Industrial Momentum Slows Down

The sector is undergoing a pivotal rebalancing, the latest CommercialEdge report shows.

Following record-high deliveries in the past two years, the industrial sector is now undergoing a balancing phase, with starts slowing down and new supply expected to decelerate in the near future, the latest CommercialEdge report shows.

Since the beginning of 2022, more than 1.1 billion square feet of new industrial space came online, easing pressure in markets with high demand and tight vacancies post-pandemic. However, sustaining such growth over the long term is impossible. Factors such as normalized demand and record deliveries have contributed to this slowdown, along with higher construction loan rates and economic uncertainty.

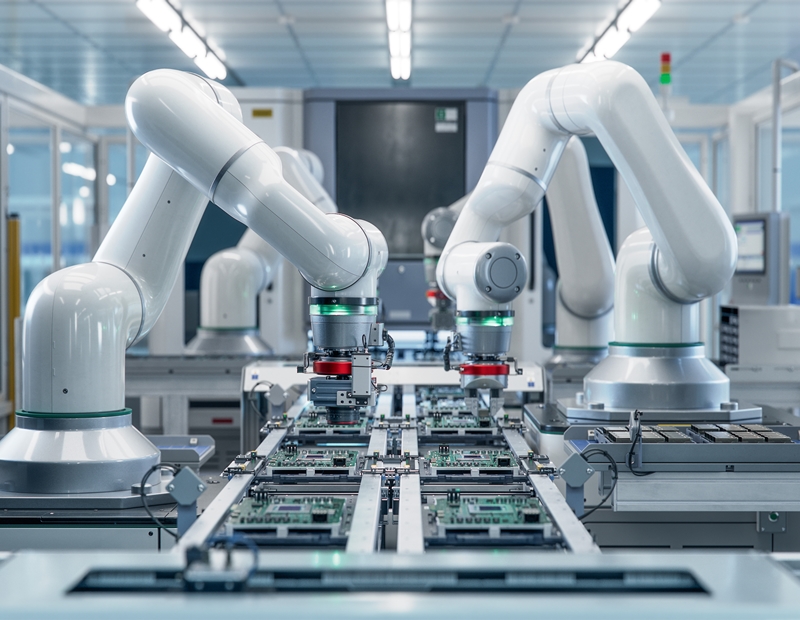

What’s more, the reshoring and nearshoring of manufacturing, particularly from Mexico, are expected to reshape the geographic distribution of new supply, especially in Texas markets like San Antonio, Dallas and Austin. Although starts may slow in 2024, future growth is anticipated as interest rates decrease and the industrial sector adjusts to recent development levels. Continued economic growth and technological advancements, such as the establishment of new computer chip manufacturing facilities, will drive demand for industrial space.

READ ALSO: What’s Next for Industrial Real Estate?

A total of 424.5 million square feet of industrial space was underway at the end of January, amounting to 2.2 percent of total stock, CommercialEdge data shows. The under-construction pipeline has decreased by approximately 300 million square feet within the past year, attributed to diminishing demand and escalating capital expenses.

The impact of reduced construction starts in 2023 varied across different markets. Among the top 30 markets, Memphis experienced the most significant decline, with starts plummeting from 12.3 million square feet in 2022 to 1.1 million square feet in 2023, marking a 91 percent decrease. Other substantial declines, in terms of percentage, were observed in Denver (down 78 percent), the Inland Empire and Cincinnati (77 percent) and Philadelphia (72 percent). Only two of the top 30 markets experienced an increase in new construction last year compared to 2022, both located in the Northeast: Boston and Bridgeport, Conn.

Rent growth to cool this year

In January, the national average in-place rents for industrial space reached $7.74 per square foot, marking a notable year-over-year increase of 760 basis points, with a slight uptick of 4 cents compared to the previous month. Looking ahead, CommercialEdge predicts a decline in rent growth this year due to reduced demand for industrial space and the saturation of new supply introduced in recent years. However, despite these challenges, the fundamental factors supporting the industrial real estate sector remain positive, indicating that rent growth is likely to maintain a steady pace overall.

Southern California continues to assert its dominance in the national rankings, with significant rental rate growth observed over the past year. Specifically, the Inland Empire witnessed a considerable surge in rents, recording a substantial 12.9 percent increase, closely followed by Los Angeles with a 12.1 percent rent hike. Miami was third, with a 11.4 percent year-over-year increase in rental rates.

At the same time, the national industrial vacancy rate experienced a small increase, reaching 4.8 percent by the end of January. The lowest vacancy rates were recorded in Kansas City, Indianapolis and Columbus, each at 2.6 percent, followed by Charlotte at 3.3 percent, Nashville at 3.4 percent, Phoenix at 3.7 percent and Central Valley at 4.0 percent.

Read the full CommercialEdge report.

You must be logged in to post a comment.