respondents expecting tapering to commence in fourth quarter. And once tapering does begin, the biggest risk for investors is the “possible surge in interest rates,” state RERC’s institutional investment survey respondents.

The risk of increasing interest rates is definitely increasing. The yield rate on 10-year Treasurys is 2.8 percent (at the time of this writing), which is an increase of 110 basis points in the past few months, and approximately 60 percent higher than the yield rates were before the discussion about tapering began this spring. Since interest rates are tied to the 10-year Treasury, we can expect interest rates to increase as the 10-year Treasury yield rate increases. (In fact, we have already seen interest rates increase for mortgages, including CMBS.) Despite the Fed’s assurance that they will keep short-term interest rates “exceptionally low… for an extended period after asset purchases end,”[1] RERC’s respondents expect that once tapering has been underway for 12 months, which puts the following estimate out to around second quarter 2015, 10-year Treasury yields will average about 5 percent, or up over 200 basis points from today’s levels.

Although commercial real estate usually lags, the economy by 9 to 18 months and there are still good opportunities to invest in commercial real estate, returns will be harder to come by as we approach the time when 10-year Treasury yields and interest rates increase to the point where property prices and values will be affected. RERC respondents anticipate that cap rates will remain stable over the next quarter, but over the next 12 months, going-in capitalization rates will increase an average of around 15.0 basis points.

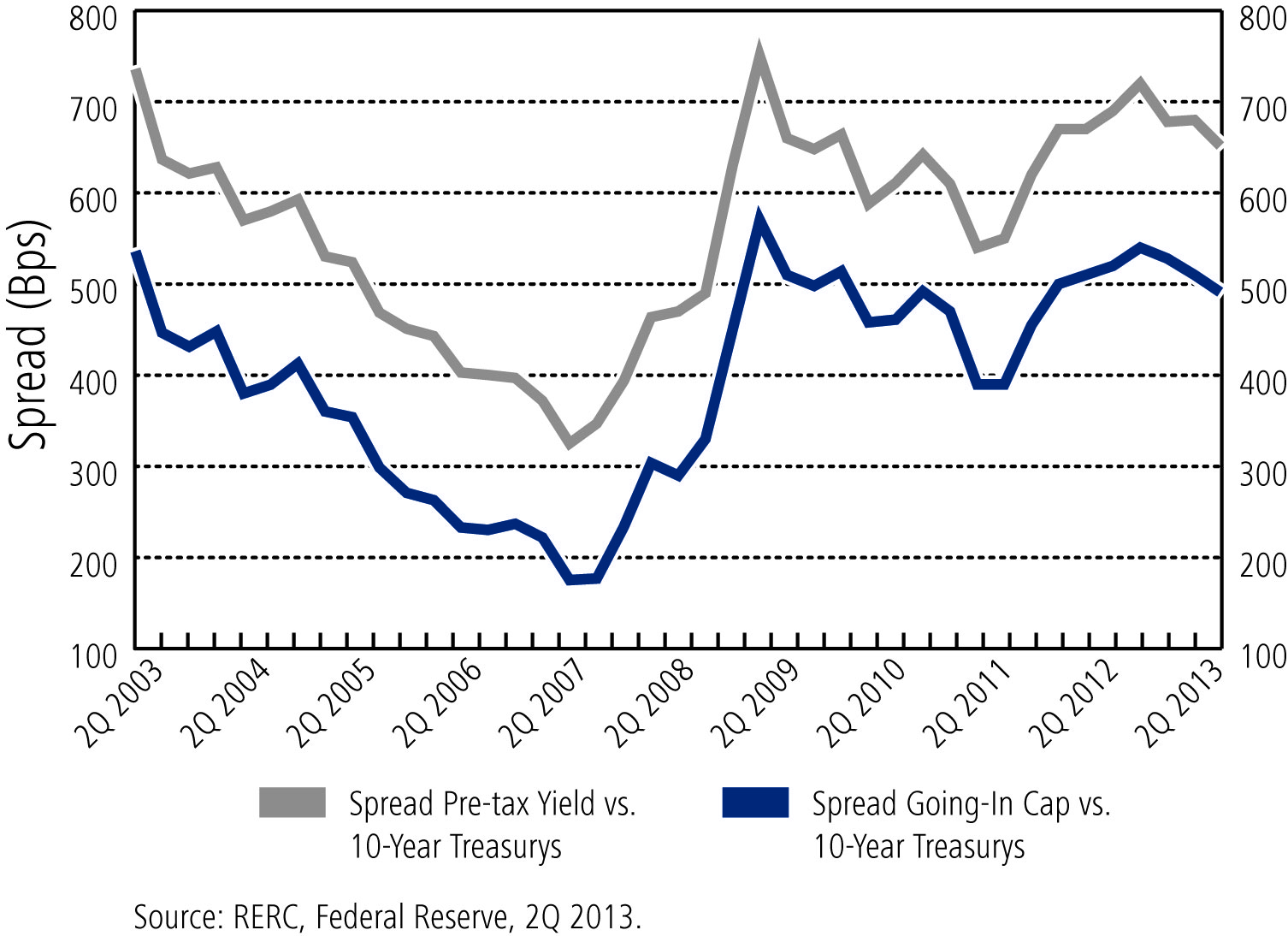

Even with the recent slight increases in the 10-year Treasury rate, commercial real estate continues to be a strong alternative investment with attractive risk-adjusted returns over Treasurys, as depicted in the graph below. As of second quarter 2013, the spread of RERC’s going-in capitalization rate over 10-year Treasurys was 490 basis points, while the spread of RERC’s pre-tax yield rate over 10-year Treasurys was 650 basis points. Both spreads have been falling since third quarter 2012 due to cap rate compression and slowly increasing Treasury rates. Although the spreads are falling, they are still approximately 100 basis points higher than the 10-year average spreads, and allow for a cushion of rising rates and providing attractive risk-adjusted returns.

[1] Statement by Ben S. Bernanke, Chairman, Board of Governors of the Federal Reserve System, before the Committee on Financial Services, July 17, 2013.

For present, investors believe that the value of commercial real estate is increasing over the price, as shown in RERC’s value versus price overall rating. However, the property sector ratings bear watching—the apartment sector rating in particular—which dropped to 4.8 on a scale of 1 to 10, with 10 being high, in second quarter 2013. This indicates that apartment properties in general appear to be priced higher than their value, and may mean there is already a pricing bubble in some markets. With respect to the office, industrial, and hotel sectors, the value versus price ratings have been increasing for several quarters, indicating that there continues to be more value in these property types than what the price would indicate. The rating for the retail sector appears to be stabilizing, with the value of this sector still slightly higher than the price.

Commercial real estate may hold up reasonably well as the Fed unwinds QE3, and investors should lock in low interest rates now. If 10-year Treasury yields increase further, as it appears they will, interest rates will increase too (despite the Fed’s attempts to keep short-term rates near 0 percent), and property values will begin to decline.

Once values decline, returns based on appreciation will diminish and property owners will be forced to increase rents to maintain their expected return on the investment. The question is can owners raise rents enough to offset the increase in interest rates and loss in value?

You must be logged in to post a comment.