Industrial, Data Centers Strongest Sectors in CBRE’s 2021 Forecast

The office sector is expected to lag the overall U.S. economic recovery by several quarters.

CBRE’s 2021 U.S. Real Estate Outlook offers a mixed forecast for commercial real estate. Industrial and data centers will continue to be among commercial real estate’s more robust sectors next year, as other markets like office, retail and hotels will have slower recoveries.

READ ALSO: CRE Investment Posts Stronger Q3: CBRE

The report states all sectors will benefit from the widespread availability of a vaccine to help push back the pandemic that has crippled the U.S. economy.

Richard Barkham, CBRE’s global chief economist, said in a prepared statement the firm expects the commercial real estate recovery, particularly the office sector, to lag the broader economic recovery by several quarters. He noted the pandemic has added another complication to normal recoveries: getting people safely back into the workplace. He said a vaccine is essential for economic recovery along with another fiscal stimulus package from Congress.

CBRE expects interest rates to remain low next year and GDP to rebound by 4.5 percent in 2021. While capital markets should remain soft compared to the pre-COVID-19 period, CBRE expects the commercial real estate market to normalize by mid- to late-2021, when a vaccine is expected to be more widely available.

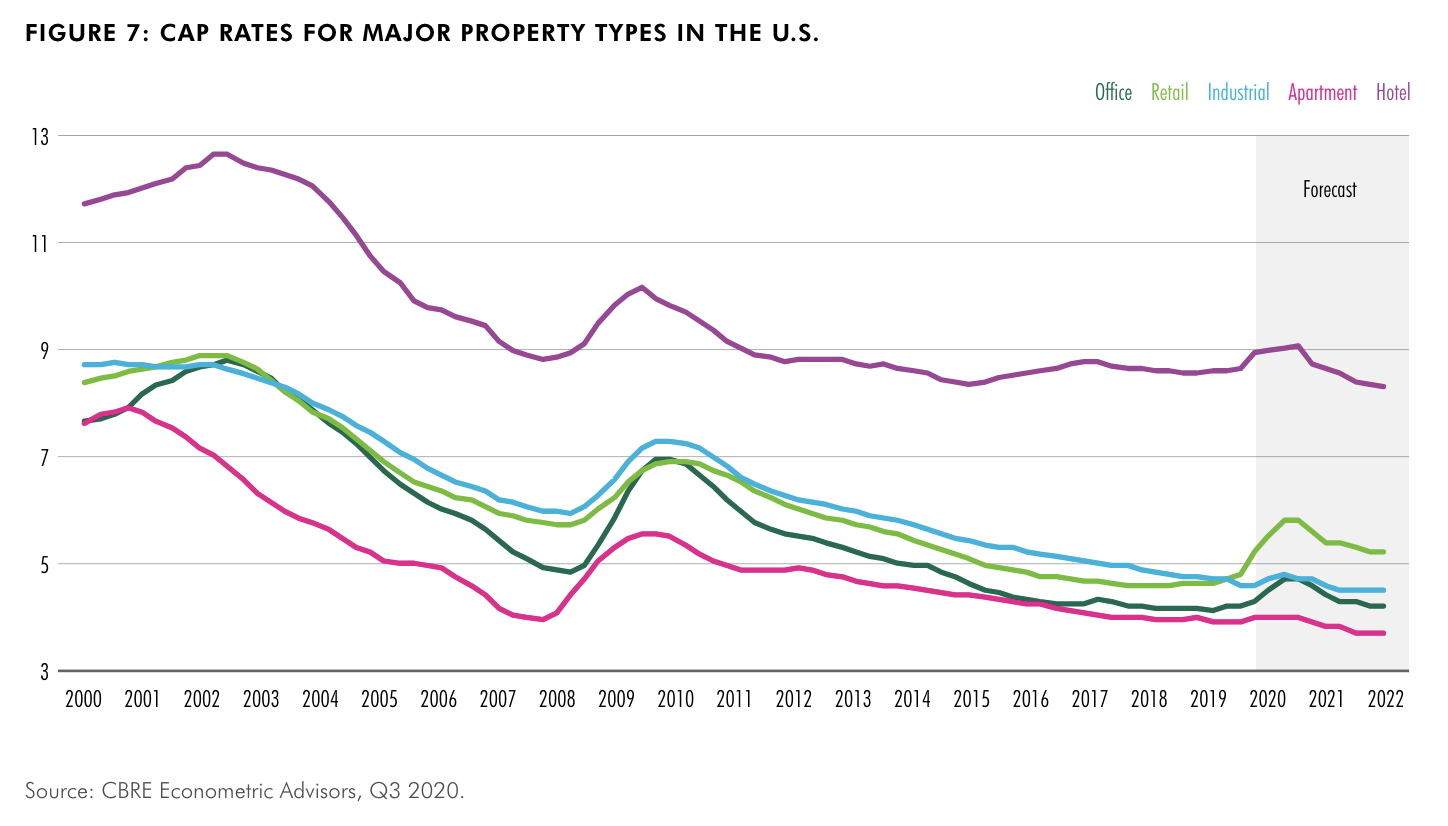

More than $300 billion in capital is ready to be directed toward commercial real estate investments around the globe, and most of it targets North America. Cap rates have remained relatively stable and the report states “this wall of capital is a major contributor to the constrained expansion of cap rates.” Industrial cap rates are at historic lows.

Industrial and logistics

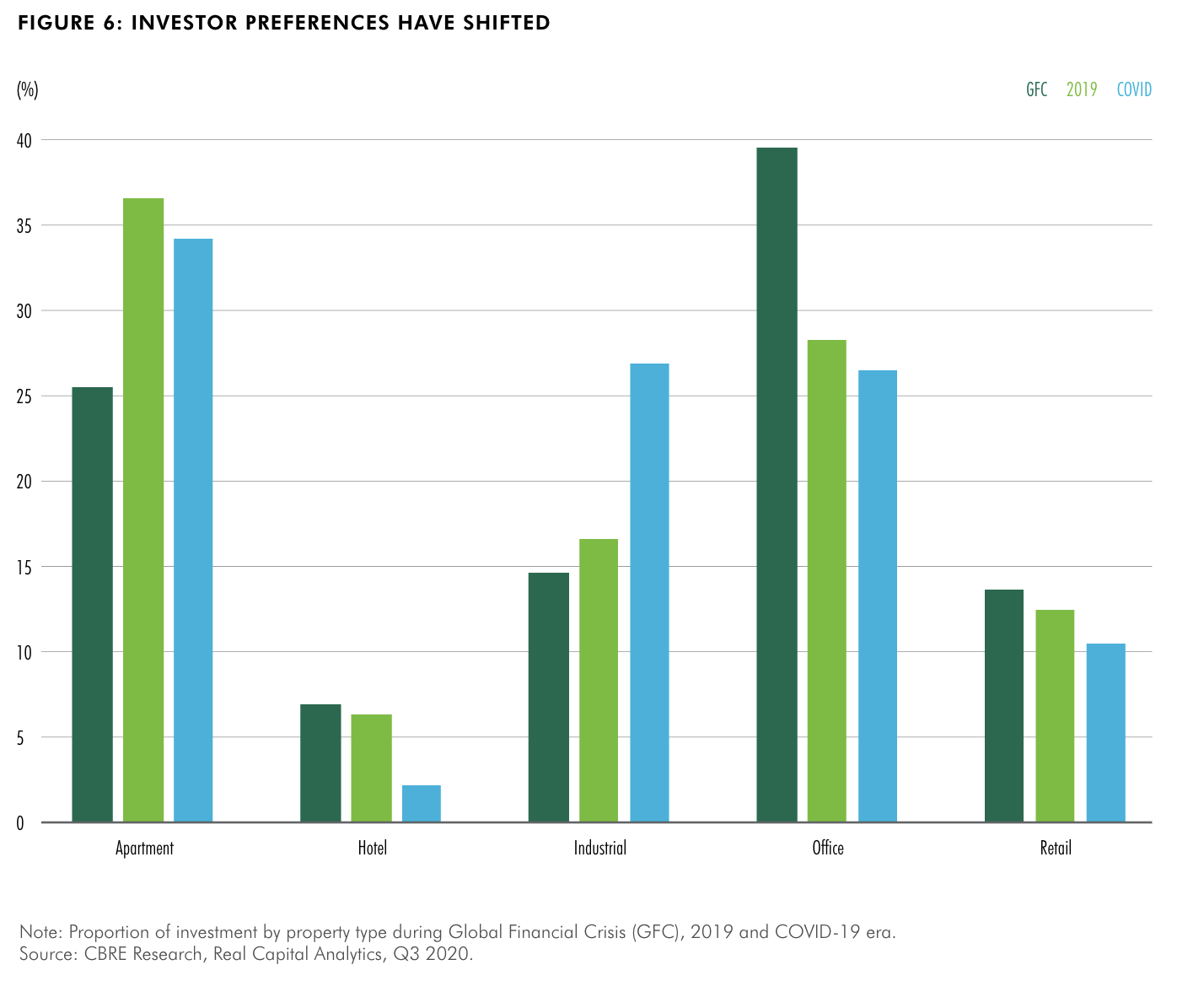

The report said the overall demand for real estate will remain as the economy continues to recover, along with investment opportunities and capital for acquisitions. However, CBRE notes investor preferences have changed, shifting to industrial and logistics, where construction completions are expected to rise by 29 percent from 2020 to 2021, and rents are also expected to increase. CBRE is anticipating nearly 250 million square feet of industrial and logistics space to be absorbed next year, more than the previous five-year annual average of 211 million square feet. The commercial real estate services and investment firm expects to see adaptive reuse of retail space for logistics uses accelerated as demand for infill sites increases due to rising e-commerce demand. Industrial has been one of the most resilient sectors during the COVID-19 crisis, as more people turned to online shopping. Year-over-year e-commerce growth surged to 44.5 percent in the second quarter, from 14.8 percent in the first quarter, before the pandemic forced national shutdowns. Occupiers will expand both the locations and sizes of facilities to accommodate the demand. New construction, already at near-record levels, is also expected to increase in 2021, with strong preleasing of speculative projects.

Data centers

The data center sector is also projected to see significant growth, according to CBRE, which forecasts inventory to increase by 13.8 percent in 2021. The sector has 373.6 megawatts under development across the primary U.S. data center markets, including Atlanta, Chicago, Phoenix, the New York tri-state area, Northern Virginia, Silicon Valley and Dallas-Fort Worth. Those markets saw 134.9 MW developed in the first half of 2020. CBRE notes investor interest in the data center market has increased because of the success of the five core data center REITs, which have seen revenue growth of more than 28 percent year-to-date.

Other sector projections for 2021 include:

- Office—Fundamentals are expected to recover in late 2021, with suburban markets recovering more quickly. Urban downtown markets, which rely on mass transit commuting, will likely pick up later in the year. CBRE says its surveys show most companies are shifting to a hybrid of in-office and remote work, with the office as a primary base. More companies will also be using flex space increasingly, as they move to more agile office occupancy strategies.

- Retail—E-commerce sales will slow in 2021 and may even fall a bit. CBRE expects brick-and-mortar sales to improve as more widespread availability of a vaccine means more economies will open and shoppers have pent-up demand. However, CBRE still predicts a 20 percent reduction in total U.S. retail square footage by 2025, from the current 56 square feet per capita.

- Hotels—CBRE expects the overall hotel recovery will take several years, with group and business travel continuing to be weak in 2021. U.S. hotel occupancy is slowly projected to return to pre-pandemic levels by 2023 and RevPAR by 2024. Drive-to leisure destinations, including Jacksonville, Fla.; Virginia Beach, Va.; and California’s Inland Empire, have already seen improved occupancy and will continue to do well in 2021. Higher-chain scales will take the longest to recover, as many are dependent on group and business travel. Economy and midscale chains are projected to improve the quickest, by late 2022.

Read the full report by CBRE.

You must be logged in to post a comment.