Increased Development Activity Burdens Self Storage Rent Growth

Although metros on the West maintained rent growth, street-rate rents declined 4.1 percent across the country. The new-supply pipeline, however, continued to rise.

Heavy new supply continued to hinder self storage rent growth in November. Over the past 12 months, street-rate rents have declined by 4.1 percent for 10×10 non-climate-controlled and 2.2 percent for climate-controlled units. Despite this, for the average 10×10 non-climate-controlled units, year-over-year rents tumbled at a more moderate rate in November─the decrease changed by 80 basis points from -4.9 percent in October to -4.1 percent in November. Metros on the West are still among the best-performing markets. On a year-over-year basis, street-rate rents have increased by 3.1 percent in Las Vegas and 1.3 percent in San Diego. Growth is fueled by limited new supply and continued favorable demographic trends.

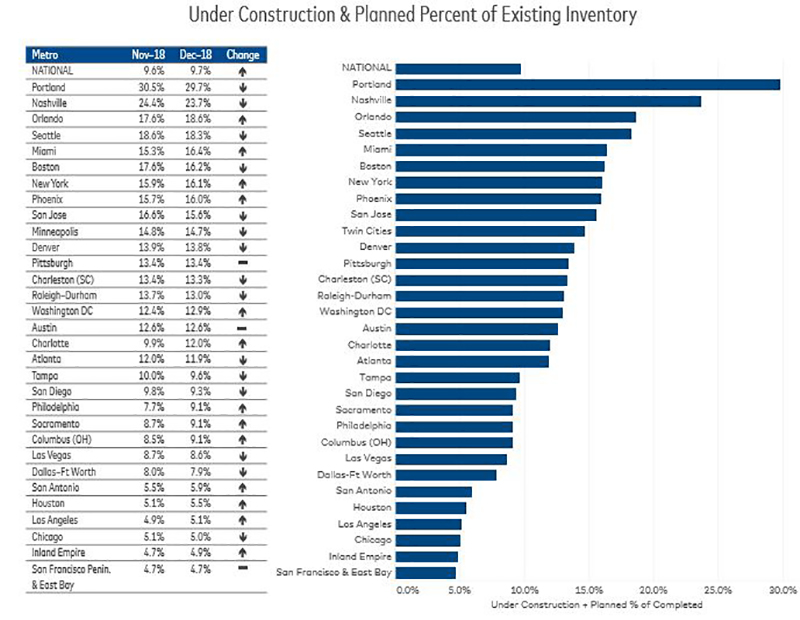

Development continued to accelerate in New York City, where the inventory per person is still around 3 net square feet, half of the national average. Projects under construction or in the planning phases represent 16.1 percent of existing inventory, a 20-basis-point increase month-over-month. Nationally, units under development and in the planning stages accounted for 9.7 percent of existing inventory, a 10 percent rate of growth over the previous month.

Portland (29.7 percent) and Nashville (23.7 percent) stayed the most active markets. Demand in the metros is driven by expanding tech companies and growing professional and business services sector, which attract higher-wage workers. Job growth has also boosted demand in Charlotte, where projects under construction represent 12 percent of the total inventory, up 210 basis points since November.

You must be logged in to post a comment.