Inland Empire’s Road to Recovery

Office leasing activity was solid in all submarkets, with nearly 1.5 million square feet leased across the metro. Roughly 200,000 square feet of space is scheduled to come online by year-end.

By Razvan Cimpean

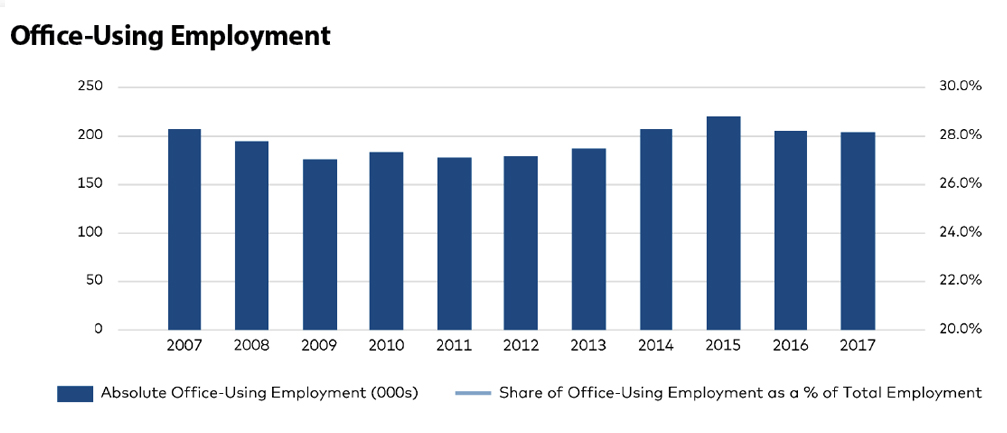

The Inland Empire’s economy is strong, fueled by port activity and a bustling housing market, but that doesn’t translate into significant growth for the office sector. Although office-using jobs have grown by about 17 percent during the last decade, they account for only a small share (14 percent) of total employment. As a result, lease rates and development are increasing at moderate levels.

Job growth is led by port-related activities. The construction-related and trade, transportation and utilities sectors have added 22,300 jobs year-to-date through June, representing 53 percent of total new employment. With foreign trade nearing an all-time high and very little vacancy in the metro’s industrial segment, the local economy should remain healthy.

Office leasing activity was solid in all submarkets, with nearly 1.5 million square feet leased across the metro year-to-date through August. The average lease rate for Class A assets was $27.15 per square foot and for Class B buildings was $24.34 per square foot.

Roughly 200,000 square feet of space is scheduled to come online by the end of the year, with an additional 152,000 square feet slated for completion in 2018. Benefiting from the presence of large universities, Riverside and San Bernardino are expected to continue their growth in the coming years, attracting talent more easily. Investor demand has also steadily improved, leading to more than $200 million in office asset trades in the 12 months ending in August. More than 75 percent of the volume was concentrated in Riverside and Ontario–Chino, the submarkets with the highest average price per square foot.

You must be logged in to post a comment.